So, Barack Obama won last night. I have always made an effort here to separate politics from analysis. While I will continue to think for the next four years the economy we would have seen under a Romney administration would have been several levels higher than what we will see, that does not color my opinion of where we are. I have made the case for the last three years despite my objection to a majority of the policies sought and implemented that we are in fact recovering and the dreaded “double dip” was not in the cards. So far, that minority view has been correct.

I have resisted the partisan “things are awful” rhetoric because, well, they aren’t. They are getting better, albeit at an agonizingly slow pace. Could they be better? Of course but “could be better” to me does not mean “they suck”. It means, you know…..thing could be better.

All the leading indicators we follow here still point to a middling expansion. None even remotely indicate a recession or a contraction. No doubt we will have another recession. The business cycle says we have one every 7-8 years on average (last recession ended 2009). That means we will probably be near or entering one by the end of Obama’s second term, it is just the way it is and no policy or party can eliminate the business cycle. Policy can minimize a recession severity or boost the recovery from one (the reverse is also true), but it cannot eliminate its eventualities. But the recession eventuality is +/-4 years away and for now, IMO it just is not in the cards currently.

The one caveat here of course is the weaker the recovery, the increased chances an external shock tips the economy into a recession prematurely. It could be the EU, Iran, “Fiscal Cliff”, bad policy or any other one of a half dozen boogeyman. A weak or middling recovery (yes, it is still a recovery) brings more potential events into the fold that could derail it vs simply “slowing down” a surging economy. But here all of the above are known events that are unfolding slowly and that has allowed US business to adjust. So while one cannot deny these potential events exist, I think they will be avoided or their effect minimized. This is not to say something new might not pop up, just that it is not “out there” yet.

So, no, I am not saying that “there will be no recession for the next 3-4 years”. What I am saying is that for the immediate time being, it is not in the cards. We are in a recovery, a tenuous and admittedly frustratingly slow recovery….but it is still a recovery.

“Davidson” submits:

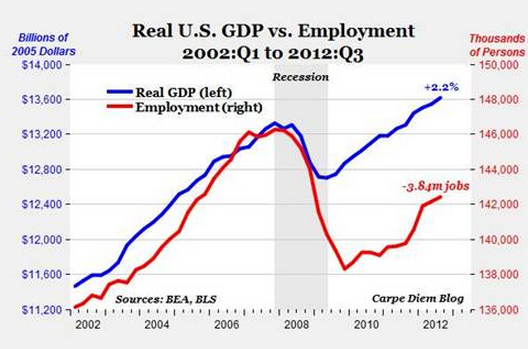

Mark Perry in a recent note shows the strength of the US is in productivity, i.e. “Faster, Better Cheaper”. Link: http://www.aei-ideas.org/channel/carpe-diem/ I excerpted one of his charts below. His full commentary is strongly positive for equity investors because the recovery in Real GDP has occurred without, (I need to repeat this) WITHOUT a US housing recovery which is just now showing some strong stirrings. A report yesterday from Martin Marietta Materials Inc. (MLM) is reflective of the early beginnings of just such a housing/construction recovery:

“Martin Marietta ($MLM) reported a profit of $62.9 million, or $1.36 a share, up from $49.2 million, or $1.07 a share, a year earlier. Sales jumped 18% to $593.9 million.” Dow Jones, 8:31 AM EDT Nov 06, 2012

The Architecture Billings Index, a precursor of the rise in large building projects has recently pushed back over the 50% level and provides support for believing that MLM’s news is likely to continue, link:

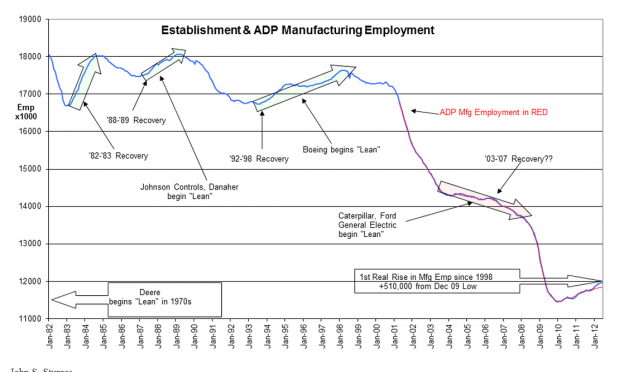

One of the reasons for the US recovery is the resurgence in manufacturing jobs. The chart of Establishment & ADP Manufacturing Employment at the bottom of this note indicates that Manufacturing Employment continues its expansion. Over the years there has been gradual acceptance and now we see a surge of US corporations embracing “Lean Mfg” techniques to out-produce, with higher quality and lower net cost products that provide greater value for consumers. The net/net is a true gain in manufacturing employment which began a very long slump in Jan 1982. Simply the fact that the US is regaining jobs in this area after such a very long period of decline shows the strength of our creative productive capacity and reflects our abilities to remake ourselves

Simply the fact that the US is regaining jobs in the manufacturing area after such a very long period of decline shows the strength of our current economy.

We have endured not inconsiderable financial distress with the government’s drive for equality in housing since the mid-1990s and the subsequent sub-prime lending debacle. Even so, the charts below reveal that US has rehoned its productive edge. That the US has accomplished this make-over is the indication of a very healthy and productive society. Those who are out of work currently are finding opportunity as Help Wanted Online, Jobs Openings and etc. reflect that the demand for employees remains quite positive and is becoming stronger. With improvements in the housing and manufacturing sectors, employment should continue to rise and economic activity to expand.As an investor I see considerable opportunity in the equity markets with the primary focus now being in US and Intl LgCap arenas including Natural Resources. With Emerging Markets, REITs and Fixed Income having seen dramatic inflows of capital in recent years resulting in excess valuations, I have recommended that these asset classes be trimmed from portfolios. What remains is historically under-valued and offers significant opportunity for equity investors ($SPY) over the next 5yrs.

Optimism continues to be warranted!

Mark Perry Excerpt:

The US economy is now producing 2.2% more output than before the recession, but with 3.84 million fewer workers

One reply on “The Election and the Recovery”

[…] The Election and the Recovery ValuePlays […]