“Davidson” submits:

It is not that complicated. It requires that we recognize markets are part of a broad Human System of individual talents and specialization which we share through barter of other’s skills.. Within that system, a percentage of individuals will be always better skilled than average. There will always be some who are the best Drs., teachers or musicians. It is not as if they excel for 1-2yrs but not afterwards. If they achieve excellence, they maintain it for decades adjusting to changing dynamics continuing that excellence. This includes CEOs and portfolio managers who achieve returns better than the market averages. What confuses many, is their expectation that gains should accrue over short periods or be consistent period to period. ‘Short-termism’ results more often than not in chasing returns well after a price-trend is in place and selling after losses have occurred in classic buy high/sell low capital destruction pattern. Only by developing longer-term perspective can one avoid the mistakes of short-term investing.

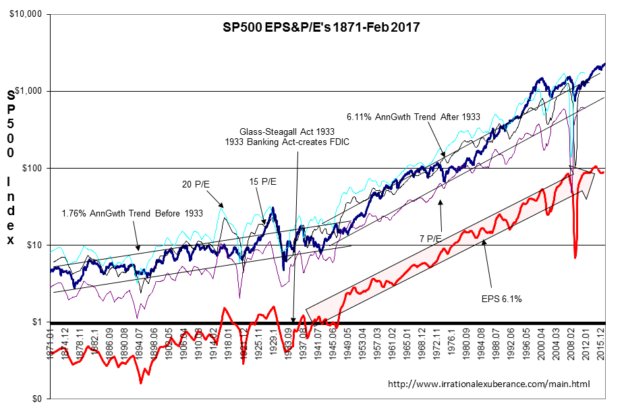

The first step is to develop reasonable expectations. Long-term the SP500, an index which captures 90%+ investible US market capitalization, since the mid-1930s has grown ~6.1% compounded annually (includes dividends). To outperform the SP500, one needs to identify those CEOs and corporate cultures which have business returns better than average.

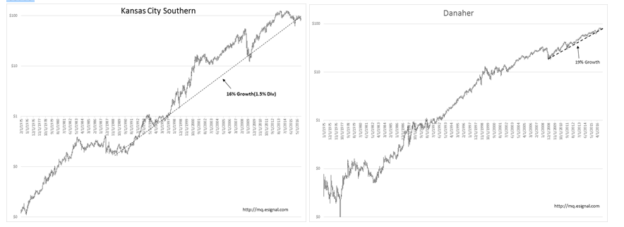

Selection is key. Every issue having outperforming business fundamentals, has price performances to match. Two SP500 members, Kansas City Southern(KSU) and Danaher(DHR) are representative. Roughly 10% of any major broad index is comprised of companies with good long-term performance. In the Russell 3000 there are about 300 issues.

KSU is a railroad and DHR is a company which makes ‘things’. Both are well run and have been so for more than 30yrs. Outperformance like this can be found in nearly every business sector. Performance is not based on the specific industry, but on the skills of management, in particular the CEO. Long-term performance also requires a corporate culture which ensures continuation when a retiring CEO leaves and a new CEO enters.

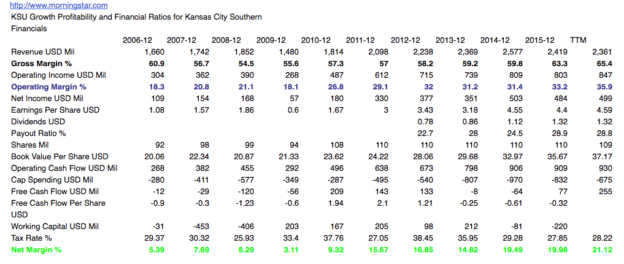

Every well operated company has the same identifiable characteristicts. They have a combination of rising Revenue, rising Gross Margins, rising Operating Margins and rising Net Income Margins. KSU’s Morningstar Key Ratios shows management’s effectiveness in operating this railroad th past 10yrs. Many speak about ‘corporate moats’ or unique non-duplicatable assets as responsible for the success of businesses such as these. These companies do not have ‘moats’.

The lesson to take away is that in a highly competitive world, it is not what a company makes that drives business success year-over-year that makes it a worthwhile investment. What makes any company successful long-term is its people, in particular its corporate culture and its CEO. KSU is a good example. KSU experienced a business slowdown 2014-Present, as did all railroads. Revenue fell $200mil in the period. But, management adjusted such that Gross, Operating and Net Income Margins rose. (Compare the last column of values with adjacent columns in the Morningstar data)

The better investment decisions are made entering into well run companies during a business downturn. It is in downturns that the better managements show their skills. In the period 2014-Present KSU’s share price fell from $125.95 to the low $60s. This is a good example of market psychology not paying attention to business fundamentals. KSU becomes a recommendation as a result.

Value Investors are always looking for issues heavily discounted by market psychology where business fundamentals are solild. Through this analysis and careful buying decisions, investors can achieve higher returns than any company’s long-term return. Short-term investors miss seeing how long-term performance is underpinned by CEOs slogging out year-over-year results adjusting to unexpected business conditions. Anyone can run a railroad for a couple of years. Only a series of good CEOs with a sound corporate culture continuously reinforced provides the track record found at KSU.

There are ~300 companies with long-term records better than the SP500. At any point in time, some are like KSU, are mispriced-buying opportunities. Likewise, out of 3,000+ mutual fund portfolio managers, there are always some which have been discounted by market pessimism. Those managing Intl Equities represent such an opportunity today.