This goes to yesterday’s post on CRE. For those new here who are not ware of Davidson’s work, please do a simple “search” for it in the search box. Simply, Davidson is the person who in the middle of March in 2009, when fear was rampant said to me “I am going all in” ……. prescient

“Davidson” submits:

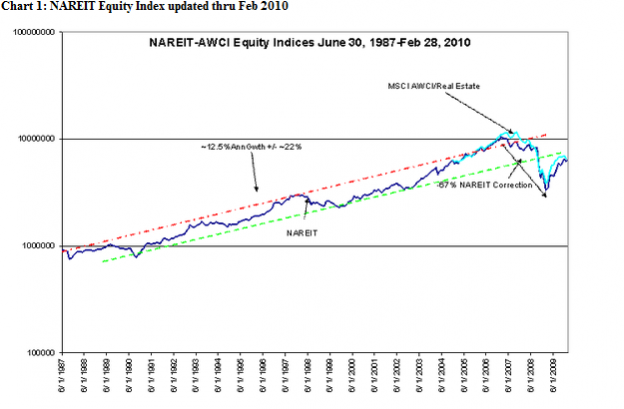

The North American REIT Total Return Index was updated this morning with Feb 2010 results in Chart 1(MSCI AWCI/Real Estate update to follow soon).

REITs are priced on dividend returns which were decimated in 2009 as firms struggled to deal with market fears of sub-prime lending and residential real estate over building. Tax law changes permitted REITs and BDCs(Business Development Corporations) to issue stock in lieu of cash dividends to maintain their status’ to payout 90% of taxable income as a means of maintaining liquidity during the market turmoil. Importantly, those REITs which had issued stock in lieu of cash are now beginning to issue all cash dividends.

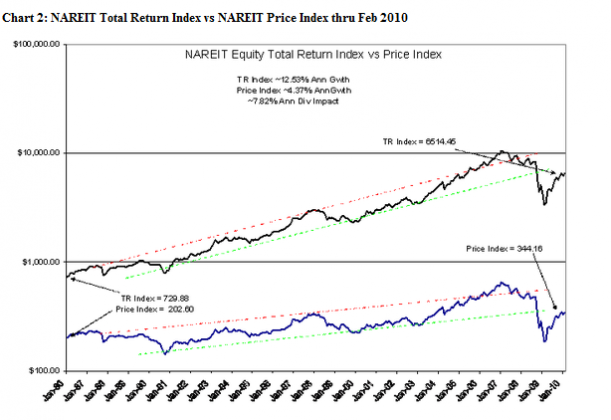

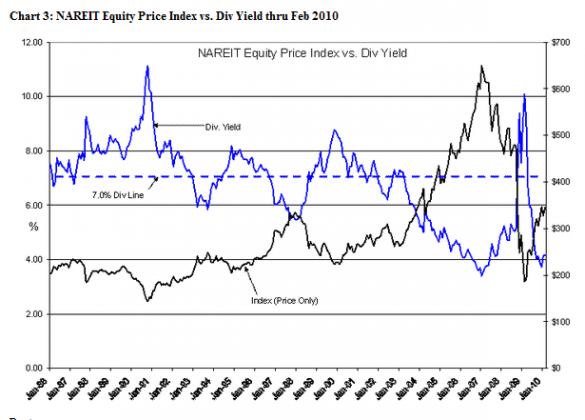

My expectation is that as dividends return to historical trends REIT pricing should adjust accordingly. The net effect should be dramatic both to price and dividend. To grasp the possibilities I have supplied two additional charts, i.e. Chart 2: NAREIT Total Return Index vs NAREIT Price Index thru Feb 2010 & Chart 3: NAREIT Equity Price Index vs. Div Yield thru Feb 2010.

Chart 2 reveals the importance of dividends to the NAREIT Equity Total Return Index. Of my estimated ~12.53% annual return for the index some ~7.8% comes from reinvested dividends. These estimates are based on setting and then estimating the average returns of each index since 1986.

Chart 3 reveals that historical yield of the NAREIT Equity Price Index has been either side of the 7.0% line and as one would expect has an inverse relationship to index price.

Historically the better REIT managers have acquired properties with a return greater than 7.5% which redevelopment and leverage on average has produced better than 12% total return under the tax régime established in 1986. The current yield in the NAREIT Equity Price Index is 4.16%.

I estimate that sans the market turmoil of 2008-2009 the yield at the current price level would have been closer to ~10% in more normal times. For the market to reposition the NAREIT Equity Total Return Index back to the mid-trend(between the RED and GREEN Trend Lines Chart 1) index members will have to begin issuing dividends in cash rather than stock. This has begun in 2010.

While one cannot predict with any precision when REIT dividends will return to historical trend, the current recovery should cause a return to normal operating conditions. The difference between the current NAREIT Equity Total Return Index level and the mid-trend is ~30% within a long term trend performance of 12%+.