One can only wonder why so much emphasis is put on it…….

“Davidson” submits:

That the Institute of Supply Management’s Purchasing Managers Index(ISM PMI) has many forecasting the end of the current economic cycle is near is an understatement. Best advice is to simply ignore the PMI! Ignore all PMI based reports including the often touted global PMIs

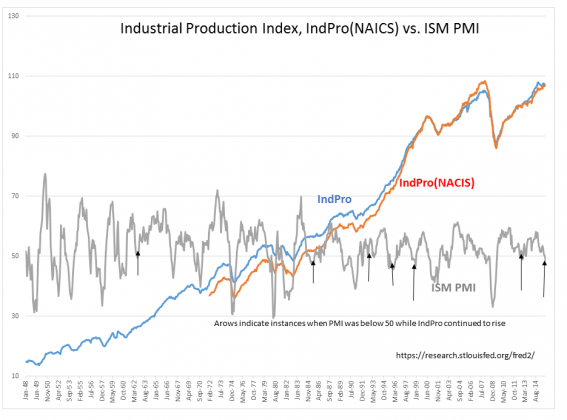

The consensus responds to every report of the PMI as if this monthly data is the final authority indicating the direction of economic activity. Unfortunately the PMI often fails to indicate the correct direction of economic activity as is revealed in the Oct 1948-Oct 2015 history below. The historical Industrial Production Index is shown as the BLUE LINE, the Industrial Production Index using NACIS is shown as the RED LINE and the PMI is shown as the GRAY LINE. All use the left hand scale. The PMI is interpreted as reflecting manufacturing expansion when it registers 50 or higher. A PMI below 50 is deemed a contraction in manufacturing output. Only a few arrows are displayed pointing out instances when the PMI indicated manufacturing contraction when IndPro indicators did not agree. It is left to the reader to go to the St Louis Fed FRED data site to examine the data directly for many other instances when this occurred using the link, https://research.stlouisfed.org/fred2/ if more convincing is required.

The reason the PMI often misses manufacturing output is imbedded in the fact that it does not actually measure manufacturing output. The PMI measures’ how individuals feel’ about their own manufacturing environment. It is a sentiment or psychological survey and not a measure of actual output. It should be clear from data of the past few months that we are again seeing indications from the PMI of a near decline in manufacturing output which is not confirmed by IndPro indices. IndPro indices measure actual output. These indices are statistically derived hard counts of the dollar value of things manufactured. While not all dollar value of manufacturing is captured by the official surveys (self-employed manufacturing output is often not counted) and while there often is a need for revision as data arrives which may have not been available in time for that particular monthly report, the trend in IndPro indices does provide a reliable indication of the direction of manufacturing output. The consensus does not use published economic data well.

The question begs to be asked like the ‘elephant in the room’, “Why do so many use the PMI when hard data is readily available?”

The answer I think comes from reading market history. There has long been suspicion by investors that stated figures provided by corporations or government have been tweaked to bolster the story corporations or politicians want the public to believe so that insiders could benefit. This is the point of view of Technical Analysts. Although they do not state a concern of insider manipulation directly, Eugene Fama’s ‘Efficient Market Theory’ and Technical Analysts believe that there is in fact greater information transmitted by price action than there is available publically. They believe market prices capture all information available public and private. This belief also has strong ties to a consensus perception that market psychology controls economic activity. It is why surprise negative events are so often translated into periods of market decline. Later many are equally surprised when economic activity did not change as anticipated and markets recover. Distrust in published data and the misperception that it is economic activity not psychology which eventually drives equity prices is what leads investors to mistakenly focus on a series such as the PMI.

The PMI is not a valid economic measure. It is a psychological indicator which has no purpose in one’s investment decision making.