“Davidson” submits:

Investing is about assessing major policy changes and guessing the future direction of events which drive market psychology which sets market prices. Always a work in progress!

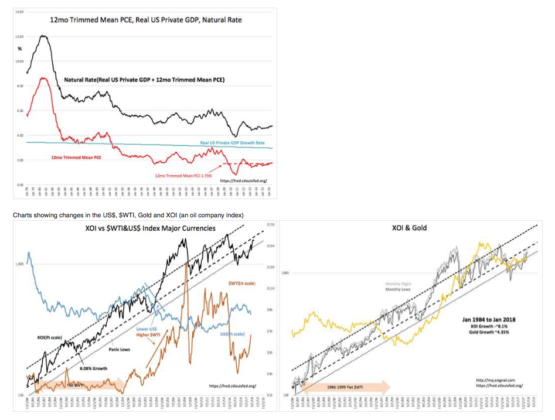

There is a lot of talk about inflation, but the actual level remains in-line with the avg since 2009, ~1.75%. Gold, often an inflation hedge, tends to rise after a period of significant inflation and after a rise in other commodities(see charts). Oil is frequently the 1st choice as an investment hedge to inflation. But, oil related companies as reflected in the XOI Index, must be run for profit regardless of oil price swings and are a better choice as an inflation hedge as they are, regardless of inflation, also simply good investments.

Net/net what we see is that oil related companies (XOI Index) rising during flat $WTI prices 1986-1999(13yrs).

It is difficult to call ‘Inflation’ even though one may have a decent handle on Government Exp&investment as the culprit. The issue is how this spending is executed which is always different from instances in the past. At the moment, there is a small rise in Govt Exp&inv without a rise in inflation. How market psychology responds is impossible to predict. Thus far the collapse of $WTI from $100+BBL to mid-$20s 2014-2016 and the recent rise to the mid-$70s has not had an identifiable impact but for a rise in the XOI Index.

Gold prices have slipped recently without a noticeable inflation threat.

In my opinion, investors should hold portfolio positions in oil related companies with good managements who adjust to oil prices and must remain profitable rather than own commodities themselves. Oil related companies must focus on generating profitable revenue for each BBL they pass on to consumers regardless of prices. The better managed companies have always out-performed inflation and greatly out-performed gold.

The annual return for the XOI Index Jan 1984-Jan 2018 has been ~8.1% while Gold without carrying costs has produced ~4.35%.