“Davidson” submits:

All data shown below comes from St Louis Fed FRED site.

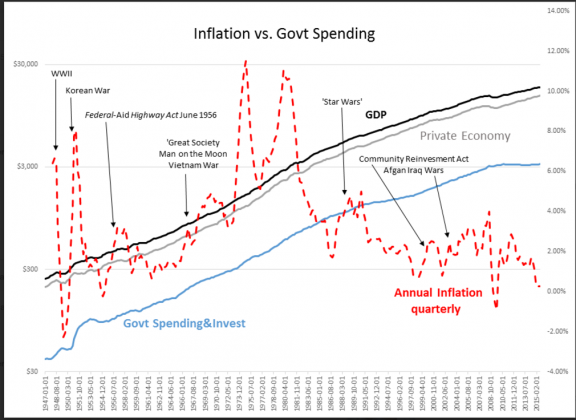

Milton Friedman claimed all inflation was a monetary phenomenon. But, recent evidence lets one go another step and see that it is expansion in M2 which comes when Government Spending which is most important and not the expansion of M2 by itself. Two charts below show the bulk of the data we have available.

1) Inflation rises every time Government spending rises.

2) Inflation falls every time Government spending falls.

Inflation is generally with us with Government transfer payments and support for highway programs, support for law and order, health care and transfer payments primarily because there is no profit motive efficiency measurement involved. This takes funds from areas which are adding to the productive economy and reduces funds available for reinvestment at higher rates of return and productivity. All this has been discussed in the past. What is clear in the data that when Govt is directing the actual spending, inflation soars. The greatest impacts are seen in the rise and fall in Govt spending for the Korean War, 1950, the early stages of developing the national highway system, 1956, the combination of the ‘Great Society’, ‘Man on the Moon’ and the Vietnam War, 1965, gave us the ‘Great Inflation’ from 1965-1982 and the late 1990s thru 2008 appear to be associated with the government’s agenda in providing housing for those who could not afford it and Afgan and Iraq wars.

It is the current Keynesian approach by the Fed to inflate M2 expansion to drive inflation higher which reveals why it is not working. Under Sequestration, Government spending has dropped falling from near 24% of GDP to under 18% today. Inflation is not even close to where policy makers believe their actions justify with a 12mo Trimmed Mean PCE of 1.7%. This reveals that inflation is not from expansion in the Private Economy, but is due to a reduction in the inflation generating nature of Government Spending. It is common knowledge that individuals and corporations have become wealthy on government contracts. This is because Government spending does not have a Free Market profit measure to determine whether the return is justified comparable to profit and loss measures in the Private sector. Very often Govt spending is directed to pay back political supporters of the party in power.

When Government directs the spending is more inflationary than when the spending represents transfer payments. Transfer payments which go to individuals carry the determination by the individual as to whether one is getting value for one’s spending. Military spending carries no such assessment and with the expenditure off human and material capital in war, we are dealing with permanent losses to the country’s value while the cost of debt remains for up to 30yrs.

A Noble Prize for that person who comes up with a reliable method of cost/benefit for Government spending similar to what profit/loss does for the Private sector.