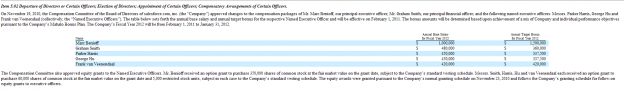

This is more that a little interesting. Here is the plan for the current FY filed in November 2010:

Basically they are looking at $840k of cash comp assuming bonuses are hit (more on that later) and options on 60k shares. This excludes Benioff who get $1M salary $1.5M bonus and options on 350k shares.

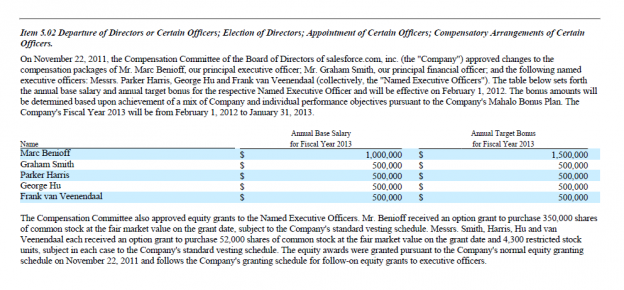

Here is the current one:

Now we are looking at $1M of cash comp per exec and options on only 52k shares?

Why the switch? Why take an additional $160K a year in cash and pass up the stock price appreciation on 8k shares? I mean shares only have to advance $20 over the next 4 years for every one of these execs to cash out ahead. Given the superlatives Benioff used on the recent earnings call about the current state and the future of the business (wonderful, fantastic, amazing etc.) one has to assume $CRM is poised for even more explosive growth? If so, why leave money on the table? Why? UNLESS, you know intimate details of the company’s performance/prospects and feel even yourself that the price is way ahead of the fundamentals and those 8k extra shares will be worthless or a fraction of the cash you can grab now in a few years as the stock price declines. This would be the time to note the cash increases in aggregate are the largest in the last 4 FY’s. It is also worth noting the % drop in number of shares being offered for options to execs fell YOY by the largest amount since 2009 (figured 4 FY’s was far enough to go back). Note: I used total shares not the value of the shares being offered as that will fluctuate with the stock price.

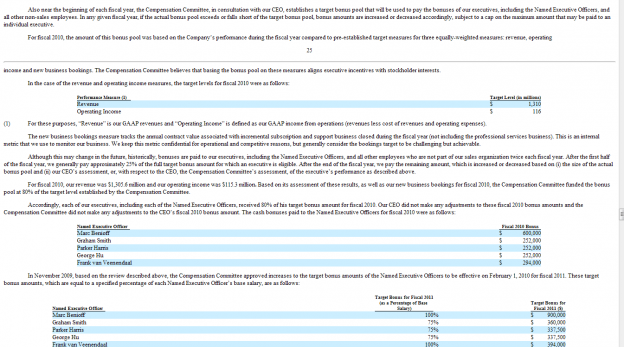

Here is some data on the cash bonuses doled out to execs (click to enlarge):

This is from the 2010 Proxy statement regarding exec. comp:

Here is the applicable wording:

For these purposes, “Revenue” is our GAAP revenues and “Operating Income” is defined as our GAAP income from operations (revenues less cost of revenues and operating expenses).

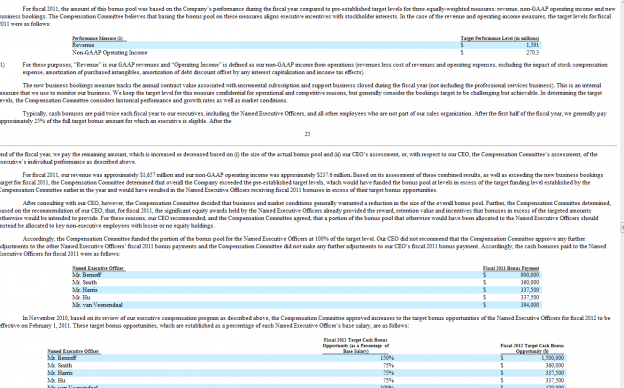

Now lets flash forward just a year to the recently filed Proxy?

The applicable wording here is (emphasis mine):

For these purposes, “Revenue” is our GAAP revenues and “Operating Income” is defined as our non-GAAP income from operations (revenues less cost of revenues and operating expenses, excluding the impact of stock compensation expense, amortization of purchased intangibles, amortization of debt discount offset by any interest capitalization and income tax effects).

Geez, I wonder why we switched from GAAP operating income to “non-GAAP” from 2010 to 2011?

Oh…..I see, the reason must be because operating income DROPPED from 2010’s $115M to $97M in 2011…according to the recent 10K. Under the old bonus system, there would have been NO BONUS for that portion of the determination.

We also would be remiss if we did not note here that not only did we change the metric used to determine the granting of the bonus or not to one we would achieve, but we also increases to amount of the bonus by 50% (from 100% of salary to 150%). Given CEO Benioff’s salary for FY 2012, that means he is eligible for a cool 66% increase in his cash bonus for the year despite operating income, as defined for the prior FY dropping. When we consider that for the 9mos in FY 2012 that have passed operating income is roughly a LOSS or $28M, shareholder ought to be outraged that cash bonus are not only being given, but INCREASED for 2013.

Anyone here wish they had a job they could change their bonus metrics around to make them a slam dunk no matter what the business conditions?? Yeah, yeah I know the CEO does not set the plan but do not kid yourself folks…the CEO is the Chairman of the Board that selects the comp committee.

Now, it is also worth pointing out that none of this is illegal. It just does not pass the smell test. As you descend into GAAP losses you should not then change how bonuses are calculated AND increase the amount you are paying out. When I see execs dumping shares early, and by early I mean 3-4 years early and when I see the weighting of compensation shift from more stock based to more cash based at the same time, I personally have to assume even executive recognize the current level of the stock price isn’t realistic given the company’s metrics. Think about the logic for a minute. On the earnings call Benioff et all emphasize they manage the business “for the long term”. Well, then, if what you are doing now will pay big benefits down the road for the company and shareholders (I have to think 3-4 years qualifies as “down the road”) then why is everyone in the executive suites exercising those options years early and dumping shares like mad?

It just doesn’t jive….

2 replies on “Does Salesforce.com Exec’s Comp Changes Reflect Doubts on Stock Price ??”

[…] the number of share being exercised. We have seen this the last few days as insider are rushing to cash out options 3 and 4 years ahead of expiration. Actually, insiders have been selling non stop for years but it has accelerated […]

[…] the number of share being exercised. We have seen this the last few days as insider are rushing to cash out options 3 and 4 years ahead of expiration. Actually, insiders have been selling non stop for years but it has […]