Economist seem mystified as to how the economy can keep moving forward while employment lags based on “historical models”. That is the reason, those model do not reflect the realities of today’s economy…..

“Davidson” Submits:

Much about investing is the development of an understanding of long term themes and then formulating a context within which to invest. As a Business Cycle Value Investor one needs to digest as much information as seems relevant. This sometimes proves to be information developed over decades just to place the current business cycle into a perspective that makes enough sense to be able to be comfortable when making specific investment decisions. I think the concept of the “Leaning of US manufacturing” is one such theme having considerable impact in today’s marketplace.

Much has been said about the decline of the US as a global manufacturing force and many analysts have decried a lack of political will, government action or government inaction as the primary cause of the US manufacturing demise. I think the truth sits far, far away from this gloomy and pessimist view. Current trends lead one towards thinking that the US Manufacturing Employment is very likely in a revival. One comes to this conclusion through the perspective of ~30yrs of economic and stock history.

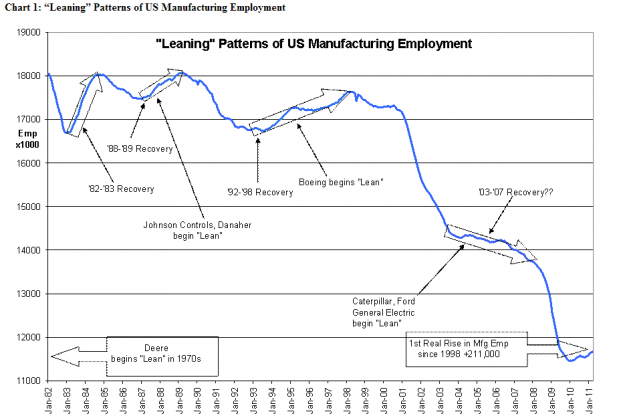

The “Demise of US Manufacturing” focus comes from Chart 1: “Leaning” Patterns of US Manufacturing Employment. In this history of US Manufacturing Employment from Jan1982 to March 2011 one can observe that the recoveries of ’82-’83, ’88-’89 and ’92-’98 reflected sequentially weaker patterns of US Manufacturing Employment. This culminated in the recovery of ’03-’07 if one could call it that showing a net US Manufacturing Employment loss of ~1.1mil. The Green Arrows reflect the weakening employment up-trends while the Red Arrow reflects the net loss during the ’03-’07 recovery. Every recovery prior to that of ’88-’89 was similar to the ’82-’83 which points to ’88-’89 as a turning point in US Manufacturing Employment.

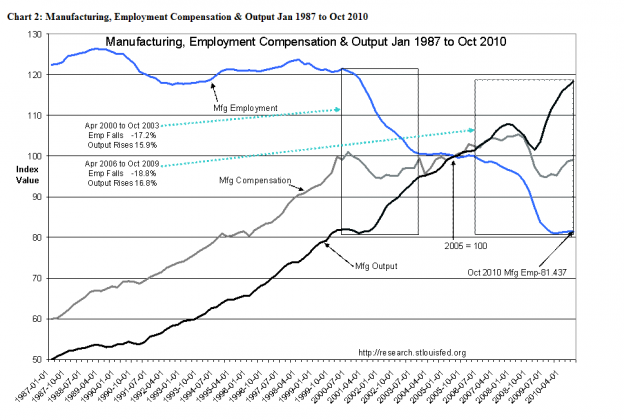

Fewer analysts take the politically less correct perspective that is represented in Chart 2: Manufacturing, Employment Compensation & Output Jan 1987 to Oct 2010. Chart 2 adds the components of compensation and output and uses 2005 to scale employment, compensation and output as indices. A very different view develops of the US Manufacturing as a whole.

Observations from Chart 2:

- US Manufacturing Output did not decline in ’88-‘89, but has continued to reach new highs each economic cycle.

- US Manufacturing Employment was relatively flat from 1987-2000, then declined sharply in two most recent recessions losing -17.2% Apr00 to Oct03 and -18.8% Apr06 to Oct09

- US Manufacturing Output soared during employment declines gaining 15.9% and 16.8% respectively.

Taking US Manufacturing as a whole, one recognizes that a more complex process is occurring than a simple decline in US Manufacturing Employment.

Gaining better insight on what it is that is causing US Manufacturing Employment to decline while US Manufacturing Output soars requires one to do considerable detailed research and lots and lots and lots of reading. Again one may come across a number of prominent skeptics that claim the US remains in decline and must get its best ideas from Asian sources, but surprise!, surprise! Historical sources make it quite clear that the best manufacturing ideas of the past 200yrs have their beginnings in the US and the UK. But, after WWII, Japanese entrepreneurs borrowed them and modified them in order to compete effectively and rebuilt Japanese industry. Taiichi Ohno, the originator of the “Toyota Business System”, adapted Western techniques to Japanese culture. The concepts behind the “Toyota Business System” came in part from Henry Ford’s 1926 book titled “Today and Tomorrow” and Frank Wollard’s 1925 paper “Some Notes on British Methods of Continuous Production” and his 1954 book “Principals of Mass and Flow Production”. As the Japanese learned, reinvented and successfully implemented their own mass production techniques, Western societies mired themselves in the application of top-down systems analysis and confrontational management-employee relationships. Western societies effectively fell behind the productivity curve while the Japanese invented the “Toyota Business System”

Modern production methods have the imprint of many authors. No one source can be credited. Methodologies evolve over generations and find more or less fertile environments where ever they may. A period of evolution typically occurs under the watch of one or two bright individuals and then the ideas again take flight. The US invented some aspects of modern production which came initially from England in the 1700s and 1800s. US corporations began to send production overseas beginning in the 1990s as management and unions found themselves in a politically difficult impasse. Toyota’s enormous success using the “Toyota Business System” brought it to the US to manufacture their cars to counter the political storms that came from producing cars more efficiently than US car companies. Toyota acted to reduce the political threat to restrict their US imports which was blamed for declines in US auto manufacturing employment by building their own manufacturing facilities in the US. But, Toyota in turn needed their suppliers to think like they did and in turn taught the “Toyota Business System” to other companies. In Japan one of these companies was Yanmar Diesel which also supplied engines in Japan to John Deere in the mid-1970s. In the US in the mid-1980s Toyota used Johnson Controls as a supplier and Johnson Controls adopted Toyota’s methods as a requirement. At about the same time George Koenigsaecker left Deere and joined Danaher. He applied the Toyota methods he had learned at Deere as the CEO of Danaher’s “Jake Brake” in 1988. The methods that Toyota had learned from Ford and Wollard were modified and adapted and found their way back to the US at time when management and employee relations were improving.

Jeff Krafcik, the CEO of Hyundai, learned of these techniques in the mid-1980s while he earned his MBA at MIT and studied auto manufacturing methods. Krafcik coined the term “Lean Manufacturing”. Krafcik is now CEO of Hyundai which has surprised many at how rapidly its automobiles have captured a share of the US market competing effectively with Toyota and Honda. And, like a Phoenix rising from the ashes, Ford under the guidance of Alan Mulally, a “Lean” graduate of Boeing, has turned what had the appearance of a company falling into an abyss back on track as a global competitor. Success has many fathers!

Chart 1 identifies when a few well known companies introduced their respective “Lean” manufacturing programs. This history is not comprehensive, but is meant to provide a general sense of the evolution of ideas over time, how long it sometimes takes and how it affects some of the economic patterns that we measure. Today numerous “Lean” graduates continue to distribute the lessons learned and continue to improve them.

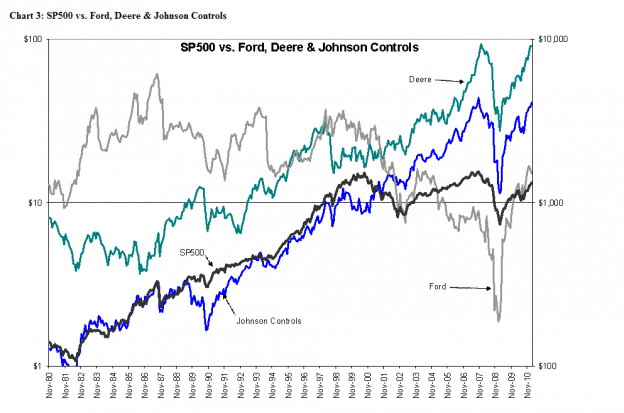

Chart 3: SP500 vs. Ford ($F), Deere (DE) & Johnson Controls ($JCI) is quite telling. When one examines each company’s individual history, i.e. the financial performances and investment results, each company’s position in the process and their relative success of implementation is reflected in the stock performance over time. The better a company implements a form of management-employee engagement, be it the Toyota process or some other process, the results are the same, corporations grow! Corporations in which employees are employed working more safely, in environments that reward employee improvement inputs see great improvements in productivity, product quality, on time delivery and because customers receive satisfying results more business. The different history of Ford vs. Johnson Controls which are each exposed to identical economic fluctuations is striking. Improved profits have not been lost on CEOs and Boards of Directors. Alan Mulally the relatively new CEO of Ford learned “Lean” while at Boeing. Ford and Caterpillar began implementation of “Lean” ~2005. General Electric began ~2003. One should not be surprised that Johnson Controls has vastly out-performed not only Ford, but the SP500 as well!

The concept of “Lean” methods as used here is not strictly defined and includes approaches far removed from the structure of the “Toyota Business System”. Ken Iverson, the former CEO of Nucor, developed his own approach in which senior management was fully engaged with frontline employees. This approach carries the term “Flat Management”. Iverson is quoted as saying, “Employees…not managers…are the engines of progress.” The employees are seen as a corporation’s most valuable assets. Business is complicated with many levels of intricacy. Each employee has developed an expertise over time that a CEO can never have the time to acquire. “Lean” methods incentivize employees to involve themselves fully in contributing to the success of the business, their fellow employees and of course themselves. The “Lean” process works best when employees know that they can talk to the CEO at any time and receive the same level of respect that the CEO would treat any individual crucial to the success of the corporation. Although compensation may differ, respect for individual input is the same for all.

That “Lean” in its various formats is having a positive effect is seen in the dramatic improvement in US Manufacturing Output. In Chart 2 a ~35% decline in US Manufacturing Employment occurred while US Manufacturing Output rose by ~50%. A profitable resurgence in US Manufacturing Employment should be the eventual outcome. The first improvement in US Manufacturing Employment since 2000 (net increase as of March 2011 of 211,000 from the Dec 2009 low) is clearly visible. This may be the first sign that a critical corner has been turned.

No governmental program has been responsible for the improvements that are apparent. It looks more to be part of a large cycle of what happens to ideas as they travel the roads of global commerce. This is the context of today’s investment climate in my opinion.

In my estimation, this is an exciting time to be an investor and a period to be optimistic towards equities.