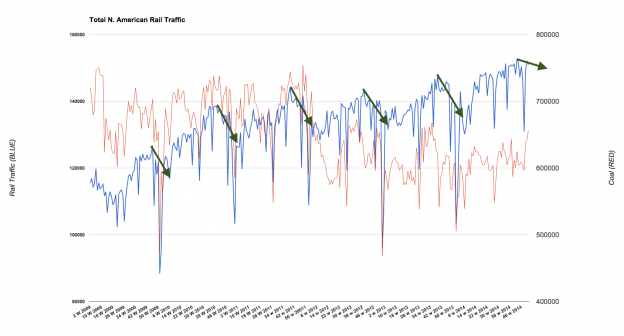

I keep getting emails asking why I’ve been so optimistic for Q4 and for Q1 2015. In its most simple form, the chart below cannot give anyone a reason to be anything but:

The chart tracks total N. American rail traffic on a weekly basis since 2009. The green arrows (click image to enlarge) indicate the historic rail traffic pattern from each year’s high point (typically week 40-45 depending on when holiday’s fall) and the beginning of the following year. You’ll notice the same trend each year….except for 2014-15. Rather than the normal steep decline from the highs into the new year, we are currently seeing basically a flatline. This is a trend I’ve commented on recently but at that time also said we had to wait this out to see if it was just a weekly oddity or a trend.

It is now a trend…

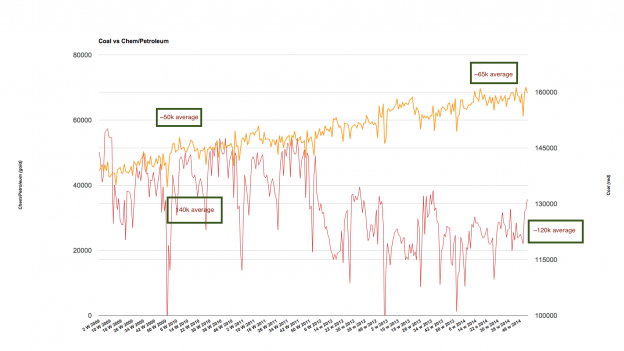

Skeptics will instantly claim this strength is due to the increase in oil shipments from shale production, not overall US economic activity. While to be sure that has increased, cheap natural gas has caused coal shipments to collapse negating any gains from oil.

The major switch from natural gas to coal began in 2011. Since that time “chemical and petroleum” shipments have risen ~15K carloads a week (note: this is “chemicals and petroleum so not all of the rise is oil) while coals shipments are down ~20k week so even considering the oil factor, rail shipments in total are still at a small deficit due to changing US energy dynamics.

The big change is in intermodal traffic which is up ~10% YOY as well as “metals” and “Stone and related products” which are also up ~10% YOY. The last two categories are direct reflections on manufacturing and construction activity.”Chemicals and petroleum” is up <2% YOY. So as I look US macro for the beginning of 2015 I see a rapidly improving job market and strength in both construction and manufacturing that belies historic trends. Add to this we have yet to see a serious national recovery in home building (we have pockets of strength) and there is still plenty of additional tailwinds for 2015.

Skeptics will toss in the “Fed raising rates” as a reason to not be so optimistic. The Fed has made it abundantly clear rates will not rise unless economic conditions warrant they rise. With energy prices collapsing due to supply, inflation (no matter how you measure it) will be virtually non existent in 2015 giving the Fed further breathing room as far as when to raise rates.

I‘ve been of the opinion for some time now gradually rising rates due to economic strength will be a huge plus for the general economy as it will open up lending to millions of potential homeowners currently locked out of the housing market due to artificially low rates (home building is the last major sector to recover). The question that matters most is “why”rates are heading higher. If they are doing so to crush runaway inflation (think Volker) then that will have a negative effects. If they are being done because the economy is strengthening and the Fed admittedly has held them below where they should be for years, then that is not bad at all and in fact opens credit to a wider array of entities (people, businesses etc) providing more broad based growth.

So, I’m very optimistic for at least the first half of 2015 and I expect Q3 GDP will “surprise” many folks with its strength just as Q3 did….