Below is a conversation between “Davidson” and a client:

Client comment:

“Very smart individuals” may not see this as a sign of recovery because they are looking at other signs . . . continued weakness in the housing market, slow (at best) recovery in jobs, etc.”

Davidson’s response:

“I think they are tied to some of the historical measures as you indicated. Establishment Employment which reported 95,000 jobs lost is the official series reported. But, the Household Employment Survey gaining 141,000 means that 236,000 small business jobs were created to offset the 95,000 lost under the Establishment survey.

I think that the Fed seems more driven by political need to show results. I think it would be better if the Fed took a more circumspect view and indicated that the recovery was in progress and further that recovery takes time to develop. Positive commentary by the Fed would assuage much of the anxiety that people are feeling.

The Fed’s public commentary that it feels it is necessary for QEII scares the wits out of most people that the Fed sees something ominous that most do not see.

This causes me to believe that Bernanke is acting like Greenspan in using the stock market as his main indicator for the economy. This is the Eugene Fama “Efficient Market” that many were taught in the ‘70’s that has pervaded market thinking and Mark-to-Market FAS157.

It will all work out as it always has historically, but the Fed could make it easier rather than forcing the economy to push through additional interference.

For us as investors, it provides a longer period of undervaluation while most investors are focused on the negative commentary by the Fed and market pundits. But, in the end the reversal out of commodities and bonds is likely to be a sharp upward and unpredictable move for stocks.

Poor sentiment has never caused an economy to stall once recovery began. Poor sentiment does result in stock undervaluation till market psychology becomes positive and then everyone races to get in.”

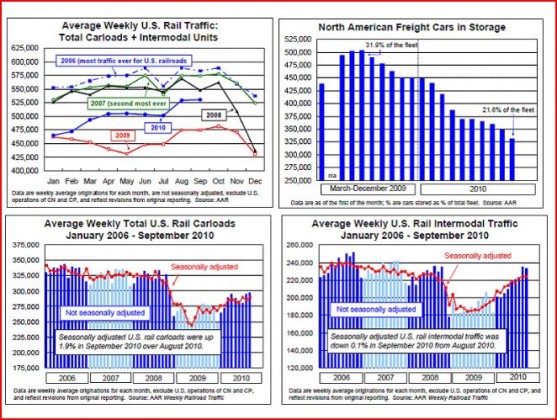

We have known for a while traffic is up on all levels. The other interesting stat is the storage levels falling like they have. These are at levels where other industries will begin to see demand increase both in terms of those that produce rail cars and those who produce parts for them (to both replace and repair older cars in storage). This in turn has other stimulative effects (steel, trucking etc).

No way to twist this into anything but good news….although they will try

One reply on “$$ More Rail Data & Storage”

[…] Rail traffic continues strong. (Money Game, Calculated Risk, Value Plays) […]