“Davidson” submits:

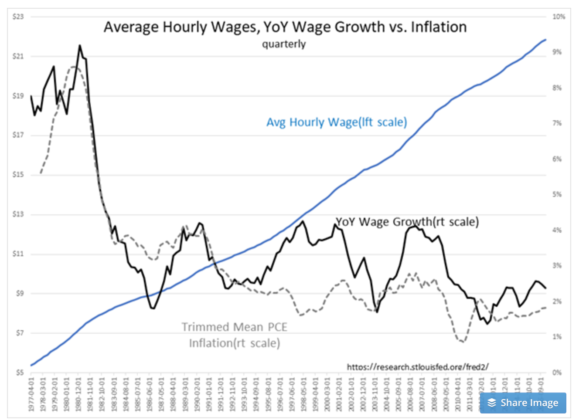

For 8yrs part of the conversation has centered around a weak recovery and weak Hourly Wage Growth.

To paraphrase: “If only we had higher wages we would have a better economy and the world would be better off.”

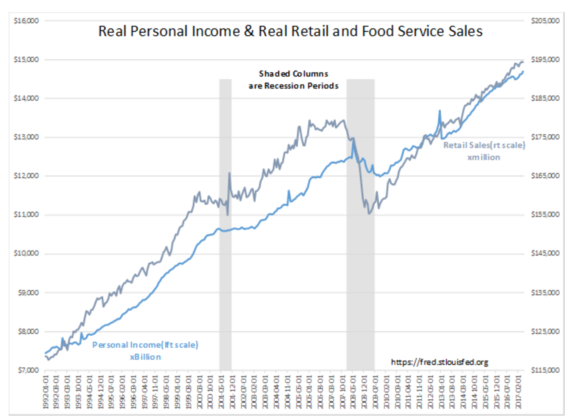

The same talk flooded the media today with the higher than expected employment levels. The problem with this hand-wringing and the pressure for government action is that is and has been ‘wrong-headed’. Wage growth has been higher than inflation for most of the historic record since 1978 even though there have been periods when inflation did run hotter than wages. Wage growth is higher than inflation today and there has been real improvement in wages since the past 27yrs since Chairman Volcker stopped the 1970s inflationary spiral in the early 1980s. Real Wage Growth shows up in Real Personal Income and in Real Retail & Food Service Sales which are at record highs. If we did not have Real Wage Growth our standard of living and our economy would have declined!

Summary:

Most of the concerns expressed since 2009 on the disappointment of nearly every economic measure have been colored by a negative bias. The data show a decent economic recovery has been in place for almost all participants. Why people have been so glum and misread the data for so long can only be attributed to human nature.

It is what it is. Economic activity has been quite positive since 2009. As long as investors are surprised by better economic data than expected, markets will move higher. History indicates this could be as much as 50%-100% than today. Only time will tell how high. Fortunately we do have economic tools to tell us when the markets are likely to see a major correction.