“Davidson” submits:

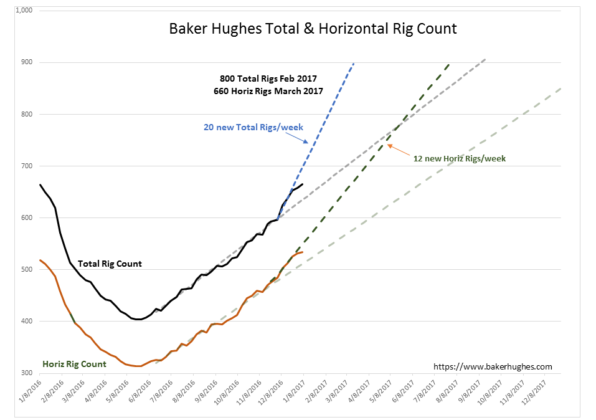

Baker Hughes Rig Count ~65% higher from May 2016 lows, but US Oil Production only higher by 300,000 BBL/DAY on 8.45mil BBL/DAY low or ~3.5%.

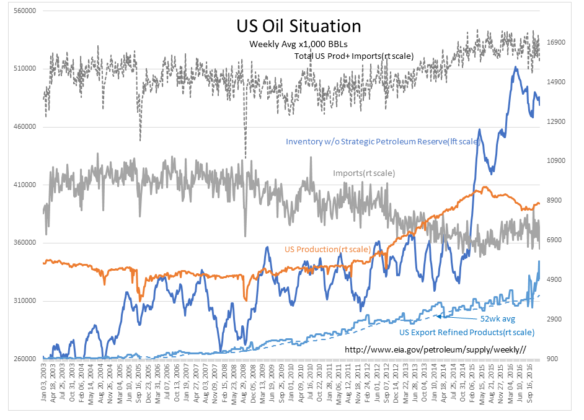

The consensus is that oil wells could be turned on and off resulting in a quick return to excess production. We do not see this reflected in this data. Oil production takes months and months to begin flowing after drilling due to need for fracking, installation of pipelines and other infrastructure. Meanwhile, US Export of Refined Products has soared in 2 ½ years by close to 70% due to global demand.

What I see in the data trends does not suggest a ‘glut’. Rather, the trends suggest US build out of additional refining capacity and storage necessary to support exports in the 5-6mil BBL/DAY range. Key to understanding this is the Total US Production+Imports trend which we have in a rising trend in the face of US Production falling 1.2mil BBL/DAY 2015-2016. We have raised imports to keep our inventories at higher levels to support rising Refined Product Exports.

Expect Refined Product Exports to continue to rise. Would not surprise, if Exports exceed US Oil Production in terms of BBL/DAY next 3yrs, perhaps sooner.

There is no sign in these trends of excess production backing up in the system as a whole. What we do see is that a stronger US$ tied inversely to oil prices caused prices to fall. This in turn caused US Production to fall due to falling economic returns. Overall supply/demand appears unchanged which is what one should expect.

Producers do not pump to excess! If there is lower demand they simply leave it in the ground. The economics of oil production do not support storing unwanted crude oil above ground in tanks, pipelines or ships. The perception of building inventory comes solely from investors interpreting falling prices as less demand when it was just the inverse relationship to the US$. The sharply rising Refined Product Exports tells us that demand has been consistently strong.

At some point, investor psychology will have to come to grips with the fact that demand remains strong and US production does not have an ‘on-off switch’ quality.