“Davidson” submits:

Investors often speak of markets as directly responding to economic activity as in the diagram.

Economic Activity ®®®®®®®® Market Prices

But, in fact, most investors do not work that way. Most investors ignore the more convoluted path which traverses from Economic Activity to Media Headlines to Market Psychology and finally into Market Prices.

Economic(Human) Activity ®®Media Headlines®®Market Psychology®® Market Prices

Investors are emotional. For the most part, they want success quickly and fear losses. Most are very short-term in their thinking. Countering one’s emotions with logic requires long-term disciplined research into fundamentals. Economic activity is human activity. This connection is entirely ignored, but for Value Investors who recognize the underlying connection. Economics as human activity is not a process taught in business schools. Business schools, for the most part, believe the ‘scientific approach’, i.e. finding a mathematical solution, as the only possible means of understanding markets. Business schools shun the consideration of human activity as the basis for economic activity. They do this because human activity is not predictable. They believe that if they work hard enough, apply enough computer power to the right algorithms, they will find the ‘Holy Grail’ to predicting markets and become wealthy. Being the one individual out of millions to catch the ‘Brass(Gold) Ring’ has never lost its allure in human history. This attitude of ‘Getting Rich Quick’ infects many investors and drives their investment activity. What is missed in business schools is that humanity and individuals have some predictability but only long-term. And at the center of this misperception is the fact that, human predictability does not have a mathematical solution.

What is predictable is human behavior over time, as witnessed across multiple market cycles, but not witnessed daily, weekly, monthly or even annually and certainly not with mathematical precision. Long-term aspirations for improving our family’s standard of living is predictable. How we do this is predictable. We are willing to work hard, but we seek fairness in our transactions with others. We have empathy for others and believe in the “Golden Rule’. We seek to maximize the value of our capital. Capital which is derived from our daily labor. We make value-based spending decisions every day. In the US, we have the most established form of Democracy. It is in the protection of individual property rights, our right to make our own value-based choices, which we have written into the 5th Amendment to the US Constitution:

US Constitution 5th Amendment https://www.congress.gov/constitution-annotated/

“No person shall be held to answer for a capital, or other-wise infamous crime, unless on a presentment or indictment of a Grand Jury, except in cases arising in the land or naval forces, or in the Militia, when in actual service in time of War or public danger; nor shall any person be subject for the same offence to be twice put in jeopardy of life or limb; nor shall be compelled in any criminal case to be a witness against himself, nor be deprived of life, liberty, or property, without due process of law; nor shall private property be taken for public use, without just compensation.”

Human behavior is the basis for human economic activity. We can predict that most people believe in the 5Th Amendment simply because we see that this belief has held up in the historical record. The 5th Amendment is the ‘Golden Rule’ without religious overtone. Our basis for self-governance was simply outlined by Frédéric Bastiat in “The Law”, 1850. We can see how human behavior impacts human activity and thinking as described by Julian Simon in “The Ultimate Resource 2”, 1981, by Eric Hoffer in “The True Believer”, 1951, and by Steven Pinker in “The Blank Slate”, 2002. Human behavior is predictable in that we are always making the best value choices for our capital at the moment. What is not predictable is how those choices will be made in the future because future inventions have not by definition been yet invented. Who could have predicted Steve Jobs’ development of the iPhone? Jobs implementation of a concept he had well before his 1995 interview at the Smithsonian Institute http://americanhistory.si.edu/comphist/sj1.html required more than 10yrs of technological improvement/invention before he could bring it to fruition. Who could have predicted the cure for Hepatitis C that we have today? Today we can know that there will be positive implications from these inventions, but what will they be? Modern technology has permitted Stephen Hawking, even with amyotrophic lateral sclerosis, to contribute his genius to humanity. Will the HepC cure mean some currently unknown genius will now be available to benefit humanity? Very likely, but none of this is mathematically quantifiable. We can predict that improvement in human standard of living will occur. But, we cannot predict any of this with precision.

Converting human activity into predictable economics has been a failure from the very beginning. A basic scientific understanding of mathematics simply does not permit relying on mathematics to predict human behavior. Value Investors like Benjamin Graham, Charlie Munger and Warren Buffett have studied human thinking and behavior over history. They have acquired an understanding of human society by reading broadly. They read “80% to 90%” of the time. One has to read with the purpose of discovering things about the world and people they had not known before. Reading history, philosophy, biographies, corporate financials and CEO interviews are part of what needs to be digested daily. Newspaper reports of specific events and concerns of the time are especially important in understanding how people perceived events at the time and how key individuals responded. Such reading, teaches us about human characteristics which are not learned by any other means. This is a pattern of continuous learning to which Value Investors dedicate themselves. It is the accumulation of broadly-based knowledge of human activity which brings the understanding of business financials, economics and market pricing into focus which is not available by any other means. Human activity is predictable, just not mathematically.

Just as human behavior is predictable over the long-term within limits so are periods of human misperception. Periods of misperception will occur. We just cannot predict when, how or to what extent they will occur. Periods of human misperception is why markets have cycles. Value Investors recognize Economic Activity as their primary basis for understanding Market Prices. The majority of investors find investing too confusing and too difficult to develop the information necessary to be Value Investors to make this distinction. Instead of looking behind the Media Headlines, they translate Media Headlines directly into Market Prices without qualifying whether or not a particular headline has any long-term consequence for valuation. A number of authors have been documented periods of market misperception with Justin Fox’s “Myth of the Rational Market”, 2009, and Charles Mackay’s “Extraordinary Popular Delusions and the Madness of Crowds”, 1841, being good examples. The Value Investor ties together financial trends, market valuations and selective listening to those whose business commentary carries better insight and are able to identify investment opportunities which the consensus misperceives. Speaking about their investment perceptions, Value Investors often use the common terms of finance, but their context is within information and insight provided by a select minority of business executives with strong performance histories.

For the Value Investor, it is always a ‘judgement call’. Mathematics can be used to evaluate the business trend, but the judgement is whether the price of the shares represent upside or downside market psychology expectations. Surprise financial results are what drives securities. A series of positive surprises drives security values higher and vice versa. No markets reflect uniform valuations. Each company has its own story and investor valuation. This is what makes investing seem so irrational and why Momentum Investors disparage valuation analysis and simply go with price-trends. It is Value Investors who recognize business change and create the larger turns in security prices. Momentum Investors follow these trends once the headlines become favorable.

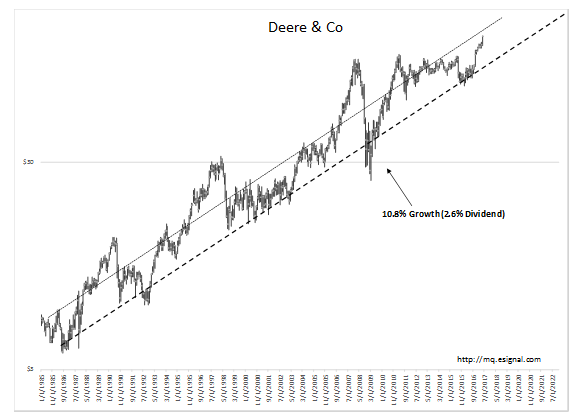

John Deere & Co(NYSE-DE) is a good example in today’s market. The history of DE showed that Value Investors were buying Feb-May 2016 with the bulk of investors forecasting doom and gloom for this company.

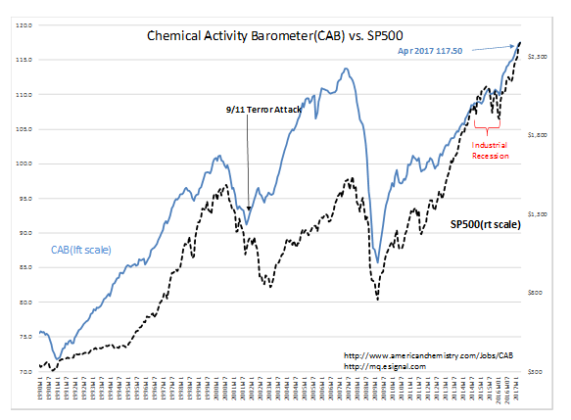

But, Value Investors already had strong indications from the Chemical Activity Barometer(CAB) in Apr-May 2016 that US industrial sector was exiting its recession.

Only now, at $120shr or 60% higher than the $70shr at which Value Investors began to buy DE, are Momentum Investors becoming interested as earnings surprise on the upside. DE is one of many examples one can identify as reflecting these differences between Value and Momentum Investor styles.

- What separates Value Investors from Momentum Investors is being able to:

1) Judge people and their abilities to run businesses during difficult periods

2) Identify when the market has turned about as negative as it is likely to turn and become a good entry point.

The Value Investor analytical process is a complex mix of understanding people skills, financials and market pricing called ‘Empathic Logic’. This is entirely a process of human judgement for which mathematical analysis is wholly unsuited.

I recommended DE at $70shr last year. I would not buy it today, but would not sell it either. It still has, in my opinion, a couple of years of improving market psychology which is likely to drive the price higher. Economic activity continues to expand as the US industrials exit the recession of the past 2yrs. There is much to like for equity investors in my opinion.