“Davidson” submits:

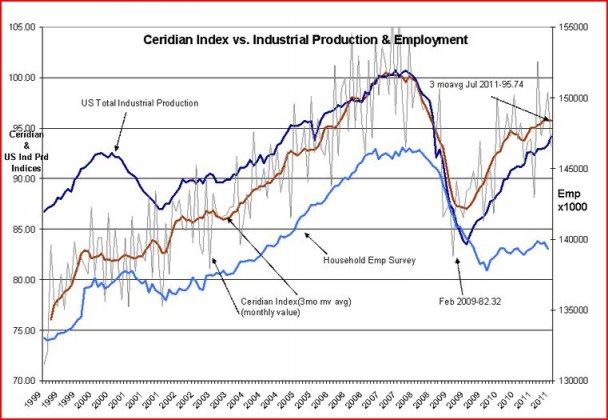

US Industrial Production was reported higher by 0.9% for July 2011 with previous month’s reports adjusted higher.

Manufacturers in the U.S. churned out more cars, computers and furniture in July, easing concern that one of the mainstays of the recovery was giving way.

The 0.9 percent increase in production at factories, mines and utilities was almost twice the median forecast of economists surveyed by Bloomberg News and the biggest gain of the year, according to data today from the Federal Reserve in Washington.There is in my estimation no basis for the current overly negative market view that has rapidly enveloped investor psychology the past few months. In fact recent Industrial Production data shows a modest surge in US economic activity even though summer historically displays economic slowing as most of the population goes on vacation during some point between June and September. In Europe the holiday period is up to 6wks.

British have noticed this seasonality since the late 1600’s and is the source of the saying “Sell in May and go away, stay away till St. Leger Day”, referring to the last race of the British horse racing season. This is also called the “Halloween Indicator”.

The best market “Buy” or “Sell” environments in my experience occur during periods in which investor perception greatly differs from the actual economic dynamics. Today, I interpret the market as offering a “Buy” environment. The fear of losses has caused investors to sell stocks and buy bonds during a period when the economic value of stocks is attractive and improving. Multiple economic measures indicate that we are in an economic up-trend of significant consequence.

I continue to recommend equities ($SPY) over bonds on a Return/Risk basis.