“Davidson” submits:

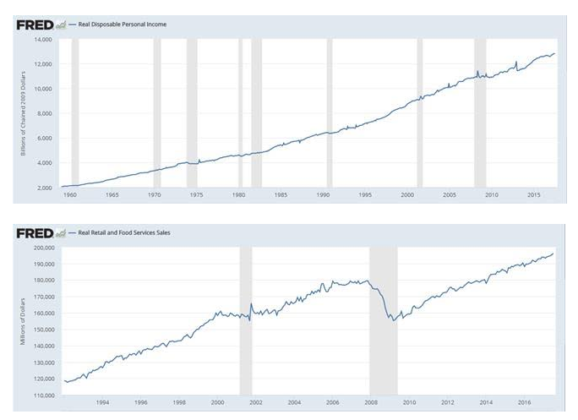

US Household Survey Employment falls a little, but remains on trend from 2009. Light Weight Vehicle Sales lower, some indicating a Harvey impact. Temp Employment and Job Openings, both precursors to higher full-time employment, continue to reach higher levels. Nothing is more telling than Real Personal Disposable Income and Real Retail and Food Service Sales reaching all time records. The US economy continues to operate at a good pace and in spite of many expressing concerns of a economic/market correction the next few months, there no evidence that we will see an economic correction in the near future. The best guess one can make historically is economic expansion should be with us at least another 2yrs and perhaps as long as 5yrs with market speculation relatively low. In every economic indicator the US has exited the Industrial Recession caused by the strong US$ and economic activity is accelerating. Good news!

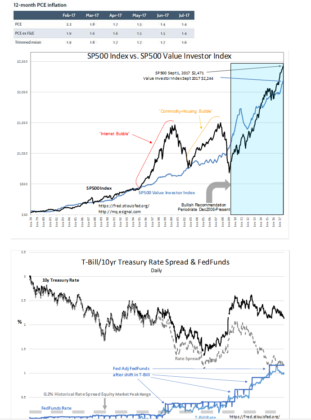

The perspective of relatively low general market speculation is supported by the Value Investor Index and the T-Bill/10yr Treasury rate spread. The SP500 the past two cycles reached levels which were 60%-100% above the Value Investor Index. The current premium of 10%, SP500 priced at $2,471 vs Value Investor Index at $2,244, matches the public pessimism we have had since 2009 economic cycle began. The historically low, low 10yr Treasury rate of ~2.2% reflects the fact that a substantial level of capital normally in Equities remains in Fixed Income. At this point in time the 10yr Treasury should be closer to 5% with Wicksell’s Natural Rate at 4.6% today.

Low general levels of market speculation are also reflected in the T-Bill/10yr Treasury rate spread currently at ~1.2% or 120bps. This rate spread drops towards 0.0% as market optimism builds and investors shift cash to equities and other investments seeking higher returns. The T-Bill rate rises towards the 10yr Treasury rate and chokes off lending once the spread drops to 0.20%. The history of this can be traced from 1953. We remain several years away from this level of speculation. Equity markets and economic expansion should continue to reach new highs till this occurs.

Summary:

Considerable pessimism remains in the markets as economic expansion continues. Several more years of economic expansion and higher markets are ahead in my opinion. Investors should be adding capital to Equity and avoid Fixed Income.