This is one of the reports that you can lean either way on and pick the data that back your point. To me, it presents some interesting questions as some of the date is moving in odd ways.

Economic activity in the manufacturing sector expanded in July for the 24th consecutive month, and the overall economy grew for the 26th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM Report On Business®.

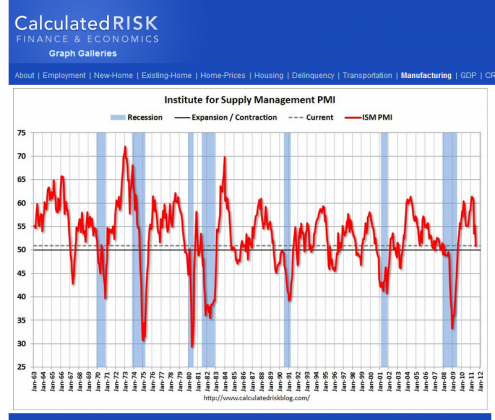

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. “The PMI registered 50.9 percent, a decrease of 4.4 percentage points, indicating expansion in the manufacturing sector for the 24th consecutive month, although at a slower rate of growth than in June. Production and employment also showed continued growth in July, but at slower rates than in June. The New Orders Index registered 49.2 percent, indicating contraction for the first time since June of 2009, when it registered 48.9 percent. The rate of increase in prices slowed for the third consecutive month, dropping 9 percentage points in July to 59 percent. In the last three months combined, the Prices Index has declined by 26.5 percentage points, dropping from 85.5 percent in April to 59 percent in July. Despite relief in pricing, however, several comments suggest a slowdown in domestic demand in the short term, while export orders continue to remain strong.”

Also:

WHAT RESPONDENTS ARE SAYING …

“Inflation pressures have finally slowed down.” (Chemical Products)

“With products sold internationally, the business conditions we are currently experiencing are declining from abnormally [high] record-breaking levels. Business conditions are currently flattening to more normal volumes, while trending slightly downward.” (Machinery)

“Market conditions — Europe weak, U.S. soft, Asia strong.” (Computer & Electronic Products)

“Demand from automotive manufacturers continues to improve.” (Fabricated Metal Products)

“Export sales very strong, while domestic sales are sluggish.” (Paper Products)

“The looming debt ceiling has government agencies backing away from spending. Forecasting a slowdown in demand in the short term.” (Transportation Equipment)

“Generally seeing a slowdown, which is typical this time of year. Hopeful that this is seasonal only.” (Plastics & Rubber Products)

“Most industrial customers seem to be sustaining their business. Export orders continue to remain strong. Price pressures persist, especially with commodity materials.” (Chemical Products)

Here it is in chart form from @calculatedrisk:

Now, we have some data that contradicts what one would think if this meant the economy was sliding into a “double dip”. Imports and exports both saw increasing levels of expansion over June #’s. Inventory’s actually contracted to the “too low” level (we would expect them to grow if the final consumer was indeed retrenching) and no this does not mean business is expecting a slowdown. Business inventories build prior to recessions, not decrease. We also saw unemployment claims dives below 400k last week, doesn’t jive with a fundamental slowdown. What does it mean then?

It would seem (it has) that domestic manufacturing slowed. It does not seem that demand did as inventories fell 4.8%, faster than the 4.4% fall in ISM. I am thinking this may be a “debt crisis” effect on producers, not consumers. Follow my thinking (or completely disregard it). With the memories of 2008-09 fresh in everyone’s mind the President and Congress running around telling us of the impending doom awaiting us as overnight markets shut down, seniors go hungry and “draconian cuts” come to the US, could business’s reaction for the month to have been to “go fetal” to preserve every cent they had?

It is worth noting at this time that the economy did still expand, albeit anemically. This does follow the similar growth we have seen in rail traffic growth and temp employment over the past few months also. Slow but unimpressive growth.

If we look at ISM production for July, 82% report “same or better” and 18% reported worse conditions. This is an improvement of the 81% “same of better” and 19% worse reported in June.

Think about it. You are owner of a manufacturing plant in City A. Remembering 2008-09, what would your reaction be with the hysteria coming out of Washington and no one really being sure of what the collateral damage of a failure of a resolution would be? Would you go guns blazing ahead? Would you ignore it? Would you claim to know everything would be fine? OR, would you step on the brakes and protect every cent you had in case the worse comes true?

My guess is the latter. This is what I think happened. It is also now worth noting that July/August tends to be the lowest ISM months annually so this drama came at the worst time for the numbers.

The neat thing though is a “resolution” coming on August 1st means we should not have to wait very long to see if my theory is correct. If we get a nice rebound in the August data, it is what happened…..if things continue to head south, it more likely than not wasn’t. Now, last August’s ISM was the prior lowest reading for the last 12 months so unless ISM falls to 46 or 47, we may have to wait until Sept # come in for clarity.

Being a generally optimistic person and based on the data I follow, I see August holding firm. But, not being naive, I also worry that our elected officials can talk the economy into what they are trying to avoid. The constant and relentless bashing consumers and business get about how shitty things are and how we are on a precipice of disaster could have a self-fulfilling prophecy result. It really is time for someone, anyone in Washington to have even the slightest bit of optimism.

Like I said in a tweet last week. If you are unhappy about how things have gone for the last decade and you continue to vote for the same people who have been there for the last decade, they are not the problem, YOU are. We know what they are going to do, when you send them back to do it, you lose your right to complain. It is not Party A or B’s fault, it is the lifers from BOTH parties who need to go. Most have challengers in primaries (I would expect a huge # to this time), vote for the other guy/gal…….could they really do any worse?

Washington sets the tone and the mood for the Country. Right now in my voting lifetime it has never been worse. Every Administration and Congress has it battles, but there has been no let up here. Economically, the low point is 2 years behind us, it is time for people to realize that.

One reply on “Thoughts on ISM…..”

[…] disappointing ISM manufacturing index for July. (Calculated Risk, ValuePlays, Global Economic […]