“Davidson” submits:

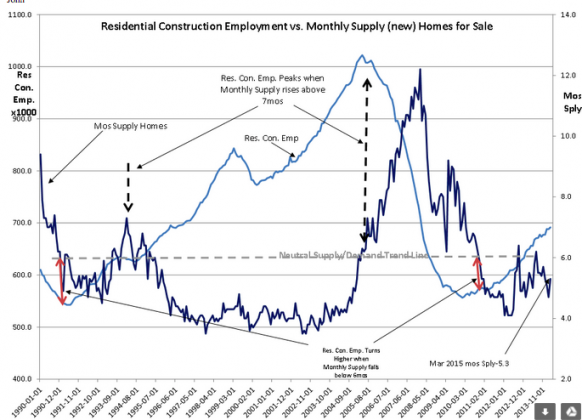

The Monthly Supply of (new) Homes for Sale remains in positive territory at 5.3mos.

It is not the number of new Single Family Home Sales which is important, but the pace of sales relative to the existing inventory of new homes for sale which is important when investing capital. The current trend relative to some historical benchmark is what provides the best long term guidance in my experience and for this reason I juxtapose the Residential Construction Employment

- Monthly Supply of (new) Homes for Sale in the chart below.

Monthly Supply of (new) Homes for Sale = Inventory of (new) Homes for Sale

Monthly Sales of (new) Homes

The benchmark is the long term level of the Monthly Supply of (new) Homes for Sale at which we see turns in the numbers of individuals working in building new homes. That number is represented by the GRAY DASHED LINE and titled Natural Supply/Demand Trend Line. When the major cycle trend of Monthly Supply of (new) Homes for Sale rises above its long term benchmark housing markets slow putting people out of work. When the major cycle trend of the Monthly Supply of (new) Homes for Sale falls below the long term benchmark housing markets become energized and hiring improves. You can see this in the Residential Construction Employment data. The relationship is quite strong and in my experience very helpful for investors. Note also that the benchmark once crossed signals generally a significant period of growth or recession with strong implications for equity/fixed income investors.

Currently we are well below the Monthly Supply of (new) Homes for Sale benchmark. You can see from the employment indicator that we remain well below full recovery. You can estimate that at the current pace the advance in housing ($XHB) could continue for another 5yrs till we reach a peak employment range. Equity prices should rise during this period based on historical precedent.

In my judgment equities are the preferred investment with LgCap Domestic ($SPY), Intl and NatResource asset classes most favored.

All we have seen is good news since early 2009. The good news continues.