“Davidson” submits:

Inflation has always seemed a mystery to many. Milton Friedman said it is always too much money chasing too few goods. At all times, he said, inflation is a monetary phenomena. In the 1970s the thought was it was consumers over-spending and oil rising that was responsible. Some demanded that unionized factories produce more to drive prices down while President Ford issued his ‘WIN Button’ (Whip Inflation Now) October 1974. It took Paul Volcker’s rate rise in the Fed Funds to 20% June 1981 which forced the economy into recession to reverse runaway inflation psychology held by consumers. Consumers had embedded an inflation based mentality into their spending and which had come to dominate their financial decisions the past 10yrs that Volcker recognized as extremely dangerous.

The confusion about the causes of inflation remain. Today there are as many discussions about deflation as there are inflation. Each side recommends actions which they think appropriate. The Fed has exercised two QEs and one OpTwist while Congress authorized TARP all to prevent deflation which was feared would collapse the US financial system as assets fell below levels needed to collateralize existing debt. The fears of bank insolvency remains today. Deflation has always been a fear for the Fed since the Great Depression as it was something believed to be outside its ability to impact financial stability.

Market is a Human System

Brian Wesbury is one of only a handful of economists and investors who actually understood the key point that most continue to miss today. The Great Depression and the Great Recession were the result primarily of ‘Mark-to-Market’ accounting rules(FAS157) applied mindlessly across bad and healthy assets during a period of investor panic. The rescues by government intervention could have been avoided had FAS157 been simply voided. TARP was not necessary!! Mark-to-Market panicked investors who could not tell good assets from bad assets. The markets turned higher the same day Ben Bernanke testified in front of Congress that Mark-to-Market rule FAS157 needed to be ignored. Two of Wesbury’s many commentaries are listed here:

1) Sept 25, 2008 Mark to Market Mayhem

2) Feb 24, 2009 Why Mark-To-Market Accounting Rules Must Die

‘We’ are the market. Markets are human systems which have evolved with the complexity of our financial system. Markets are based on rules with which all agree are fair. When we believe we improve ‘fairness’, we modify the rules. Because we have changed the rules, the market of 2008 is not the market today. FAS157 is not the standard today. We learned, we adjusted, we moved forwards. We are constantly modifying old rules and adding entirely new ones to improve the market’s fairness to all participants. Even so, we do not understand markets well enough to have always imposed the best rules especially with much of the rule-making coming from individuals politically biased. We do our best. If one learns this, then one learns that the only way to look at our economy is with a ‘long-term-lens’. From this perspective, the source of inflation becomes apparent. Government Spending correlates with inflation-see chart below.

Correlation between Government Spending and Inflation

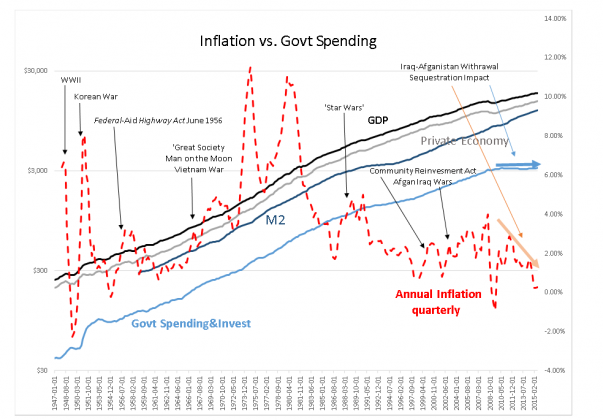

The ‘Dog that did not Bark’! The chart reveals the trends of Government Spending(LIGHT BLUE LINE), GDP(BLACK LINE), M2(DARK BLUE LINE-history from 1959), Private Economy(GRAY LINE) and Inflation(RED DASHED LINE) from 1947 to Present. The rate of inflation is plotted against the right hand axis. The Private Economy is derived from US GDP by subtracting Government Spending. What should be evident since 2008 is that Government Spending has been nearly flat. But, during the same period we have a sharper rise in M2 than we do in GDP from Fed stimulus. Inflation is clearly in a down trend. This is the first time we have a true disparity between M2 and Inflation. This is the ‘Dog that did not Bark’! If M2 is the inflation factor we have believed to be since the time of Milton Friedman, it should be higher and quite obvious. The Fed has a strong belief that M2 and inflation are bound in lock-step and has pushed M2 relentlessly. That inflation has dropped tells us that something else is at work.

This recent non-correlation reveals that inflation comes from government spending activity. Our low inflation level in spite of vigorous Fed M2 stimulus, reveals that it is the slowing of government spending which is the culprit. Look back thru the data to 1947 at other instances in the rise and fall in inflation. Each rise has been accompanied by a rise in direct government spending for goods and services. Likewise each decline in inflation resulted in a slowing in government spending. The ‘Great Inflation’ of the 1970s actually had its roots in three government agenda begun in the mid-1960s, the Man-on-the-Moon’, the ‘Great Society’ and the ‘Vietnam War’. Every inflation bump higher has a corresponding bump in government spending. Every decline in inflation has a corresponding decline in government spending. Our current environment reflects the winding down of spending for the Iraq and Afghanistan conflicts as well as the government spending ‘Sequestration’ currently in effect. This correlation reveals the connection between inflation and direct government spending. One could not make this correlation without the recent data. Friedman had it partially right, but now not just M2, but specifically M2 generated by government spending.

Government contracts have always been attractive to suppliers as government typically overpays to get what government policy demands. Government works by outlining an outcome and achieves it often by directed spending. Military contracts have inflationary impact. In times of national emergency, defense spending carries urgency. Time is not spent to find a lowest bidder. Time is more valuable than the funds allocated. Overpaying occurs because time constraints make the immediate demand greater than the immediate supply. Long term defense contracts are especially prone to contract changes as new technology presents itself during the contract period. Government typically demands new technology be added to make equipment more effective/up-to-date. Cost over-runs of 100%-200% and twice the time to completion are not unusual. It is also not unusual for government to want products with technology not yet developed. That is very expensive! Government social policies can also suffer from excess spending for common goods. Government often likes to have policy implemented quickly for political reasons. The party in power is willing to pay higher prices to achieve the hoped for outcome while they are still in office. This is another situation in which the immediate demand is greater than the immediate supply. Spending also has a component of political payback to supporters. Sharing the largess-of-the-tax-purse helps in the next election. Unfortunately, there is a mind-set that government money is somehow ‘free money’. I think the chart tells us that inflation is our real cost.

Current Investor Misperceptions

The current belief that we are in deflation or in a poor economy comes from two major misperceptions. The first misperception derives from the investor belief that commodity price movements lead to changes in inflation. Recent fall in commodity prices are believed to signal a weak global economy and deflation. Everywhere in the media is this repeated endlessly. Recent economic trends show that global economic expansion has been with us since 2009 and remains with us today. Commodity prices are like any prices; all prices are direct reflections of market psychology and future expectations by investors. Market psychology can drive any price in any direction till the facts tell investors differently. A good example of this today is what is happening to Valeant(NYSE-VRX). Inflation does not comes from commodities but from government spending! Julian Simon in his book “The Ultimate Resource”, 1981 shows that over the long term commodity prices fall as humans advance technology skills.

The second misperception is that US GDP is slow and that stocks are over-priced by a substantial amount. This perception is where the calls for the Dow Jones Index to collapse from its current near $18,000 to $5,000 originate. This erroneous perception is over-turned by separating out the Private Economy from US GDP. The Private Economy is actually growing nicely, a little slower than in the past, but still decent. Vehicle Sales reported at 18mil SAAR(near a record) and Employment at record levels can only come from real economic expansion. Equities are priced on earnings based on the Private Economy. Equity earnings come from the Private Economy. Government spending rests on taxes of the Private Economy’s earnings. It is government spending which has slowed (not to be confused with transfer payments). The Private Economy is rising. Government spending slowdown is primarily due to the pull-back in military spending. The same occurred after every war and had the same impact on inflation and GDP

Key to understanding the current situation is in understanding that government spending has a double impact on GDP. The first is the amount of government spending is part of GDP. The second is that inflation from government is additive to GDP. Government spending has a double impact in GDP*! With military spending slowing, government spending and inflation are much lower than one would have expected if one thinks M2 creates inflation.

There is nothing weird or dangerous in our current economy. There is nothing one cannot understand. There is no ‘Black Swan’ lurking hidden somewhere which we cannot see. Our economy is expanding, inflation is low, we are on track to continue expansion for several more years based on the direction of activity in the US Single-Family Home sector.

*One should not take these comments as saying something about one political party vs. the other. Government is necessary as are many of its functions. Bastiat made the clear in this book, “The Law”, 1750, which I recommend all read-I promise it is short and to the point, 82pgs. Link: https://fee.org/files/doclib/

20121116_thelaw.pdf Government can do that which individuals or separate states do not have the capability. The issue is that government does not have an effective cost/benefit measure as corporations do in trying gain a profit. If it is not going to lead to a profit, to stay in business, a corporation goes out of business. It creases to exist. Not so for governments. Governments can be extremely wasteful because they spend without direct consequence, but the public sees inflated prices. What is needed is a measure for government effectiveness. There is a Noble Prize for the individual who does this!! If government spending could be put on the same basis as individual spending, then my expectation is that benefits from that spending would equal its cost and spending by government should not contribute to inflation.