“Davidson” submits:

The jobs reports all were waiting on are out and many express disappointment. How typical! There is always some one who will be more pessimistic than the rest and low and behold they get media time. Hmm…maybe if I became overly pessimistic, I would get substantial media time. The data is the data. The trend is the trend. It is all quite good.

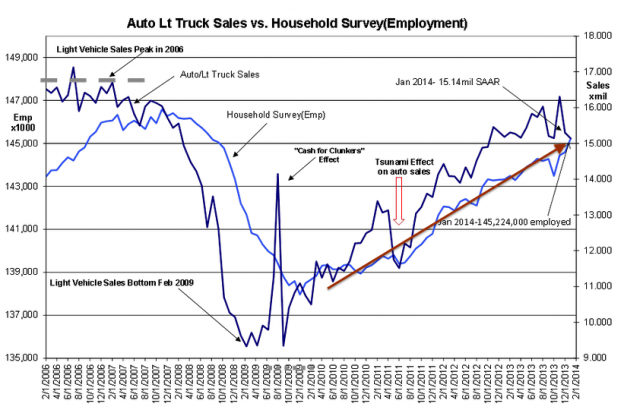

I have always preferred the Household Survey which even though more ‘statistical’ than the Establishment Survey, i.e. former is a telephone survey on 60,000 homes while the latter is derived from payroll reports, primarily because the Household Survey incorporates the self-employed, the entrepreneurs of our society not working for someone else.

The Household Survey came in higher by 638,000 vs. the previous month. This number is not revised month to month, but may be periodically refined every 5yrs or so years. This does not change its utility as we should be more interested in the current trend and not the monthly report itself. The survey of 60,000 homes is scaled to ~310mil people with an error of +/- 436,000. This is the nature of statistics and why a monthly change of 638,000 is pretty useless as a single point but a 4mo-6mo trend is all important. I call the employment trend in the chart below as quite solid.

Our economic expansion shows no indication of a slow down, which is consistent with vehicle sales, housing and construction activity and what one sees in the Temp Help and Job Opening data.

I would pound the table yet once again at this point but my investors have heard it so many times the last 5yrs, since Dec 2008, that I am afraid it falls on ears deafened by excessive repetition.

Oh what the heck…Buy stocks in my opinion ($SPY) ! Every economic data point thus far continues to support an economic expansion stretching perhaps another 5yr-7yrs. Market tops do not occur till the credit market freeze over (Flat Yield Curve) and with 70%-80% still estimated as thinking we remain mired in a recession, when they turn bullish the market has always turned much higher.