“Davidson’ submits

It has been as usual a busy week for economic reports. Again, multiple analysts have called for a collapsing economy citing weak Hourly Wage Growth, weak Retail Sales, weak Personal Income Growth. Oil is cited even by some in the Fed as headed potentially towards ‘zero’. Multiple authorities claim a huge number of oil companies are headed towards bankruptcy which by these forecasts will take a number of banks with them. What is so interesting is that periods of pessimism have never resulted in a recession. Pessimism is always greatest at the turn of market psychology and markets. I suspect we are close to this turning point today. The turning point may even be behind us. Time will tell. No one can accurately trade market psychology!

Pessimism without factual basis historically comes up against common sense and morphs into optimism quickly and unpredictably. The best investor defense against periods of unjustified pessimism is to arm one’s self with good sources for economic data and know what the data means. A note last week showed good trends in Employment, Personal Income and Retail Sales. This week housing, chemical and US oil reports are useful in assessing our current environment.

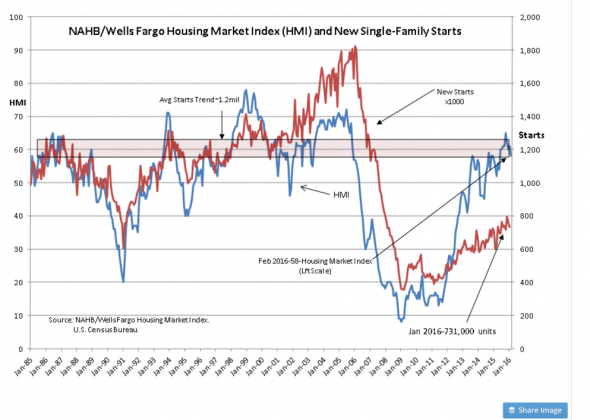

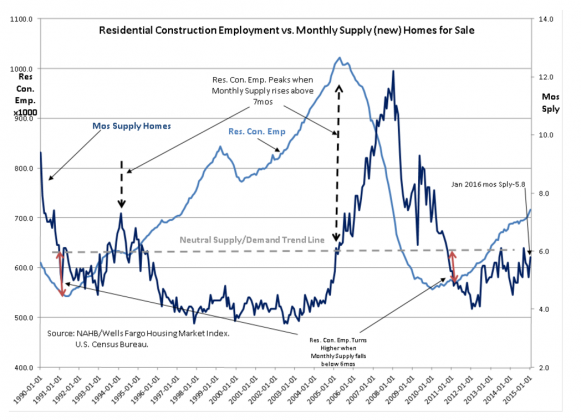

The HousingMarketIndex(HMI) and Monthly Supply of New Single Family Homes for Sale(MSSFH)were reported as continuing their up-trends. One may have heard the media express disappointment as these were reported. What analysts typically miss are past months revisions. Analysts have tended to ignore reports higher than the previous month and focus on those which reflect declines. The problem is that if we are in an up-trend, previous months are often revised to the better as additional data becomes available. It is the nature of economic data to require revision of the most recent reports. The HMI and the MSSFH past reports were revised to the better. Both charts reflect continued positive trends with New Single-Family Starts and Residential Construction Employment reflecting continued expansion. The Mortgage Credit Availability Index(MCAI), which will next be reported in 2wks, shows that bank mortgage lending has been curtailed with the Fed’s 0.25% rate rise. Yet, non-bank lenders continue to fuel housing and there continues to be a river of capital coming into US and Western country real estate seeking safe havens. As the MCAI pulled back in Dec 2016, I advised investors to exit banks and housing equities expecting them to under-perform. Bank-based housing-lending has been hobbled by regulation and unless regulators improve credit conditions this sector is likely to underperform other sectors in the economy. Even with tighter credit conditions, housing continues to plow ahead.

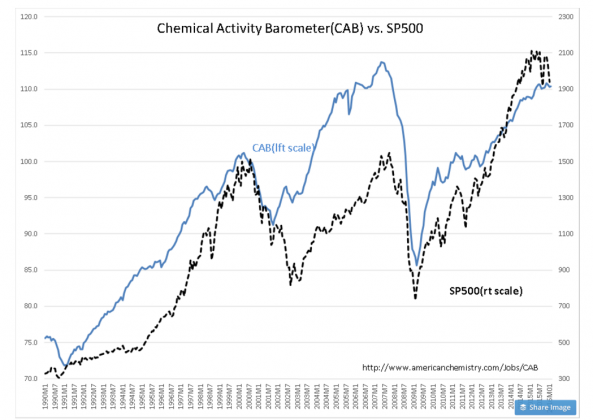

The Chemical Activity Barometer(CAB) continues its up-trend. Chemicals which are used throughout industry as lubricants, coatings, to make fabrics and are combined into a host of polymers used to replace metals in lower cost and more functional products. Lets not forget that nearly every electronic device we use is mostly plastic. We think electronics but plastic is used to encase the electronics and computer chips which make every minute of every day so much more efficient. We usually never think of the plastic! Our smart phones in addition to communication provide us with a constant stream of current information from weather to maps, our pace of travel and how long till the next gas station and what price the fuel is so that we can determine if we want to stop or move to the next station. Our smart phones help us find hospitals, favorite restaurants and while we are waiting once we get there we can Google information on any topic from medicine, nutrition, history and even advanced science and math. Smart phones are incredible life efficiency/knowledge delivery devices. Chemicals make these devices possible. The CAB continues to expand as do other economic indicators. No wonder the CAB is a good economic indicator.

The pessimism so prevalent currently is not supported by the fact. This does not stop many from claiming that the data is awful. They say that “Every month sees a decline!”. They do not pay attention to the previous month revisions. There is in fact much to like. There is quite a bit of “Good News”. One simply has to look at the trends.

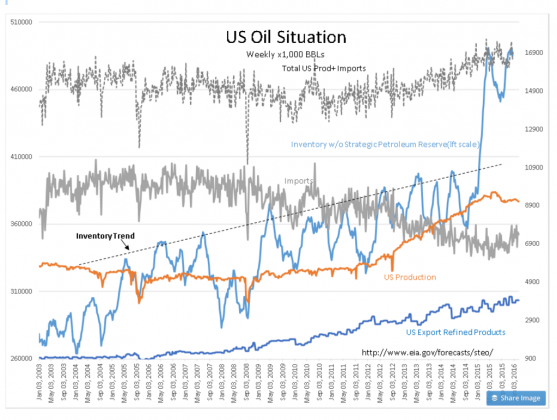

Last but important is the US and global oil situation. The discussion of our entire economy seems to hinge on the price of oil. With the US success at oil discovery one would think that in general lower prices should be a positive. One should not expect so many to declare the end of the world is upon us. Just 5yrs ago investors were panicking about “Peak Oil” and the end of our standard of living as we knew it. Pessimism from low oil prices as led even the St. Louis Fed to indicate that oil was on trend to be priced at ‘zero’. In my opinion this is a good example of how trend-following produces silly outcomes and worse. People tend to believe anything coming from an authoritative source.

St. Louis Fed: Financial Markets Are Saying Oil Will Be Worthless by mid-2019

Beware market-based measures of inflation expectations.

Today’s EIA report is actually more positive. US oil production as of this morning’s report appears to be shifting lower after falling from the July 2015 high of 9.6mil BBL/Day and stalling at ~9.2mil BBL/Day for most of last fall. That production recently begun to slip lower as can be seen in the recent downward in the ORANGE LINE in the chart, now at 9.1mil BBL/Day. US Inventories continue to be stable, i.e. not growing as can be seen by the LIGHT BLUE LINE. Yet, many continue to make panicky comments that inventories are moving ever higher. They are not!!!

Based on historical fall off in shale oil wells, many were surprised by production holding up as advanced methods were used to stimulate production in completed wells even as the rig count fell by ~70%. Looks like we may be entering the production drop which helps to correct the Supply/Demand imbalance. Only time will tell.

Most of the commentary the past 2yrs on the growing ‘glut’ is over blown in my opinion. Oil production requires a massive infrastructure. It has never been able to shut-down or ramp-up quickly. It occasionally goes out of balance, but it always rebalances. It is simple economic Supply/Demand. Things correct naturally thru the pace of global GDP growth. There is no global recession.

I continue to recommend investors have allocations to LgCap Domestic and Intl equities and a portion allocated to Natural Resources. The next 5yrs or so look quite positive.