“Davidson” submits:

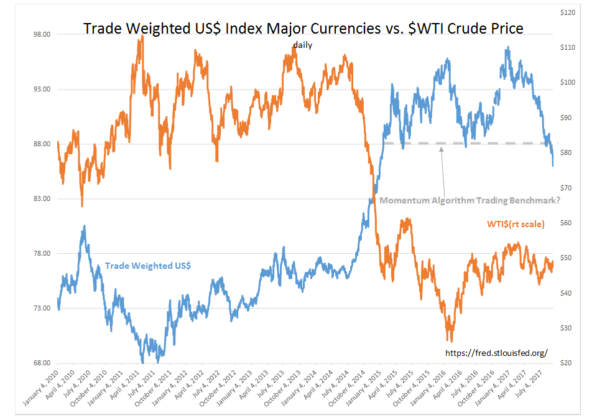

The US$ has continued to fall without an immediate response from $WTI. This is not unusual. Although the inverse pattern is fairly strong, it is not a lock-step daily pattern. There has been confusion with Harvey’s and Irma’s impact on production/consumption. We should see a sharp rise in $WTI the next month if the algorithms reassert themselves.

There were disruptions across the system. We saw production declines, crude inventories build, gasoline inventories drop by record levels, a drop in exports, a drop in refining and top it off the EIA has dropped its over-supply forecast by 30%. Harold Hamm indicates the forecasted supply remains decently higher than that of industry insiders and another 20%-25% reduction in excess supply estimates should occur.

I remain surprised that the EIA and API forecasts, on which traders rely, are always backwards-adjusted and few seem to pay much attention.