UPDATES AT END

A major part of the short thesis in $GME has been the effect of next generation systems. It was said that they would be better optimised by download and cloud gaming killing the need to go to $GME for a new or even worse, a used game.

Now there is a new wrinkle, see the bold section below:

From the WSJ

Microsoft MSFT -0.34% and Sony 6758.TO +5.87% have taken diverging approaches in their expanding war for the hearts and minds of gamers. Yes, their next-generation consoles both offer high-fidelity games, and they can both play music and movies. But the rest is rather different.

In particular, the companies have taken different approaches to Internet services, or the “cloud.” Sony, for its upcoming PlayStation 4, dove head-first into technology that allows customers to play a game on a server far away, and then stream the images and button presses to the device over the Web. That technology, called “cloud gaming,” was popularized by companies like OnLive and Gaikai, which Sony purchased last year for $380 million.

The technology also plays into Sony’s larger vision of a videogame console that would “melt” into the network, more easily linking players together. This approach has generated quite a bit of buzz, particularly for one feature that allows gamers to play high-end titles on the company’s PlayStation Vita handheld game console.

But Microsoft doesn’t see it that way. It says the Xbox One, and revamped Xbox Live service, is designed from the ground up to allow game companies to use Microsoft’s servers to better their games.

“We created something that understands how to be performant for all scenarios and all combinations,” said Don Mattrick, head of Microsoft’s interactive entertainment business, in an interview.

So what does that mean? Imagine a typical game: there are characters in the foreground that interact with the player, and a background landscape with trees, hills or an ocean. Mattrick said Microsoft’s new servers, which the company increased to 300,000 from 15,000 currently used by the Xbox 360, will be able to do some of the work creating images for that background landscape and then stream them back to the console and TV, while the Xbox One focuses on making the characters look as impressive as possible.

There are disadvantages to both approaches. Gamers will need to have steady and strong Internet connections to ensure the images streamed to them from servers far away look good and perform well on their screens.

Compatibility between software and hardware is also a challenge. For example, nether the PlayStation 4 nor the Xbox One can play game disks made for their predecessors. Sony said it is working to make its gaming system offer customers a way to play older games made for the PlayStation 3 (and earlier) by streaming all the information from servers. Microsoft indicated it isn’t planning to offer that type of service.

Microsoft’s Mattrick says he doesn’t think compatibility is really a problem. He said only 5% of customers play older games on a new videogame system anyway, so spending time and money to develop technology to allow them to play older games isn’t worth it.

“If you’re backwards compatible, you’re really backwards,” he said.

Social media research firm Fizziology said its surveys of potential customers before the Xbox event showed 12% of them would be unhappy if there wasn’t backwards compatibility.

Michael Olson, an analyst at Piper Jaffray, said in a note to investors that negative sentiment could hurt sales in the short term, but it could also help drive sales for the new devices, “as gamers rebuild their entire library for a new console.”

So, why is this a big deal. The bulls will say “gamers will just go to $GME to get the new consoles and new games” and that is good for the company.

The thing is recent history says that is not the case.

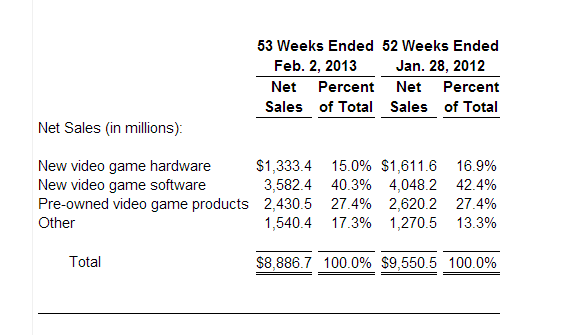

Same store sales fell for all of 2012 for $GME despite a record release for the new Wii system and record releases for Halo 4, and Call of Duty. Further, new game revenue and console revenue also fell by nearly $800M combined.

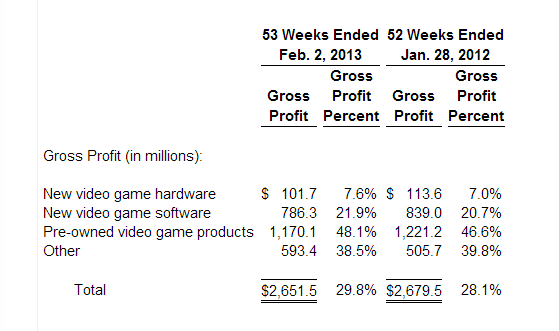

But that is secondary. It is the used game traffic that is the key for $GME. While at nearly $1B less in revenue than new games, it accounts for 55% more profit than selling new games:

Bottom line is that if this trend continues with other console makers (and it will), $GME will see it most profitable division, and roughly 40% of its profits wither away and die. That makes what is being called a “cheap stock” today look VERY expensive down the road. Without the used game traffic going into $GME, there is very little reason for them to exist as new games can be bought for similar prices at $WMT, $AMZN and dozens of other sites. It is the used games and “trade in” allowances that drive store traffic, NOT new games

This also ignores the effect on their new game sales from the cloud gaming and direct downloads that will explode over the next two years. In 2012 there was a 29% drop in SKU’s for physical video games. Why? Gamemakers are moving to digital at a record clip. As the new physical DVD game business smelts away (down 6% in ’12 despite the record releases above) all you then have is their “other” category which is their mobile efforts and as a seller of second hand devices and new hardware. This does not even consider what $AAPL may or may not do.

As I have said before, there is a business here, just one at a fraction of its current size.

$GME reports tomorrow and I have no idea what they will report. I know share buybacks will be prominent (but cash for them is dwindling) and they will tell us “new releases will boost sales” going forward. How do I know? They said that all 2012 as sales cratered. Why change now? They may beat, they may not. I don’t really care, all I know is the writing is on the wall for those who want to take a look

The bottom line is that their main business is facing insurmountable headwinds….. what looks “cheap” today and become very expensive very fast tomorrow

UPDATED WITH EARNINGS:

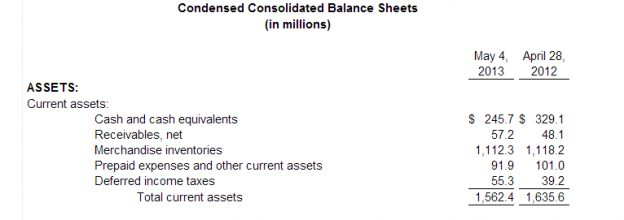

Nothing has changed. Sales are down, same store sales are down, net income is down. In short, the company’s main business drivers continue to deteriorate. Yes, they are buying back shares but as I said before, they are doing so with a dwindling cash supply:

Cash fell 25% in Q1. This is a true fall as the increase in receivables is offset by the decline in prepaid expenses. Deferred income taxes continue to grow so keep an eye on that as that check has to get written at some point.

Here are the key metrics:

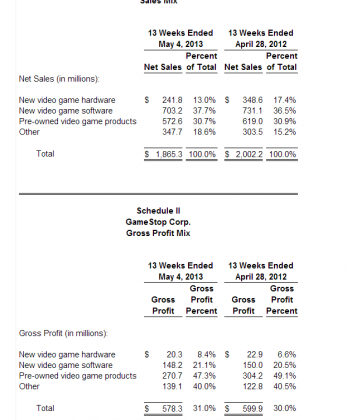

Pre-owned video games profits dwarf other categories and continue their fall. When one looks at $GME one has to assume this category continues to shrink (for the reasons above) and then wonder where they will replace near 50% of their profits? Nothing they have tried to date has come even close.

They can continue to buy back shares until their shrinking cash balance runs out and prop this thing up for a little while longer but reality always hits…

Remember, these revenue and same store sales decreases below are coming off a lousy 2012.

First Quarter Results

Total global sales for the first quarter of 2013 were $1.87 billion compared to $2.00 billion in the prior year quarter, a decrease of 6.8%. Consolidated comparable store sales decreased 6.7% compared to the prior year quarter. Topline sales continue to be impacted by the late stage effects of the current console cycle.

During the quarter, mobile sales grew 290% to $46.8 million and digital receipts grew 47.3%. Sales in new software decreased 3.8% compared to a U.S. industry decline of 14.2%, leading to a 470 basis point market share increase in the first quarter. New hardware sales declined 30.6%, while pre-owned sales decreased 7.5%. Year-to-date, GameStop’s U.S. market share of new PS3 and Xbox 360 software is 47.7%.

GameStop’s net earnings for the first quarter were $54.6 million compared to net earnings of $72.5 million in the prior year quarter. Diluted earnings per share were $0.46, exceeding the high end of the company’s guidance by $0.03. The better-than-expected results were primarily due to a 100 basis point increase in gross margins. EPS declined 14.8% compared to diluted earnings per share of $0.54 in the prior year quarter.

Paul Raines, chief executive officer, stated, “GameStop’s continuing margin expansion, growing new businesses and market share gains are the results of executing our strategic plan. We look forward to capitalizing on the upcoming new console cycle.”

Capital Allocation Update

As previously reported on March 28, GameStop repurchased approximately one million shares at an average price of $25.07, or $25.5 million worth of stock during the first quarter of 2013. The company remains committed to returning 100% of free cash flow to shareholders and as of today, there is $400 million remaining on the existing repurchase authorization.

GameStop’s board of directors also declared a quarterly cash dividend of $0.275 per common share payable on June 19, 2013 to shareholders of record at the close of business on June 4, 2013.

Earnings Guidance

For the second quarter of fiscal 2013, GameStop expects comparable store sales to range from -16.0% to -12.5%. Diluted earnings per share are expected to range from $0.01 to $0.07.

The company is increasing the lower end of its previously announced full year diluted earnings per share guidance range of $2.75 to $3.15 to $2.90 to $3.15. The previous full year comparable store sales range of -6.0% to +1.5% is being narrowed to -5.0% to +1.5%.

UPDATE NUMBER TWO: IF THIS IS TRUE….$GME ‘S USED GAME BUSINESS JUST WENT *POOF*

3. Used games require an unlock fee

Here’s where things start to get complicated. Whether or not the Xbox One would play used games was one of the biggest questions heading into the event, and one that wasn’t addressed during the presentation. It was asked a million times by the press afterward, but Microsoft still isn’t giving out a full spectrum of details.

The short answer is yes, the Xbox One will play used games.

The long answer is a bit more complex. All Xbox One games must be installed to the hard drive, either through digital download or the disc itself. That allows easy access to titles without disc switching, but it also causes complications. If you buy a physical disc and want to say, loan it a friend, they’ll have to pay an unlock fee to get the game to work on their system with their account. There’s no word on either how much this fee would be, or how many times you could do this with one disc. If the fee is small enough, $10 or so, it would allow people to essentially clone games for cheap. But if it’s expensive, like $30, then that really puts a damper on sharing altogether. Microsoft HAS clarified that if you play a game on a friend’s Xbox using YOUR account, a sharing fee is not required. But if you loan it to them to play on their own account, there would be.

And also what’s clear is that buying a used game will likely come with this same additional fee, meaning the era of uber cheap used games where Gamestop makes 100% pure profit is likely over. Sony so far has refused to comment on their own system for used games, but speculation is that it’s similar to MIcrosoft, and the two will stand united on this front.

On top of all of this, Microsoft says they’re still not releasing all their plans about game swapping and sharing and resale. “We’ll have more details to share later,” they say, but in the meantime, it’s apparent that the definition of what a “used game” is has changed dramatically.

Update: There seems to be some indication that this unlock fee might actually be the full retail price of the game. That’s certainly what it sounds like from what Phil Harrison is saying here. If that’s the case, then how exactly do “used games” even exist at that point? This is only making things more opaque.