UPDATE AT END

“Davidson”: submits:

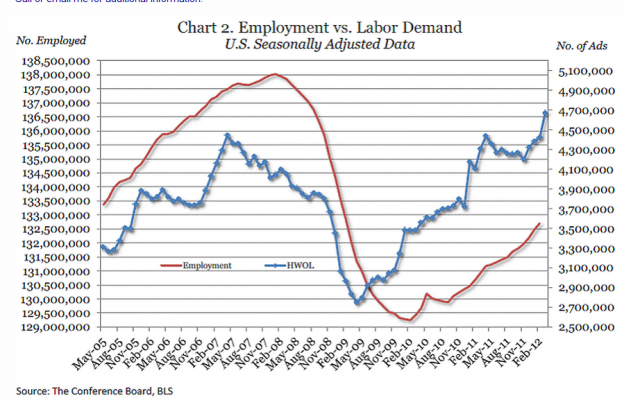

The Conference Board released its Help Wanted Online report for March 2012 with a 246,300 increase from February. The surge in this index the past 4mos has been particularly strong. The past 4mos is very positive for employment trends the next 6mos+ and positive increases in employment translates historically to higher equity prices and lower bond prices. The link for the press release is: http://www.conference-board.org/pdf_free/press/PressPDF_4442_1333327149.pdf The historical chart of the HWOL vs. the Establishment Survey is excerpted below. The lead time of the HWOL trend vs. the Establishment Survey is in the 6mos-9mos range with HWOL being particularly robust since May 2009.

As the economy demands that a greater number of individuals be employed to meet the demand for goods, the new employment in turn creates additional demand until we reach full employment. One cannot predict when employment will find it’s “Top” with any precision ahead of the event, but with our current situation of 11mil individuals yet unemployed using historical trends one can assume that an employment peak is still several years away. As we should all know by now, it is the economy which is the underlying driver of the investment markets even though market psychology may dominate for short periods.

This is the time to be optimistic and expecting higher equity prices long term in my experience.

Let’s put this together with what I said last week regarding Temp Employment:

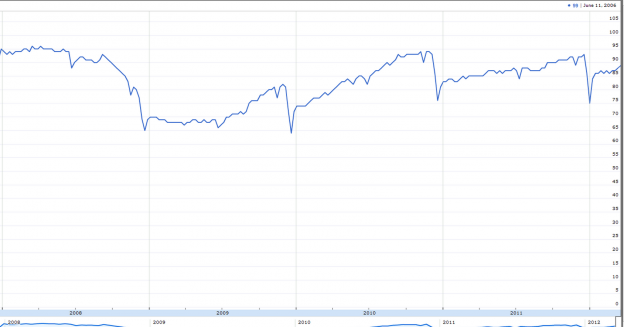

BUT, if we look at what is happening now (chart below), we see a different story. We are seeing the index begin to strengthen through March (like it did in Dec ’11 & why this year’s strength was no surprise). If that continues, we should see NFP begin to strengthen in late spring/early summer

Let’s put the two together:

HWOL lead NFP by about ~6 months and Temp leads by ~3 months. The action in both of of these is backing the view I have that employment gains will moderate this spring before accelerating, perhaps significantly by summer. Note: A decrease in the HWOL index does NOT necessarily mean employment will worsen, it means a slowing of the underlying trend, which we have seen. If it craters, then we would expect to see NFP fall also.

Look close. The HWOL index weakened/flatlined through summer/fall and bottomed in November’11. That does correlate with what we are seeing and expect to see this spring (slowing progress in NFP). Temp employment has remained above last year YTD but hasn’t really improved. That also backs the “flat” jobs improvement outlook I currently have.

Now, if we go to November ’11, we see a “V” bottom and then a hard acceleration from then to now. This matches timing of the recent sharp increase in temp employment. BOTH point to employment data improving, significantly come late spring/summer (note: both indexes operate in a range, which is why I give a range for results)

We’ll see if this holds but it may be the reason, despite hearing EVERY SINGLE DAY “a correction is coming” we watch the market march higher. I can’t be the only one who follows and sees this, maybe other people are expecting strength going forward?

UPDATE

I felt compelled to update this post from last week after the hysteria I am seeing over today NFP GAIN of ONLY 120K vs the “consensus” 205k. Now it should be noted that for the prior 4 months we beat expectations well in excess of today’s “miss” so if your time frame is more than today, we are still a net “beat”.

Anyway, I wanted to report this again because today’s number was not a surprise (see bold above). I also expect April’s to be in the same neighborhood. Then, as I say above I expect a re-acceleration, and possibly a very significant one in May/June. The key today is manufacturing. The low for it was Jan 2010 and since has increased by an average of 18.8k/month. March was 37k increase. That is significant and means there continues to be underlying strength building. How strong is that number? Consider it is 20% stronger that the Feb manufacturing number, a month that added 240K jobs and “beat” estimates.

Is it a “great” number? No. Is it terrible? No…a negative number would be, this still shows more people are employed this month than last and that is positive.

Please be careful of relying on “consensus” data estimates. More often than not they simply extrapolate current trends forward. The problem with that is we all know that is not how reality operates. Reality is all numbers ebb and flow. Nothing goes in one direction uninterrupted. For proof of this watch how April/May NFP “consensus” estimates come crashing down over the next week as we now extrapolate the current trend (yes, in this world 1 month is a trend) indefinitely into the future.

2 replies on “Data Continues To Back Late Spring/Summer Employment Surge… UPDATED 4/6”

[…] There have been several pieces out that do a good job detailing how the March numbers were not “bad”. I had my take on them here. […]

[…] There have been several pieces out that do a good job detailing how the March numbers were not “bad”. I had my take on them here. […]