This is essentially like Ackman buying shares of $HHC @$58.38.

Under his agreement with $HHC, he cannot just go out onto the open market and purchase shares (other 10% owners were concerned about another 10% owner having too much voting control). Nor are the options in $HHC priced accurately or liquid enough for him to make a call option bet on 2.6M shares. We should note there are only 37M shares of $HHC outstanding so this amounts to ~7% of the outstanding shares (he also holds swaps on another 2.7M shares, see below).

This is the next best thing to make a long term bullish bet on the stock price. Based on previous swap transactions Ackman will pay ~3% interest annually to the counter party and when the swap is unwound in 2013/14, they will settle up for cash.

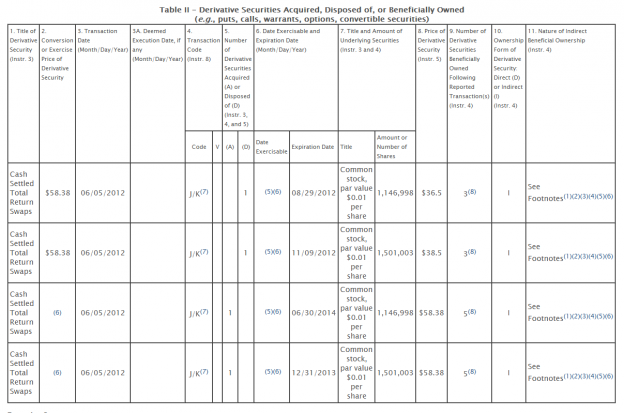

Under the terms of each total return swap (i) the applicable Pershing Square Fund is obligated to pay to the bank counterparty any negative price performance from the reference price set forth in Table II for each notional share of the issuer’s common stock, par value $0.01 per share (“Common Stock”) subject to such swap as of the expiration date, plus interest at the rates set forth in the contract, and (ii) the bank counterparty was obligated to pay to the applicable Pershing Square Fund any positive price performance from the reference price set forth in Table II for each notional share of the issuer’s Common Stock subject to the swap as of the expiration date. Any dividends received by the counterparty on such notional shares of Common Stock during the term of the swap were to be paid to the applicable Pershing Square Fund. All balances will be settled in cash.

The Reporting Persons unwound the total return swaps set forth on the first two rows of Table II that were set to expire on August 29, 2012 and November 9, 2012, respectively, and concurrently entered into the total return swaps set forth on the last two rows of Table II. As a result of these transactions, there was no net change in the notional number of shares of the issuer’s Common Stock underlying the total return swaps.

As reported on the Form 3 filed by the Reporting Persons on November 19, 2010, in addition to the total return swaps set forth on Table II, the Reporting Persons own (i) a total return swap with 1,250,836 underlying notional shares of Common Stock expiring on October 29, 2015, (ii) a total return swap with 1,501,002 underlying notional shares of Common Stock expiring on January 31, 2013 and (iii) warrants to purchase 1,916,667 shares of Common Stock.