If we are looking at N. America production, it was only up 12 rigs as Canada saw a 17 rig decline.

“Davidson” submits:

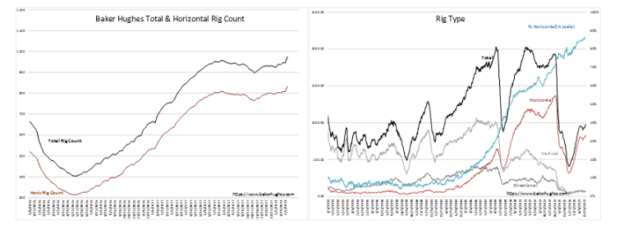

The fall in $WTI below $59 BBL is the response to those who view a higher rig count as leading to over supply. Baker Hughes Rig Count popped by 29 with 24 being Horizontal Rigs. There is always more than one way to view data. The rise in US oil production to 10.2mil BBL/Day is due to demand in my view as is the rise in the rig count. Economic activity is broadly expanding as can be seen with other important economic indicators.

This report is positive for the US oil patch in my opinion, and undeserving of the negative market response.