“Davidson” submits

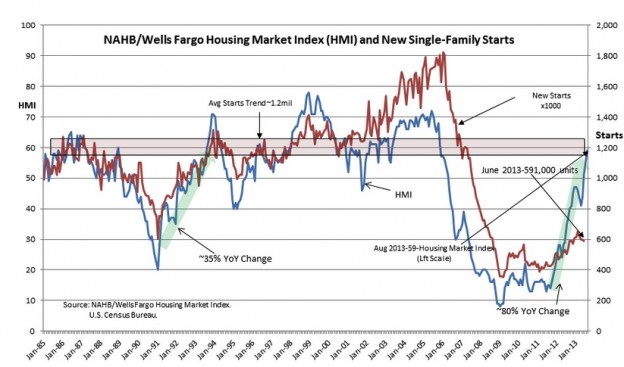

The National Association of Home Builders ($XHB) Housing Market Index (HMI) reported August 2013 at 59. This is a level which previously has been associated with the long term average of 1.2mil New Single-Family Starts. New Single-Family Starts will be reported next week, but the most recent June 2013 reported level of 591,000 New Single-Family Starts remains well below the historical average-see the chart below.

In the next few years I expect to see the New Single-Family Start level rise to and even exceed the long term average or 100%+ from the current level. It will take some time for housing activity to ramp higher. Based on the historical cycle I expect the housing market activity to be an expanding economic force for the next 5yr+. Housing and construction activity make significant contributions to our economy. Each new hire in Residential Construction equates to 7-8 additional hires elsewhere in our economy according to the Mtg Bankers Association. If Residential Construction Employment undergoes a full recovery from the current 579,000 to 1.1mill, one can estimate ~4mil new hires elsewhere in our economy for a total impact of ~4.5mil.

Our Unemployment Rate is currently estimated at 7.4% out of an estimated Civilian Labor Force of 155,798,000 which calculates to 11.52 mil unemployed. We normally have 3% of the Civilian Labor Force who are between jobs (called “labor friction”) counted as unemployed which means that 6.88mil are truly unemployed. Comparing this figure to the number of individuals who could be hired by a full recovery in residential housing of ~4.5mil, one can quickly comprehend the importance a vibrant housing market is to our economy.

Banks are only now able to expand lending to the average borrower as interest rates rise. It is my opinion that the Fed’s approach to stimulating the economy by forcing long term rates lower thru QE2 and QE3 has actually hampered bank lending because banks could not make enough profit to offset the normal lending risks. The Fed is the primary regulator of banks and I have been surprised by this form of “economic stimulation”.

The “market” which has been dominated by short term traders, i.e. Hedge Funds, has rapidly adjusted holdings as it shifted away from a prior bet that the US$ would collapse. This strategy change has caused gold and other US$ hedges to fall in price. some Hedge Funds continue to make the bet that the US economy will continue to falter and that the Fed will attempt to push rates even lower. This strategy results in the owning of 5yr-10yr-30yr Treasuries ($TLT). When these trades are unraveled, Treasury rates rise fairly quickly. This is how I would interpret the rate rise of the past several days. We will most likely continue to see jumps in interest rates rather than a gentle rise due to rapid portfolio adjustments by Hedge Funds. The “market” is comprised of many points of view. With ~$2tril concentrated and leveraged in the hands of a limited number of Hedge Funds, there is often considerable short term impact in market prices. In the long term though, it is economic activity which dominates long term market pricing.

In my final analysis, rates rising is a normal part of economic recovery as investors become more confident in seeking higher returns. Banks are a considerable part of the process. Bank reserves ($XLF) are typically held in Treasury securities. If they shift to lending to new home owners vs. lending to the US Govt., they will sell Treasuries and replace them with mortgages at higher rates of return. Mortgage rates are now approaching 5% and the anecdotal information confirms that bank lending is expanding.

I continue to urge investors to add to portfolios at this time. Equities should rise with economic expansion! The HMI is a good confirmation of housing market expansion.