“Davidson” submits:

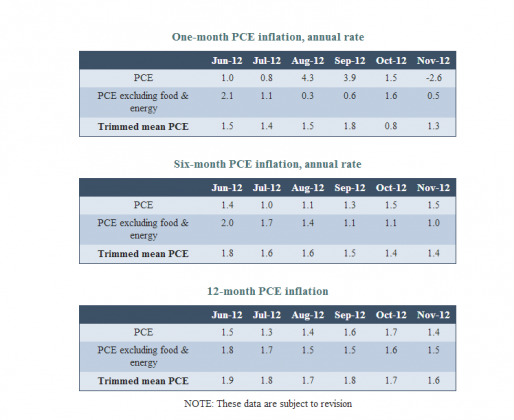

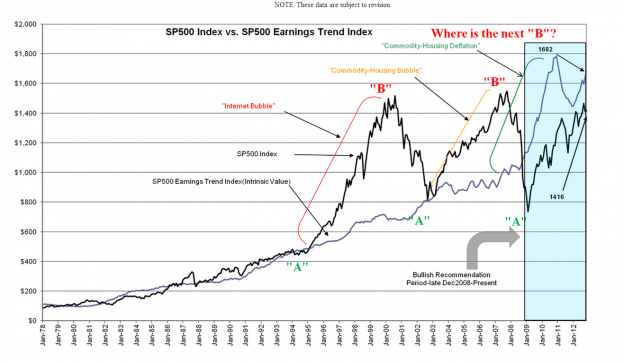

The Dallas Fed reported the 12mo Trimmed Mean PCE for November 2012 after the market close at 1.6%-see table. This lowers the “Prevailing Rate” to 4.62% and brings the “Intrinsic Value” of the SP500 to $1682-see chart. The effect of falling inflation results in higher stock pricing all other things being unchanged.

Inflation has been falling mainly due to the controlled spending of $Trillions injected by Chairman Bernanke. Basically, most are hoarding these dollars as a safe haven against future uncertainty. The inflationary risk is unpredictable as should now be obvious by the many unfulfilled forecasts of higher inflation at this point in the economy. I think that all we can do is to monitor the data on a monthly basis and adjust portfolios as the risks become apparent. The market itself does not have a history of being correct in pricing inflationary expectations.

For the past several years inflationary fears have caused many investment funds to buy hard assets as a protective asset. The problem with this concentration in oil, gold, copper, land and etc is that inflation fears have not been realized while returns on these investments have stalled at low levels. History shows that falling inflation is beneficial for stocks while rising inflation causes stock prices to fall-see the chart history. More than half of the $SPY rise from 1982 thru 1997 was due to inflation falling from ~10% to ~2%.