Current rail traffic data is telling me two things. Either Q1 GDP will be revised up, quite a bit OR Q2 is shaping up to be an impressive quarter due to delayed economic activity due to the brutal winter we had for the eastern half of the US. The traffic for the first 8 weeks of this year did meander around before beginning a pronounced uptrend in weeks 9 to 11. Either scenario depends on the timing of when items were counted. More on that at the end

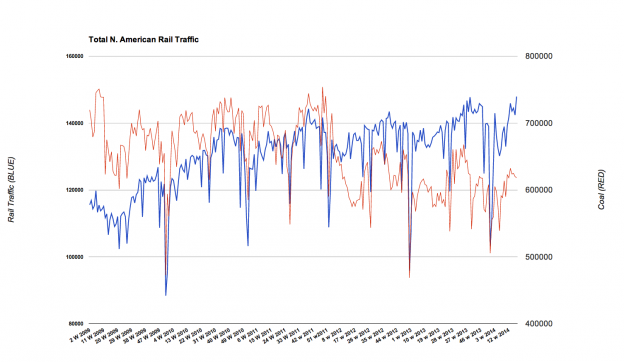

Total N. American rail traffic last week came in at 739k carloads, the highest reading since I began tracking the data in 2009.

As per usual, those who are bearish will tell us that the difference in traffic is solely due to petroleum being shipped from the Bakken due to rail. This is false. To be sure they are playing a part, but YOY for week 17 petroleum shipments are up 5k carloads vs 54k for total traffic.

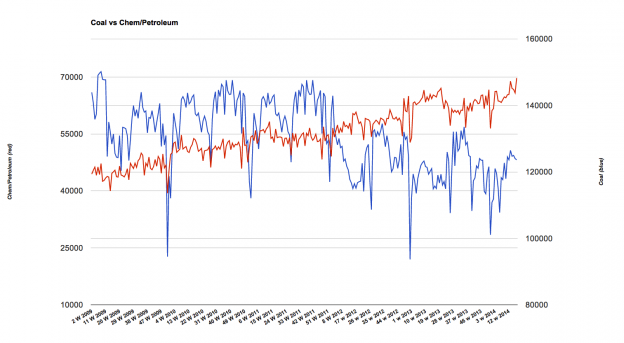

If we push the issue more, we can see that coal shipments since 2009 are down 25k-30k a week while petroleum shipments are up 15k-20k a week. So even here petroleum has not yet replace the rail traffic lost due to reduced coal shipments. Of course at some point it will, (assuming Keystone stays in limbo) but at best now it is a net neutral. Even the reduction in coal is not bearish as we have seen a large shift by utilities using natural gas to generate electricity.

Now, GDP. It is made up of two components, publix and private activity. Let’s break is down as see how each are doing:

“Davidson” submits:

Thought you would appreciate this breakdown. I expect to update my SP500 Intrinsic Value Index shortly once the Dallas Fed issues the 12mo Trimmed Mean PCE for March 2014, but the SP500 is still a little below fair value. Market psychology has considerable impact on security prices and can last as long as the particular news trend. Once the news trend pessimistic/optimistic changes, so do security prices.

———————————

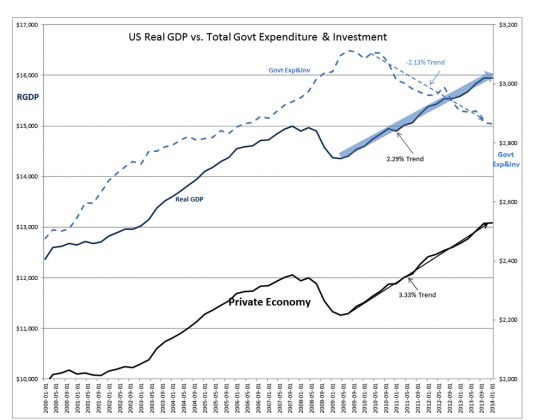

I periodically like to look at Real GDP growth broken down into its two major components, the Private Economy and Government Expenditure&Investment. It is very revealing as shown in the chart below.While Government Employment has stopped falling helping the overall employment numbers to look better, Government Exp&Inv continues to fall at more than a 2% pace since April 2010. This contraction of Government spending lowers reported Real GDP. The Private Economy which is simply the Govt Exp&Inv subtracted from reported Real GDP shows that underneath the Gross Real GDP is a Private Economy growing at 3.33% trend. Compare this to the 25yr pace of US Gross RGDP at slightly over 3% at this juncture.

It is the Private Economy which is mainly responsible for public company earnings. The SP500 represents mostly the Private Economy even though some earnings come from government spending. The fact decent earnings are being reported in spite of the slow down in Government Exp&Inv is the reason stocks should be higher today. But, the commonly reported analysis which does not breakdown Real GDP into its components leaves many with the impression that our economy is growing more slowly than it is!· Stock ($SPY) and bond prices are set by human perception. Once the government spending decline ends and no longer subtracts from Gross Real GDP, many investors will turn from being pessimistic to being more optimistic.

· No one seems to be watching this data in this way-it is impossible to predict when the turn in psychology will occur, but history shows that it will occur

Once investors suddenly realize than things are better than they thought, I estimate that they will price stocks higher than they have today. Investors need to incorporate this into their thinking and be patient.

The private economy is doing just fine. That is why we continue to see startups born and succeed, employment fall and if you look around your neighborhood, I’d dare say more people are employing contractors to do some improvements. The gov’t side of the equation is falling, this is also good. The less the overall economy is propped up via gov’t expenditures, the better for all of us in the log run. All that is needed now is for the decline trend to subside into a flatline level and we have GDP jump to >3% overnight.

Could things be better? Of course, they always could……but we are nowhere near a place we should be worrying