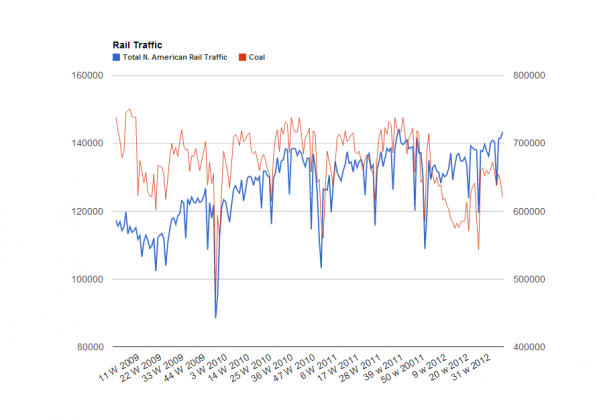

Total N. American rail traffic came in at 717k card last week. The adjusted total of ~735k cars sets a new 4 year record for a single week in the series handily beating the 721k set during the same week last year.

As we have done since the beginning of the year we adjust for the collapse in coal shipments (~20k) cars per week due to the switch from coal to nat gas by energy producers. Coal is down 19% and natty up 35% for generation YTD 2012. Since electric demand is steady and coal is shipped via train vs pipeline for natty, the drop effects rail traffic negatively. Since the drop is NOT due to economic conditions (electric demand has not fallen) but simply input changes, we adjust to get more valid YOY comps for rails.

Not to sound like a broken record but as we have said almost weekly for the last three years following rail traffic, there is absolutely nothing in these numbers that gives any indication of a material slowdown in the general economy or even a recession. If anything, the magnitude of the YOY beat and weekly rise could lend one to think that the economy is acceleration. We of course will have to watch this over the next few weeks but this is an impressive numbers.

Word of caution. Weeks #39/40 tend to be the high point of the year for rail traffic as it slowly declines for the rest of the year. SO, we will not be too concerned with the direction of rail traffic from here on out (expect it to decline) but we will focus on the YOY numbers. If the past is a predictor, you will see websites that tend to have a bearish outlook use the weekly “stagnation” or “declines” as proof of an economic slowdown. Take them for what they are. Weekly numbers tend to vary up and down through Oct/Nov so weekly changes should be viewed through that prism. We will focus more on the degree of the trend vs weekly data YOY. I of course will still display weeklies it but simply note this as a disclaimer going forward. Post thanksgiving we will see a fairly dramatic slide through the end of the year before rebounding in week 1-3 of 2013. An over 20% decline in traffic over this period is not unusual. This is all 100% normal behavior

4 replies on “Rail Traffic Sets Multi-Year Record”

[…] Still no slowdown in N. American rail traffic. (ValuePlays) […]

[…] Rail Traffic Sets Multi-Year Record | ValuePlays […]

[…] the rest of the analysis and see the chart, here. […]

[…] Rail Traffic Sets Multi-Year Record Value Plays […]