“Davidson” submits:

“In the world of investing, . . . nothing is as dependable as cycles.”

Howard Marks wrote this in his 3/27/2006 investor memo titled “It is what it is”.

Marks’ comment captures one of the essentials of investing successfully. All Value Investors view investment markets in terms of cycles. Individual investments are bought and sold within the context of related market cycles. They also have two other essential investment perceptions. These are a ‘value sense’ and long-term ‘optimism’. Value Investors are optimists. Value Investors would never say this typical comment during a financial correction:

‘This is the end of our financial system as we know it’

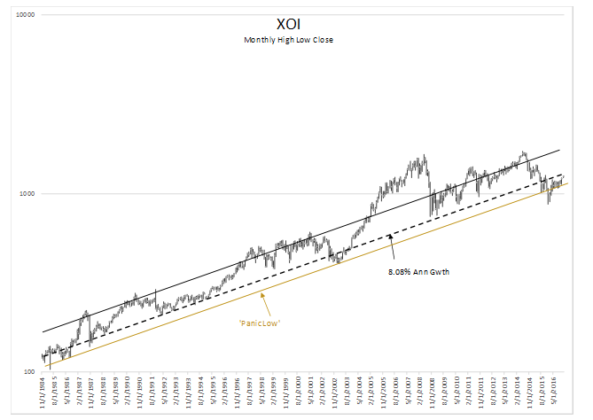

Just last spring, advisors indicated that oil will be at low prices for ‘decades’ and most of the oil industry faced bankruptcy with many banks to follow. Six months later, nothing remotely close to these fears has occurred. Today we find ourselves in a very strong rally of precisely those issues which were in the heart of last spring’s crisis. The XOI (NYSE Arca Oil Index, previously AMEX Oil Index) is a price-weighted index of the leading companies involved in the exploration, production, and development of petroleum. https://en.wikipedia.org/wiki/Amex_Oil_Index In the price history of XOI on a semi-log chart, you can see the cycles. Most of the cycles are predictable by following economic trends. Economic corrections/recessions have always resulted in lower oil and oil related equities. If you monitor economic trends, you can see a period of lower energy prices coming, usually. Many did not feel this way the past 2yrs when they saw oil fall from over $100BBL to a low of $27.96 avg price on Feb 9, 2016. The calls for economic recession due to oil’s collapsing price were as wide as they were loud

There was no recession. Economic trends continued higher thru this oil decline. They have trended higher uninterrupted since early 2009. Suddenly, with an election investor psychology has turned decidedly more positive. Value Investors knew at the time of greatest fear that the collapse most feared would not occur. How did they know that?

The vast majority of investors and advisors tend to see the products/services which are offered when recommending investments. “Oh, that is a food company, it is safer” is a typical comment when comparing consumer-staple type companies to industrial companies. It is very difficult to understand business dynamics when one stops with product/service descriptions and financials. Business dynamics in my definition are the people and how they work together. In short the business culture. Business culture starts at the top, the CEO. How the company operates, its efficiency, its inventiveness and responsiveness to its customers is directed by the CEO. If the CEO attracts and assembles of dedicated and enthusiastic people into the corporate culture, the outcome for share owners can be dramatic. It is people who drive businesses, who drive value proposition for consumers and who by their efforts create corporate profits which are used to expand the company’s business and advance its growth. When a company’s market becomes difficult, it is the people who double-down and re-invent themselves to get through hard times. Combine the human ingenuity in thousands of companies reacting to difficult periods and one can see why market corrections, while they may have resulted in large price swings and great periods of pessimism, there was always a bottom and a recovery afterwards. Value Investors know this. Value Investors know this by studying history. If you take this outside financial markets to the broader Human System of which we are part, markets have been part of human DNA and evolution for millions of years. Commerce is innate to human evolution. It has never failed even though there may have been from time to time significant adjustments. This is the source of Marks’ comment “In the world of investing, . . . nothing is as dependable as cycles.”

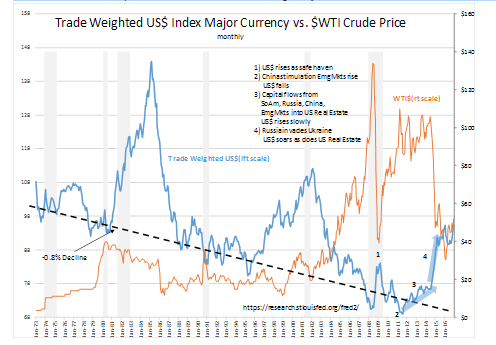

If one can identify the factors influencing any cycle, then one will be better at identifying the low points of the cycle and take advantage of the values presented. The oil related declines can be directly tied to the shifts in the US$. The US$ has a trend based on global economic fundamentals. It has spiked in value from time to time as investors shifted capital to US markets believing they offered the ‘better returns’. The term ‘better returns’ can mean higher returns or simply returns with lower risk.

We saw a shift in the early 1980s when Chairman Volcker was the first to conquer global inflation. Capital flowed to the US with a peak in the US$ occurring Feb 1985. Another peak occurred Feb 2002 as investors shifted capital to participate in the Internet Bubble of the 1990s. The most recent shift came as a result of US withdrawal of its support for global Democratic individual property rights. Capital pooled in Western countries and the US in particular. This forced the US$ higher once again impacting oil and industrial businesses but not overall economic activity. Today the US$ is less important as one of a few single safe exchange currencies than in 1980. You can see that we have a series of lower highs in peaks in US$ strength since 1973. I make the estimate that the US$ has likely peaked in the current cycle. Support for this thinking comes from oil prices, from the XOI history and from a number of individual companies I monitor in portfolios.

Investing is never precise. One will never capture ‘The Bottom’ or ‘The Top’ of any cycle, but one can certainly buy lower and sell higher. A key part of my research is the analysis of market cycles as Howard Marks outlined. Markets never fail, they have periods of excess, then adjust and move forward. Markets are part of the Human System which self-repairs.

If you view markets as never failing, but going through periods of adjustment while those affected figure out what occurred and adjust, then you will be thinking like a Value Investor.

I continue to recommend that investors own equities and especially LgCap Industrials, Commodity related and Intl LgCap equities.