UPDATE:

“Davidson” submits:

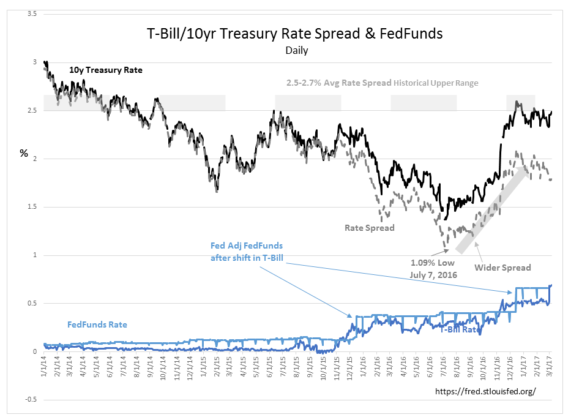

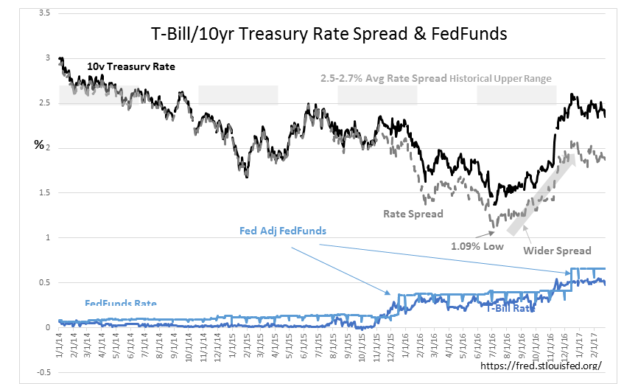

The T-bill has shifted higher than Effective Fed Funds Rate. The Fed will raise the Fed Funds Rate in response as it has done so in response for decades. The T-Bill/10yr Treasury rate spread has shifted lower, below 1.8% at the moment. This is a non-event unless this spread narrows further.

Investor optimism is building, but has ebbs and flows. The narrowing in the T-Bill/10yr Treasury rate spread with a pause in the rise of the 10yr Treas rate reflects an ‘ebb’ in optimism. Expanding optimism is accompanied by rising rates across the yield curve will the rise in 10yr rates shifting higher initially at a faster pace than the T-Bill rate causing the T-Bill/10yr Treasury rate spread to widen. We should see optimism continue to expand accompanied by a widening T-Bill/10yr Treasury rate spread the next few years.

“Davidson” submits (original post 2/24):

Rate rise not likely:

This is the updated daily rate history of T-Bill, 10yr Treasury and Effective Fed Funds rates from Jan 2014. The daily history can be taken back to 1962, the monthly data to 1953. There is a lot of history available on Fed rate adjustments. The Fed waits for T-Bill rates to shift before they adjust the Fed Funds rate.

Only once did the Fed adjust rates without keying on the T-Bill rate. Chairman Volcker’s actions to stem runaway consumer inflation spending in the early 1980s was the only time the Fed acted preemptively. Every other instance one can observe, the Fed reset the Fed Funds rate after market forces caused a rise or fall in T-Bill rates. Chairperson Yellen’s 2 rate rises follow the same pattern. T-Bill rates shifted higher, then the Fed followed.

The chatter about a March rise or Yellen’s statement of 3 more rises in 2017 does not have the support of history. T-Bills have recently fallen slightly below 0.50%. It would be unusual for the Fed to raise Fed Funds rate with the current differential. Yellen (or any Fed) does not have the ability to predict T-Bill rates as one can surmise from her comments during her tenure in which her multiple forecasts for a rate rise did not result in such.

A rate rise in March is not likely.

Market top not in sight:

The calls for a major market top seem to come every day. If one does not keep track of history, one can believe that this time someone is right. So many use price-trends to direct their investing that it makes listening to media very confusing. It is far more simple than many think. The historical data has a single relationship which is highly correlated to stock market tops. That relationship is the rate difference between T-Bill and 10yr Treasuries, the T-Bill/10yr Treasury rate spread. This is the spread on which lenders determine lending profitability. The wider the spread, the wider the lending profits, the more lending activity expands, the faster the economic expansion. The current condition is a widening rate spread which supports expansion of lending activity

Market tops are highly correlated to lending spreads narrowing to 0.0%. The way this comes about is through increased market speculation. After a long period of economic expansion, investors become so optimistic that at some point in the investment cycle they even sell holdings of T-Bills for higher returns elsewhere. When this occurs, T-Bill rates rise to the level of 10yr Treasury rates driving the rate spread to 0.0%. The economy having been in a strong period of economic expansion with many businesses and individuals carrying much higher levels of debt than is prudent and betting on a better future, suddenly is faced with a 0.0% T-Bill/10yr Treasury rate spread and rapidly slowing lending activity. In short order, the economic expansion no one expected to stop, enters a major correction.

The T-Bill/10yr Treasury rate spread is far from a 0.0% T-Bill/10yr Treasury rate spread. The T-Bill/10yr Treasury rate spread is 1.9%-2.0% today. The T-Bill/10yr Treasury rate spread is currently widening. When the T-Bill/10yr Treasury rate spread begins to narrow, it comes slowly with at least 18mos warning. Once 0.0% T-Bill/10yr Treasury rate spread occurs, an economic correction begins in a few months. The markets fall as investors come to recognize the economic correction. It is all quite simple.

As we stand today, no market top in sight!