I’m not going to recite the history of GGP/BAM/SPG here. Regular readers (since 2009) know it and if you don’t simply do a search by ticker on the blog and you can catch up. What I am going to focus on here is the Board of GPP and BAM’s apparent reason for their actions. We all know GGP rejected Ackman’s call for GGP to be merged with SPG and said that BAM was effectively “creeping” its ownership of GGP to a point that they in effect would control it.

It is important to note that BAM has framed the argument as a “sale” of GGP as if the economic gain of the transaction for shareholders ends there.

The reality is it is a merger in which GGP shareholders would own ~28% of the new SPG/GGP entity and they would continue to profit for as long as they opted to hold their shares. It is a material difference.

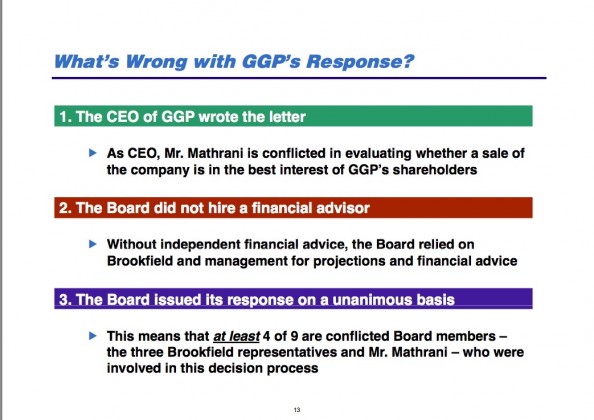

Why is Mathrani conflicted? Well, if GGP merged with $SPG, he would be out of a job. Now, he of course would walk away with a nice payday, but I am guessing as a young guy he wants the job longer term for a larger payday down the road…

It get’s worse in terms of conflict…

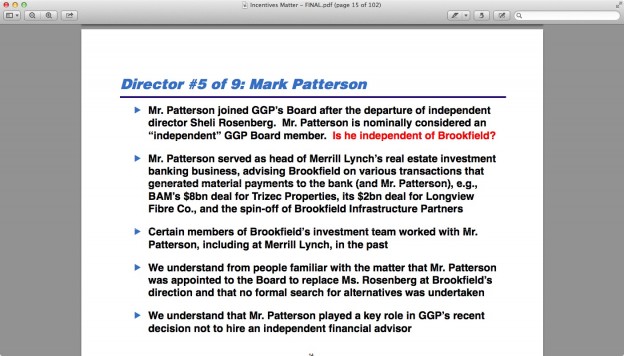

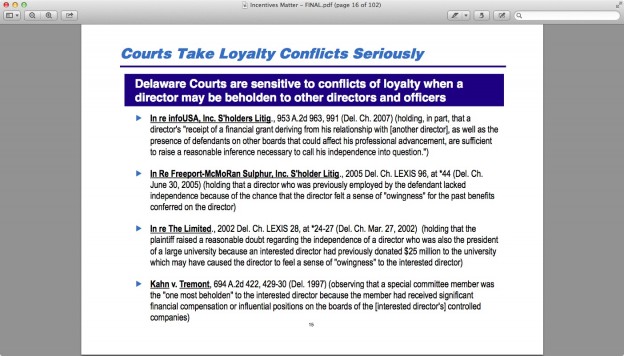

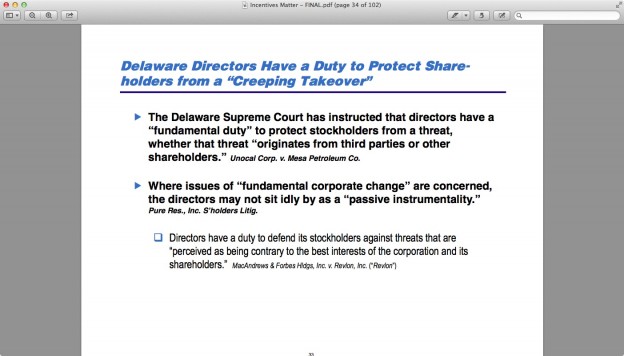

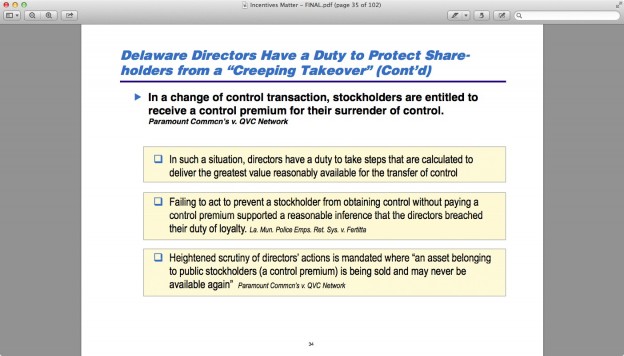

Now, you might say, “is that a big deal”? Well, the courts seem to think so…

So, it is clear 5 of 9 directors have a conflicts of interest in their vote in terms of what is in the best interest of ONLY GGO shareholders. The BAM folks are there to protect BAM’s interest, Mathrani wants to protect his job and Patterson has a long and involved relationship with BAM that has been very profitable for him and I think he would prefer not to endanger that as one never knows what the future holds. “Independent” to me means they have no previous ties to either company and likely won’t in the foreseeable future. But, I’m just odd that way…

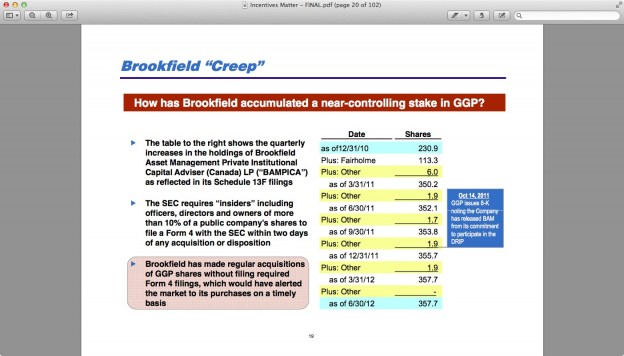

Back to the first paragraph. Has BAM been increasing it share stake stealthily as Ackman claims ?

Where are the form 4’s or 13D/A? The SEC does not have them if they were filed.

Now, where has GGP’s Board been? Were they unaware of BAM’s increasing stake? That is a problem if that is true but since the CEO of BAM is the Chairman of GGP that argument is highly implausible unless Flatt just did not inform the rest of the Board. At this point who would believe anything from BAM anyway?

When it comes to matters of takeovers directors……

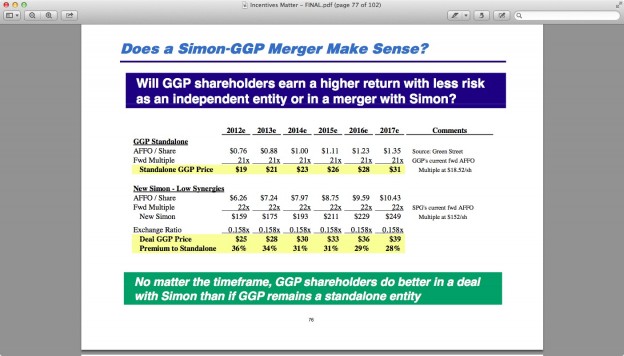

Well, would the proposed merger really be in the interest of GGP shareholders? At this point, yes. Pre-emergence from Chapter 11 the answer as I argued was no because of the still to be had appreciation on GGP and the successful formation of HHC that has risen 100% since it was spun off. In the then proposed SPG deal, HHC would simply have been spun to GGP shareholders without the necessary funding & indemnities that it had under the Pershing deal that have made it so successful.

Here is Pershing’s comp for the independent GGP and merges entity. Yes, I know they are “talking their book” but they are using assumptions from Green Street and Citi to form the comps so the analysis is not simply 100% theirs. Anti trust issues have been raised in the past (I raise my hand) but $GGP has reduced their mall holdings from 188 to 133 so in essence, the supposed divestitures I spoke of have already in essence already happened. There may be a few others (for instance the entity would control the Central/Eastern parts of my state of MA) but they will be minimal and won’t stop the deal at this point.

It seems pretty clear things are not honky-doory with the GGP Board. Now remember all of this omits the Flatt $BAM CEO/GGP Chairman discussion we have had prior (again, I’ll direct you to previous post(s) rather that re-write them all here).

So, then, what is BAM’s deal? Why are they doing this? Why not just make a deal or talk to SPG…….

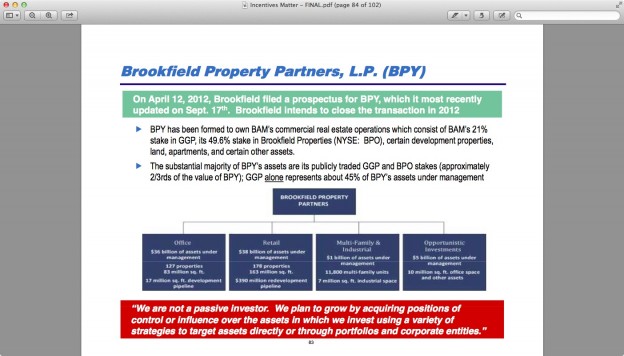

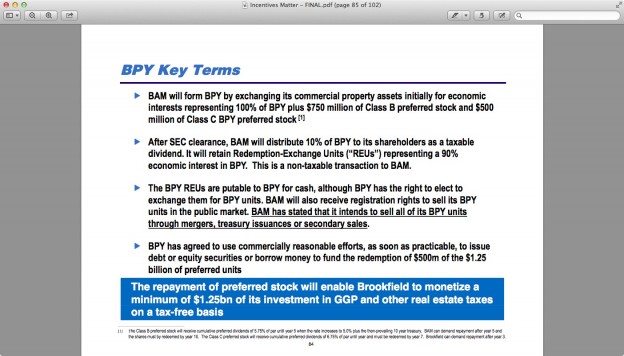

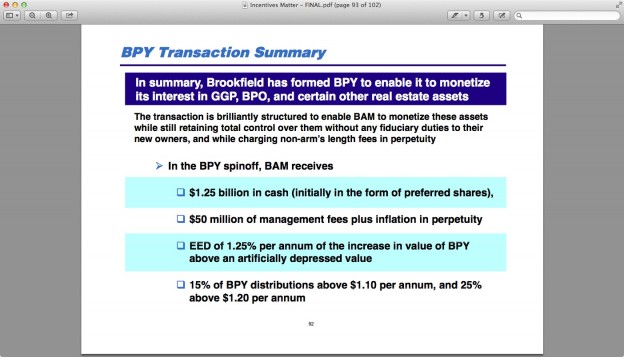

The reason? BPY

What is BPY?

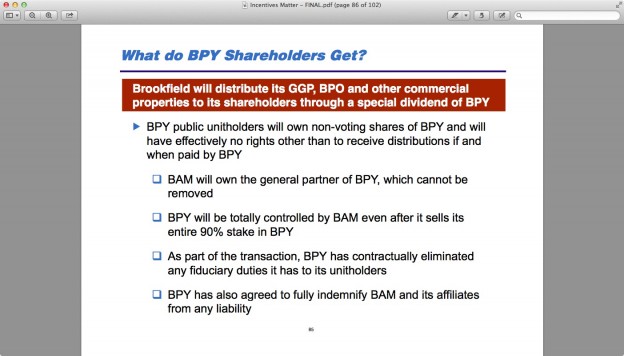

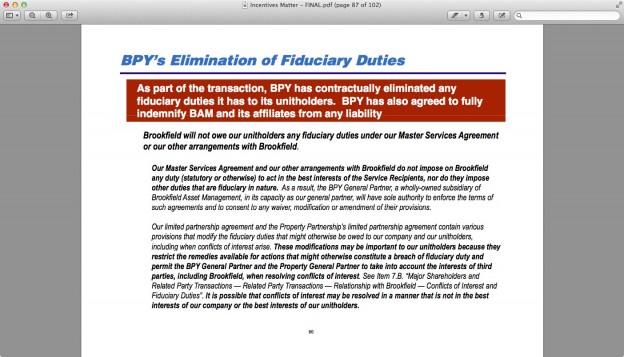

You might be asking, “what do you mean they have no fiduciary duties to shareholders?” It is amazing, but true….you have to read it for yourself to believe it

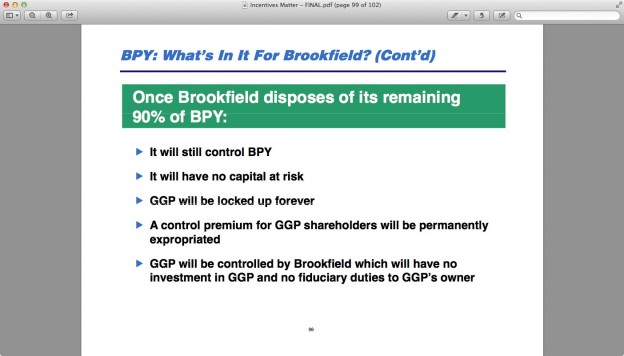

So, BPY shareholders will have a stake in an entity who will be controlled by BAM, will pay BAM handsomely but will have a controlling shareholder that has no duty to protect their interest in BPY.

As Ackman said, it is “brilliant” for BAM (they monatize GGP tax free and get a perpetual management fee), lousy for GGP shareholders as GGP will NEVER be sold one it goes into this entity and its owner, BPY will be controlled by an entity, BAM that has no fiduciary duty to it and ergo, GGP shareholders. As for BPY shareholders, …….why?

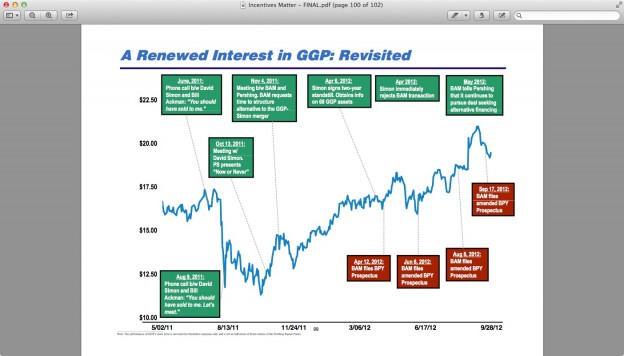

Now, was this the plan all along or was it something that BAM recently came up with after the SPG deal fell apart? Remember that we really just do not believe is amazing coincidences, take a look at the following time line:

BAM was planning this all along and never had any intention of buying GGP or doing a deal with SPG.

This stinks……. While one has to admire BAM for its ingenuity here, as a shareholder of GGP one had to be outraged at the otal lack of god faith exhibited towards them in this entire process. Remember Flatt’s letter in which be said BAM ascribed to the Berkshire Hathaway theory of investing? Buffet should sue him for defamation. No, I’m not serious but comparing this activity to the way Buffett has done business for 50 years is a utter joke.

Here is the issue, once this transaction is done, it is very hard if not impossible to undue. Why? Right now the only disadvantaged shareholders are GGP’s. Once this transaction is completed, then to undue it would also disadvantage BPY shareholders for the gain of GGP’s. Since BPY shareholders did not initiate that transaction, undoing it then become a bit of a mess.

While Ackman “strongly urged” GGP’s Board to form an entirely independent committee and hire independent financial advisors to look at the merits of a SPG deal, I think the clock here may be ticking before shareholder lawsuits are filed to stop the BPY share transfer. If nothing else, a suit filed would more likely than not obtain an injunction against the formation of BPY and GGP share transfer until the legal issued are sorted out. Since there are no current shareholders of BPY to be damaged, due such an injunction as it does not formally exist yet, I don’t think the courts would be unduly hesitant to grant one.

That would buy time for additional pressure from shareholders on the current GGP Board to actually act in the interest of GGP shareholders….I know, a whacky and novel idea but hey, why not dream?