Now, I’m no Fed basher by any means and in fact I can’t even think of the last time I wrote anything either way about the Fed and its actions. I do think Uncle Ben may have saved civilization in 2008-09 and even though some of those actions now are blowing back in the courts ($AIG case), Ben was flying by the seat of his pants and really did not have time to think about 7 years down the road. I don’t think I’ve ever written anything about Aunt Janet but today……….

As I said earlier “Yellen screwed the pooch”

From the release:

Information received since the Federal Open Market Committee met in July suggests that economic activity is expanding at a moderate pace. Household spending and business fixed investment have been increasing moderately, and the housing sector has improved further; however, net exports have been soft. The labor market continued to improve, with solid job gains and declining unemployment. On balance, labor market indicators show that underutilization of labor resources has diminished since early this year.

Let’s be honest, labor markets are heating up. We have job openings at all time highs, employment levels at all time highs and the unemployment rate stands at just over 5%. In fact in the tech a housing industries we are seeing labor shortages that are holding back production.

Inflation has continued to run below the Committee’s longer-run objective, partly reflecting declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation moved lower; survey-based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term. Nonetheless, the Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace,

Yellen & Co are stuck on the “pace” of economic expansion. It is as if they are waiting NOT for full employment and price stability to begin to raise rates, they are waiting for GDP to go from the 2.5% -3.5% gains we’ve seen the last 5 years to 3.5% – 4.5% gains. That, however, is NOT their mandate. Labor markets in many industries are getting tight as seen by job openings data and prices have been stable for 5 plus years now.

with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced but is monitoring developments abroad. Inflation is anticipated to remain near its recent low level in the near term but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of declines in energy and import prices dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress–both realized and expected–toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee’s holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Dennis P. Lockhart; Jerome H. Powell; Daniel K. Tarullo; and John C. Williams. Voting against the action was Jeffrey M. Lacker, who preferred to raise the target range for the federal funds rate by 25 basis points at this meeting.

So, if we come to the realization the Fed is really watching GDP and not labor markets and inflation, then we have to look at the situation and ask “what will it take to get GDP moving??”. The Fed had lamented the “moderate’ the pace of economic expansion since Yellen took the helms at Constitution Ave NW. So, we have to ask ourselves, if a 0% -.25% Fed Funds Rate is not goosing the economy to a level Yellen feels the need to raise rates, then maybe the reason the economy hasn’t been goosed is because the Fed Funds Rate is stuck at 0% -.25%?? It is the old geometry “if this then that” rule.

Think about it. Who are the major providers of liquidity to businesses and people? Banks and now to some extent insurance companies (many insurance co’s have branched out into CRE & mortgage lending). Both are required to hold large portions of their reserves in US treasuries and since Treasuries pay squat, they have branched out into other forms of lending.

But, loses, and avoiding them are key here. Bank and insurance companies essentially, when it is boiled down make money on credit spreads. As rates go higher, those spreads widen and they make gobs of cash. They, then wanting to make more money banks make more loans to people and that does involve going down the credit chain to below 700. Now, when rates are higher that is ok because the bank is being compensated for that additional risk in the form of higher rates.

Since rates are so low, only the best risk is obtaining credit. Of loans guaranteed by the GSE’s, 60% of home mortgages have a credit score of 750 and above and 80% are 700 and above. What does this mean? Well, according to Experian only 56% of the US population has a credit score >700 meaning 64% of the US population is effectively shut out of the US housing market (those in the lower credit ranking who get loans are putting more money down to purchase) as 80% of loans are going to 56% of the people. Even for developers, AD&C (acquisition, development and construction) loan volume is only 40% of what is was in 2008 and because of that we are not building enough homes to house the >1MM household formations we see each years and haven’t since 2008. THAT is causing the rush to rentals and cause rents to spike everywhere. This is exacerbating income inequality as “ownership” of assets is being restricted to most of the country.

Lending remains tight for those not at top end of credit scale http://t.co/NjqtdjS7Mmpic.twitter.com/tqsbVtDKZM

— Todd Sullivan (@ToddSullivan) September 15, 2015

From the FT:

“We’ve created this market where big companies can get credit – in some cases cheaper than pre-crisis levels – and at the same time for individuals and smaller entities it’s very hard to get credit,” said Peter Tchir of Brean Capital.

Later:

Bankers say a number of factors have combined to deter them from residential mortgage lending and the business of packaging home loans into saleable bonds. Housing reform remains bogged down in Washington, the details of many new lending rules have yet to be finalised and there are continued worries over lawsuits.

“You can’t lend and make a basis point or two and have to pay 40 bps in legal costs. Those are the current economics of the business,” says one banker who declined to be named. “The rules have been rewritten midway through the game.”

“There’s a lot of concern about whether it’s going to be a profitable business going forward,” says Kenneth Kohler, senior counsel at law firm Morrison Foerster. “A lot of banks are trying to pull back and make [home] loans just as a way to accommodate customers and have a full product mix, but they’re not really pushing them as a standalone profit centre.”

Now to be sure we do not want to go back to the “give anyone with a pulse a loan” days of 2005-08 but the pendulum has gone way too far. Mortgage originations will essentially be flat in 2015 vs 2014 despite credit quality and national home equity being at record numbers. Just looking at default rates, credit quality and household balance sheets banks one would think banks would be rushing to make these loans, but they are almost loath to. Why?

It all comes back to rates. Rates have been too low for too long and regulated financial institutions only have enough spread to make loans to only the best credit whether that be people or businesses. There just isn’t any money going down the scale.

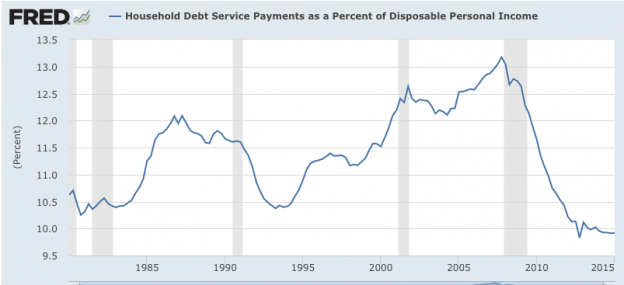

Doubter will say “Oh great….more credit, that is just what we need, that is what got us into this mess!!” Or something to that effect equally erroneous. True, credit abuse and over leverage caused the housing crash (payments to disposable income were at record highs) but look where we are now?

Household debt payments as a % of “disposable” income (NOT just income) are the lowest they’ve been in almost 4 decades.

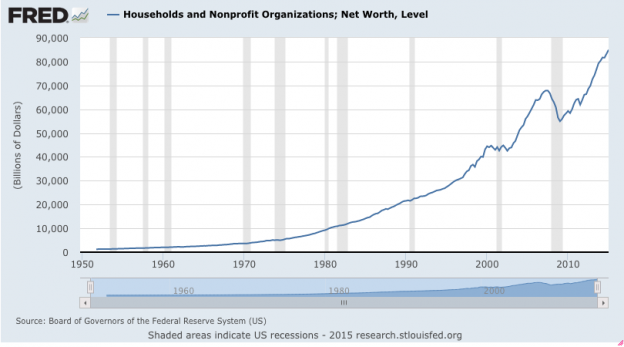

Household net worth?

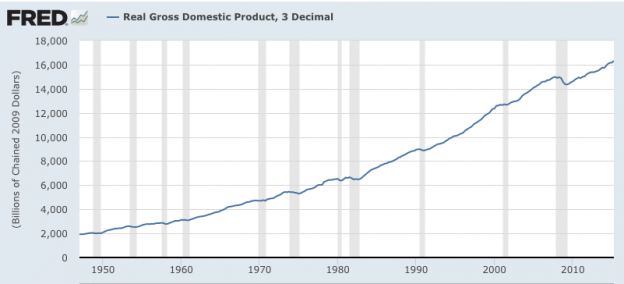

Think about it one step further, real GDP is at record levels:

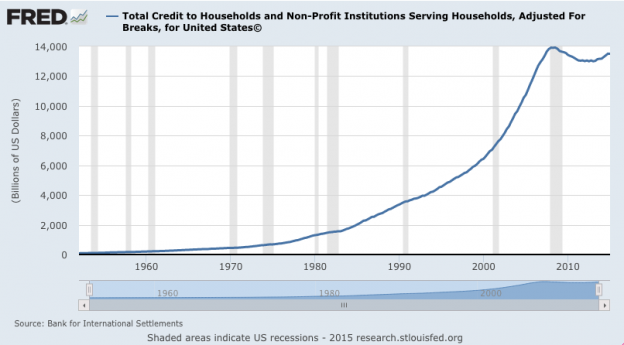

But total credit to households has flatlined:

Credit is stuck and GDP increases are not coming from credit expansion. THAT is because of low rates.

What would rising rates do? “Normalizing” interest rates would go a long way to “normalizing” the flow of credit up and down the credit chain. More credit would be available to those <700 scores. Developers, seeing more demand would find more loans available to purchase land and start developments. The desperately needed increase in supply would slow the price appreciation in homes that has gone on for 5 + years now unabated.

When you have record auto sales, record employment, a 5% unemployment rate, record retail sales, record job openings and household balance sheets as healthy as they’ve been in most people’s lifetimes and the most interest rate sensitive area of the economy (lending) is stuck in neutral (opr growing well below historical averages) and with it GDP is only plodding along, then ought we might want to look at rates as the culprit?

Policy makers, the Fed and consumers have been frustrated by the lack of lending going on since the recession ended and the only constant during that time frame has been interest rates at 0%- .25%. I have been and remain of the opinion that the Fed will only get what it wants, a more rapidly improving economy only after it starts raising rates.

The market was ready for a rate increase today. Now we get another 5 weeks of uncertainty and guessing games over what will happen next and what it means. An increase would have sent a clear signal the economy was improving (it is). She could have done what was expected and raised and then sat pat for a meeting or two to let it soak in. We have been doing this “will they or won’t they” dance since June now and it is tired and serves no purpose. The Fed is letting markets and their natural maniacal behavior dictate their direction. That is decidedly not their mission. When people think the Fed simply follows the vagaries of the market, they lose confidence in it.

We all see the data and all know the economy is getting stronger. when the Fed does not raise into that, the market pauses and naturally thinks the Fed know something it doesn’t. Businesses think there is another shoe to drop somewhere. It causes uncertainty.

At the end of the day going from 0% – .25% to .25%-.50% isn’t going to make a huge hill of beans either way and fundamentally would not have been a shock to the system. What it WOULD have done was boosted confidence and that matters more…..

Yellen blew it……