“Davidson” submits:

Markets are rising globally in response to better than expected economic news. Value Investors discussed this months ago. They saw that fundamental trends were continuing higher as they have since 2009. Market psychology meanwhile has been ‘on-again-off-again’ with every event and economic report different than expectation. Market psychology is always impossible to predict as are market prices. Timing lows and highs is the game many say they can do but when all is said and done, trend timers also known as Momentum Investors call for market tops many times when they later prove not to have occurred and the same occurs for market lows. What does work over the longer time period is expecting market psychology to drive market prices in the direction of fundamentals. We are beginning to see this with Intl LgCap issues.

These charts show the long-term and short-term performance of an Intl LgCap portfolio management team. Performance has been better than the benchmark, but was impacted in May 2014 when the US$ suddenly strengthened. This was not a strengthening due to economic fundamentals but a reversal by Momentum Investors who had bet that Fed actions would cause inflation. Inflation did not occur. Inflation fell in part because of Fed actions and in part with the decline in US Govt Military spending. Then an unexpected event occurred. Russia invaded Ukraine. This caused a flood of capital to seek US$ denominated assets as a safe haven. The US$ rose and forced Momentum Investors to reverse what was a sizable bet for inflation and for a weaker US$. This bet was so ubiquitous that it included 10yr Treasuries, commodities and specifically oil. This investment reversal forced the US$ ~40% above its long-term trend and resulted in oil falling from $100+/BBL to $27/BBL and the 10yr Treasury rate falling from ~3% to less than 1.4% in July 2016. The Momentum Investors who believe that price trends are the result of fundamental Supply/Demand, called this period an ‘Oil Glut’. The evidence we have did not and continues to not support that perception. Intl LgCap issues fell as the US$ strengthened finding a low early Feb 2016. Since that date, Intl LgCap have risen sharply. This particular portfolio has risen ~27%.

Market psychology once it builds momentum can be a powerful force on market prices, but for the most part it does not impact economic fundamentals. During this entire period, the global economy has continued to grow at a relatively steady pace as it continues to do so today. The US$ in my opinion is beginning to return to its long-term fundamental trend. That is, ~30% lower from current levels relative to US major trading currencies.

One cannot predict the timing of market psychology or its impact on market prices. In my experience, Momentum concepts always differ from fundamentals. Someone detects a price trend and it catches the attention of other trend followers. Perhaps an event reinforces their thinking so that they ‘double-down’ and suddenly everyone is talking about and investing in the same. This is markedly different from Value Investors who measure and track economic fundamentals. The differences between price trends and fundamentals provide Value Investors with investment opportunity. Value Investors cannot predict when opportunities like this will occur, but they take advantage of them when they do. The current opportunity is substantial in my opinion. Having exposure to Intl LgCap equities should benefit portfolios.

Markets too high? Don’t think so!

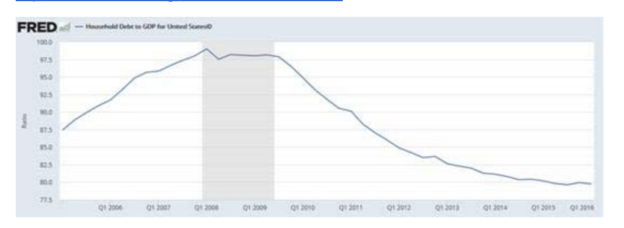

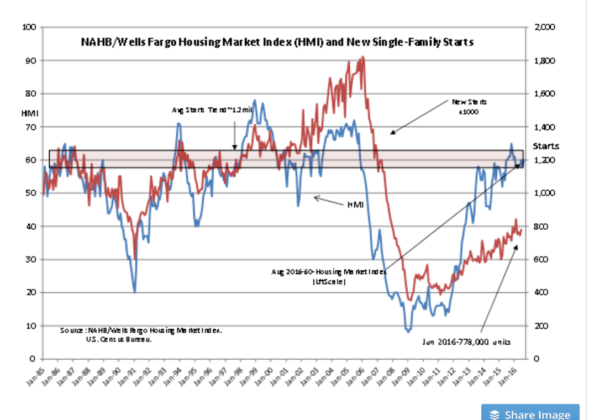

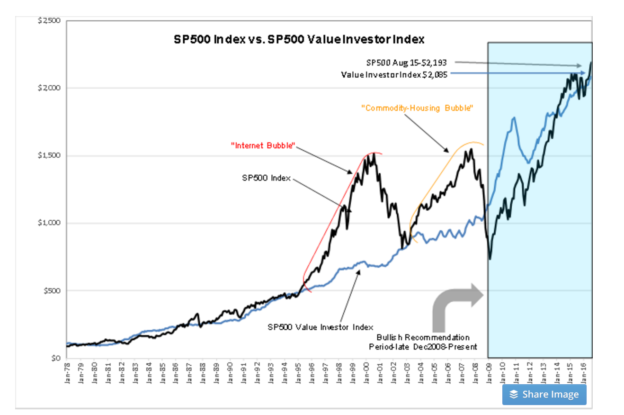

The recent media attention on the DOW, the SP500 and NASDAQ all hitting all time highs and many calling for a market top are without fundamental support. Markets do not peak till optimism dominates and consumption has been built by borrowing from the future to spend today. It is called ‘skiing too far over your tips’. When this occurs it has always been reflected in many economic measures. Three of these, Household Debt to GDP, Single-Family Housing Starts and the SP500 Value Investor Index show that our economy and our market prices are nowhere at excess levels.

Household Debt as a Percentage of US GDP is well below 2008-2009 levels which lead to recession. This bodes well for continued economic expansion.

Single-Family Starts remain so low that current levels equal levels in place during the 1991 recession. We remain at half the pace of historical levels of 1.5mil Single-Family Starts. The associated Housing Market Index(HMI) at 60 remains well into positive territory and bodes well for continued economic expansion.

The SP500 Value Investor Index remains relatively close to the SP500. Excess valuation in past markets reflected high optimism, 100% over-valued in 2000 and 55% over-valued in 2007. There remains little optimism today which is reflected in current levels. This bodes well for higher equity prices as economic activity surprises the pessimists.

Summary

Currently there is little support for concerns that record price levels reflect market excesses. There are no economic measures which support the belief of ‘economic excess’. Markets exhibit relatively little optimism as measured by the Value Investor Index. Economic activity should continue to surprise on the upside for several years. Markets can be expected to move higher.