Posting will be sporadic from here until after the New Year…… but I though this was excellent given the year the markets have had

“Davidson” submits

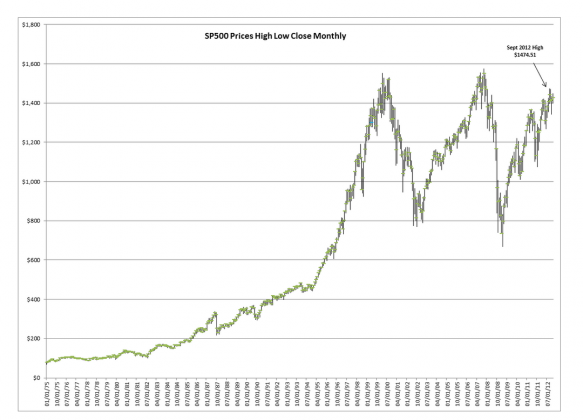

While it may not seem like it, the SP500 ($SPY) has risen ~14% from the Dec 31, 2012 close. The high during this period occurred in September 2012 at $1474.51 according to data from Thompson Reuters. The chart below shows SP500 formatted for the Monthly High Low and Closing Prices as published by Thompson Reuters.

From what I can tell, within the majority of advice provided by the many who have been featured in the media the past 4yrs, there is no one who has correctly predicted the market’s minor or major turns since the lows in late 2008 and early 2009. Look back and saying that “I could of…” or “ I should of…” makes it appear far simpler than it really is. The difficulty in predicting markets is embedded in the wide spread belief that investor and consumer sentiment drives markets which in turn drive the economy. The body of data which has only recently become readily accessible through the St. Louis Federal Reserve FRED site lets one test the many assumptions which are prevalent in investor thinking. Low and behold, when one carefully compares the many economic data series for support of the existing methodologies so frequently repeated one finds little correlation. What one does find is not a series of multiple short term relationships with which active investors must trade, but something far simpler, longer term and dominant which can only be captured through a patient and carefully crafted approach.

What one finds is that it is the economy which drives not only markets but investor sentiment in spite of the many heralded short term issues which appear seemingly out of thin air to threaten investor destruction. (At least, you think your capital is at risk of imminent threat of destruction if you listen to the media and do not “do something” at each ebb and flow of geopolitical news). The US economy and with each passing year the global economy shows many signs of responding to the economic needs of maintaining and improving individual standards of living in spite many issues which eventually reveal themselves as trite in comparison.

What we tend to lose track of is that US Real GDP has averaged close to 3% the past 25yrs. What we have missed in our overly detailed daily news call to action media pronouncements is that an overheated economy occurs at the 4% Real GDP range and that recessions are in the ~2% Real GDP range. These are not large variations yet they result in euphoria at economic peaks and depths of despair at economic lows which cause some to describe the markets as “Bi-Polar”. We have come to recognize these extreme highs and lows in investor sentiment and to believe that it is sentiment which drives the market and the economy. This is the problem of our focus on the “Trees” and not the “Forest”. Human history is replete with instances of facing difficult problems and through examination of the details of the issue we improved our understanding to a level at which a previously unknown solution suddenly presents itself. This is the art of discovery which has served us well over the eons and advanced human society. We have attempted the same approach with investment markets the past 100yrs using many highly complex detailed mathematical approaches. The fact that this approach has not worked to date has spurred yet even greater energy in the belief that a form of market “Holy Grail” remains just out of reach if only the right mix of formula and data can be identified.

The “Forest” perspective reveals a far simpler picture. When one compares Real GDP and various economic trends looking for historical trends, one is struck with the clear correlations between broad measures of economic activity and investment markets. Rather than having to be on pins and needles alert to taking action at every twist and turn, a strategy of valuation combined with patience emerges. One can see that there are simple valuation benchmarks that markets track across investment and economic cycles. To capture them one needs to have “Patience” and courage of ones convictions in the face of the onslaught of the many urging one to “Do Something!” The fundamental driver of markets and investor sentiment over the business and investment cycle is quite simply the economic cycle. The economic cycle today is more global than in decades past as trade has tied each of us to others’ economic success in countries thousands of miles away. Each of us has become increasingly more connected to the 7.090 Billion other individuals now populating the earth. Economic cycles are increasingly correlated and they certainly are quite powerful. Once they begin to correct from excesses, they trend together! Once we begin to rise from a corrected level, global economies trend together! The desire inherent in 7.090Bil to improve individual standards of living overwhelms whether Greece, Spain, Ireland and etc. will have an economic impact on the whole. We tend to focus too much on the “Trees” and so often fail to see the “Forest”.

We react in panic to the issues with Greece’s 11mill individuals and fail to see the broad trends in the global population of the other 7.090Bil.

Economic cycles vs. market psychology. The many short term swings in markets and sentiment are buffered by the relentless and the snail like pace of economic activity. Economic activity does not stop and suddenly start, it does not ebb and flow monthly or even quarterly! Economic activity includes too many individuals working diligently to have fits and start. What is more(in my opinion) likely is that we are imperfect in our understanding of our abilities to measure economic activity. This is coupled with our desire to “Do Something!” and causes us to over-interpret near term trends as long term direction. Once economic activity begins to improve from recessionary levels, it tends to progress to excess, i.e. once the US lifts off from ~2% Real GDP growth history suggests no stop till we enter excess growth near or above the 4% annual growth level. This is because recessions build unsatisfied demand which results in additional hiring as economic activity improves. The additional hiring itself adds to economic demand and like water sloshing in a bathtub, demand builds its own momentum till the hiring and production become too much for long term economic demand to support. The economy has cycles which we tend to disbelieve while we are in them. Our pessimism leads us to believe that recessions will never end and when the boom times arrive we tend to believe that this time it is different and that the “Boom” will last forever. Ahh…the vicissitudes of human psychology!

Economic activity is a massively relentless force! Once it lifts from recession, the history shows a routine progression into economic excess unless government massively changes the rules of the road. The lows of the SP500 in 2008-2009 reflect the lows of automobile sales. The next economic peak I expect will reflect peak automobile sales. The large and small mini-dips in the SP500 since March 2009 come from responses to potential effects of events which many took to be threatening at the time. Market participants felt threatened till the relentless pace of the economy proved that such threats were of no importance. History lets one predict higher stock prices till economic activity goes to excess. But, how high a market can climb and when it is likely to reach a particular price is impossible to forecast. While one can measure an “Intrinsic Value” for a market and for individual stocks and bonds, security pricing is heavily influenced by market psychology and predicting its impact is not something anyone has ever been able to do no matter how hard the effort the past several hundred years.

This does not stop us from being able to invest with some level of certainty if we make ourselves familiar with history. Market history tends to rhyme if not repeat with precision! As of today, it appears that housing and commercial construction which are the last pieces of our economic puzzle are in recovery. Historically, this lets me estimate that the current recovery has another 4yr-5yr to run with higher stock market prices likely till we reach economic excess. Once, you learn that market predictions cannot be precise, you drop the math from prediction and become a better investor!

As we enter 2013, I remain quite optimistic towards stocks.