“Surprised”? Not if you’ve followed these pages for the past year or more… Today’s jobs data reflects on Wednesday’s post

“Davidson” submits:

The Establishment Survey and Household Survey employment reports are out and not only higher than expected. The Establishment Survey carried revisions of 30,000 more employed than first thought with past 2mos revisions. Yet, the comments on CNBC indicate that many believe only a shallow recovery continues. So…better than expected, but “Not so good!”

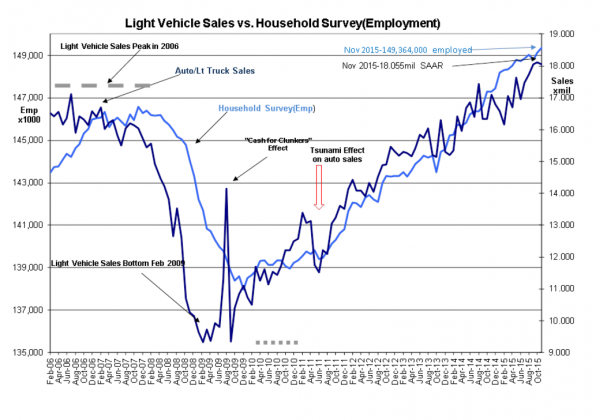

I use the Household Survey. The Household Survey is the only one to count the self-employed and is the most comprehensive count available. This report came in higher by 244,000, at 149,364,000 vs. October’s 149,120,000 report. If you look at the chart below, it should be apparent that the employment trend shows no signs of slowing. Vehicle sales in this chart have been adjusted to the official 18.055mil SAAR pace which is a little lower than the estimated 18.2mil SAAR(Seasonally Adjusted Annual Rate) discussed earlier this week.

Markets may or may not rise on this information. Yesterday’s negative response to Europe’s Mario Draghi not adding greater stimulus than expected caused the Hedge Funds to reverse what has been an expectation for a stronger US Dollar. This reversal forced the Euro, oil and 10yr Treasury Rates sharply higher as Hedge Funds scrambled to cover positions which had gone against them.

The Free Market has always been bigger than any single entity or even any group of entities. The Free Market is the proverbial ‘Us’ and as technology connects us all more tightly to each other sharing commonly-shared desires for better lives, we generally recognize the importance for individual freedom of choice. This is not just in the US. The desire for freedom is globally recognized. In spite of the events of today, the attacks in the US, the attacks in Europe, the incursions by various political groups and governments for control, the desire to maintain individual freedom of choice and individual property rights remains the basis for the Free Market. This is the most powerful force globally. I believe that it will eventually overpower all efforts to the contrary. If you can grasp the concept of the Free Market as fundamental to the human advancement, then you will enjoy this Op-Ed by Rupert Murdock in this week’s Wall Street Journal: America the Indispensable If you would like me to send a copy send me an email.

In the current context, I expect that the negative views so many have of the global economy will be replaced by optimism. This is what has always occurred during economic uptrends. There is no reason not to expect this historical pattern to repeat. Every market in history has carried multiple misperceptions during the economic cycle. Eventually, pessimism gave way to optimism.

The ‘Good News’ keeps coming. Equities will rise once market psychology shifts to being more optimistic. It can happen in the blink of an eye. Predicting when this will occur is not possible, but predicting that it is very likely to occur has strong historical support.

Continue to be bullish.