From the NY Fed’s website:

July 16, 2012: Net proceeds from additional sales of securities in Maiden Lane III LLC enabled the full repayment of AIG’s equity contribution plus accrued interest and provided residual profits to the New York Fed. The New York Fed will continue to receive 2/3rds of residual profits generated by future sales of ML III LLC assets.

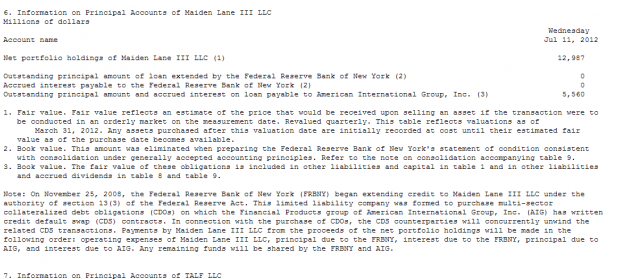

As of 7/12 that was $5.56B:

I would now expect the Treasury to soon announce another share sale with $AIG taking most of the offering. At $5B that comes to ~9% of the outstanding shares that will disappear instantly.

That still leaves the ~$7B they have coming from the ILFC IPO, $2B from what is left in the ML III portfolio (they get 1/3 of the remaining sales) and ~$7B in its stake in AIA that will be sold in September. Based on past statements from management, I would expect them to use most, if not all of this to repurchase Treasury shares which means at current prices they can effectively take 35%-40% of the share off the market before Thanksgiving and reduce the gov’t stake to 19% (this assumes AIG buys every share the gov’t offers, the gov’t can easily sell more to shrink their ownership).

I’m not sure we’ve seen such a rapid cap shrink in a $56B company before. That will also push BV from the current $57 to >$70.