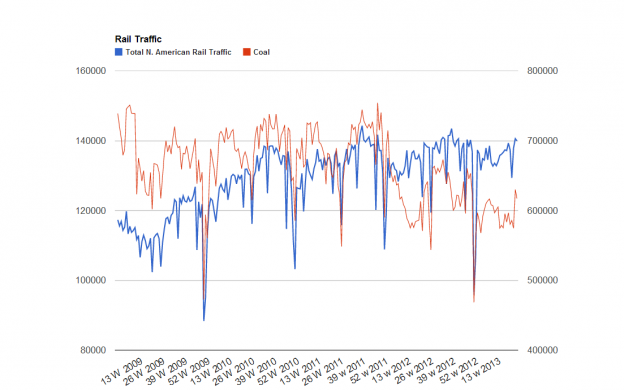

Total N. American rail traffic remains higher YOY last week ($IYT). We are entering a point where YOY comparisons on an absolute basis are now more valid. They were skewed for all of 2010 due to the collapse in coal shipments due to the natural gas ($UNG) glut and price declines there. Here is the chart with the coal discrepancy also plotted

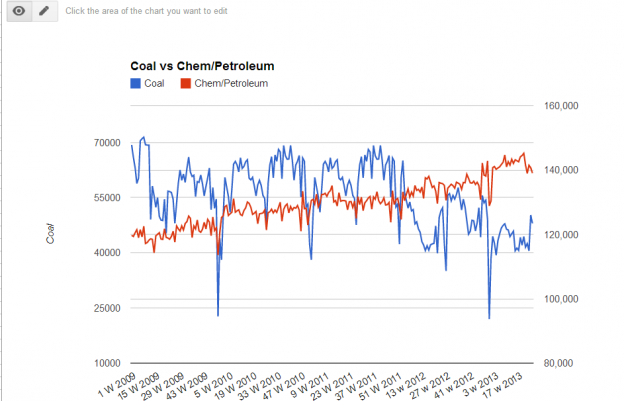

Many have tried to negate the coal collapse claiming that the increase in oil shipments ($USO) via rail from the Bakken and other areas are offsetting this. Below I have plotted that data.

While the category “chemicals and petroleum” had certainly increased, it has nowhere increased enough to offset the huge decline in coal shipments. Coal shipments have dropped roughly 20k carloads a week from 2010 while the category “chemicals and petroleum” has increased roughly 8k carloads. For last week coal traffic YOY was down 3k while “chemical and petroleum” was up 3K so they were a net wash. In fact every shipping category saw YOY gains except coal and grains. The most impressive growth was in the “metals” and “stone and related products” categories (think manufacturing and construction).

If we net/net everything out, we are seeing continued growth in rail traffic (from the other categories) which correlates to GDP growth. Now, the growth in rail traffic is unspectacular, again backing the unspectacular GDP we have seen. But, I would add that it does appear based on the last month of data that rail traffic seems to be picking up. This gives further evidence that we might see GDP increase at higher rates as we go through the second half of 2012.

A couple weeks of data is still too little to make a determination but it has to give one increasing optimism that we are going to see continued increasing improvement as the year goes on…