Davidson is at his best when markets are rocky…..

“Davidson” submits:

The current environment appears scary much like a ship in a storm without a rudder. Events seem to come out of nowhere from unanticipated directions. Each new headline threatens to topple what seemed positive consensus a few weeks past. Positive earnings reports are ignored adding to the appearance the markets have become illogical and no headline provides comfort. Pessimistic shifts in market psychology when positive economic signals abound are specially disconcerting. But, fortunately the markets are littered with many such events. The many times short-term panics have occurred during positive economic signals define how markets operate. Market psychology impacts short-term market prices but is not driver of long-term economic trends. The driver of long-term economics is a very basic desire for each of us to advance our own and our family’s standard of living. It is this drive which produces what we call economic activity which in turn produces economic/business headlines which drive market psychology and in turn market prices. Market prices are after-the-fact and always temporary as they are perpetually reset by headlines which come from long-term economics.

Today, long-term economics look quite positive with multiple policy shifts likely to spur future economic growth. The ‘scary’ part is October which is the month of Halloween, the month of spooks and monsters, and in market lore the month of the 1929 Crash, the Crash of 1987 and many believe a month of ‘Black Swan’ events. One should not lose sight of the upcoming November mid-term elections and investor concerns that the gravy-train market since 2009, the longest bull market in history, could come to a sudden halt should the current administration lose control of its economic agenda. The fear of losing control has been underlined with events at the Saudi Consulate in Turkey. Geopolitical events do influence global economic balances and headlines of recent events are threatening to investor psychology specially in October.

One should be specially aware that most investors are Momentum Investors at any point in time. Momentum Investors believe that price trends predict economic activity. Some even believe price trends determine future economic activity. Investors are generally wrongly focused on price trends and have produced a long history of selling into panics and buying at market tops. If one observes closely when markets respond to reported events which have been long in the making, markets are highly inefficient and illogical. The belief that markets track Fama’s “Efficient Market Theory” arises from a ‘Top Down’ perception which misses the fact that prices adjust quickly after the headlines. Price adjustments occur so quickly, usually in a few seconds, that Top Down-analysis concludes market prices logically anticipate headlines when detailed analysis reveals that most investors chase returns rather than anticipate them. To be a long-term investor, one needs to understand the interplay of financial trends, the headlines and market psychology in order to benefit from divergences.

A more recent policy shift, the demand that global tariffs should be lowered to provide a fairer global trading market, has been in part responsible for the Chinese Yuan decline. The Yuan has fallen to 2008 lows. This has rolled into Chinese equities and debt markets lowering prices globally. China has been an unusual command economy run by autocrats. Unusually, Chinese leaders have been trying to maintain a capitalistic base to spur its citizens creativity and value creation in order to support the tax base for government spending plans. Chinese citizens fear their own government and are responsible for a steady flow of capital to Western nations with individual property protections. In the US, real estate and Treasury obligations have seen historic prices (low yields) the past 10yrs with this capital inflow. China has boosted its reported internal GDP with ample use of debt. They have spurred many real estate and infrastructure projects with a ‘build-it-and-they-will-come’ mentality some of which remain unoccupied and unused. There are many who have mistaken China for a global growth engine when it was exports to the US and others in an skewed tariff regime which have fueled China’s growth. The US tariff policy shift towards a more equal tariff regime makes the Chinese economy vulnerable to correction. While some market disruption is possible, the growth engine of this cycle remains the US as it has been in past cycles. The current weakness in China is a sign that US tariff policy is having a desired impact and that China is likely to adjust tariffs lower, in my opinion.

Over the long-term market psychology follows economic and business trends. Short-term, markets often appear illogical and dancing to the beat of an unknown drummer. In my experience markets are always illogical. They never anticipate good or bad headlines even when the economic trends make the future direction clear. Seeing these differences is the core of investing with fundamentals. There are many indicators which are useful. Every market cycle has it important nuances and one never relies on a single ‘tell-all’. Two indicators continue to stand out and are useful anytime markets have entered ‘silly territory’, the T-Bill/10yr Treasury Rate Spread and the Chemical Activity Barometer(CAB) updated this morning.

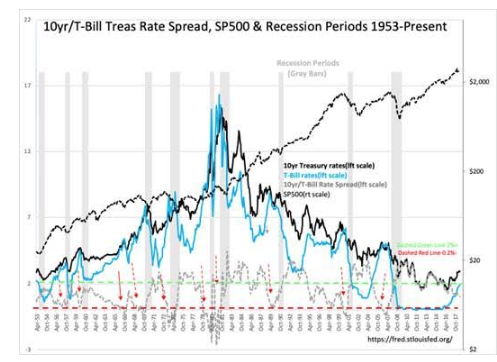

The best full cycle indicator is the T-Bill/10yr Treas Rate Spread-currently ~1% is mid-range. History since 1953, when spread falls to 0.2% or less marks the cycle top. This has to do with lending margins being choked and existing bad debt not being able to be rolled over. Bad debt defaults when it cannot be refinanced and a cycle correction occurs. The rate spread is also a very good proxy for market psychology with 0.2% spread reflecting euphoria and greater than 2.0% representing high pessimism. Today’s mid-range ~1%, indicates continued economic expansion with bad debts and all.

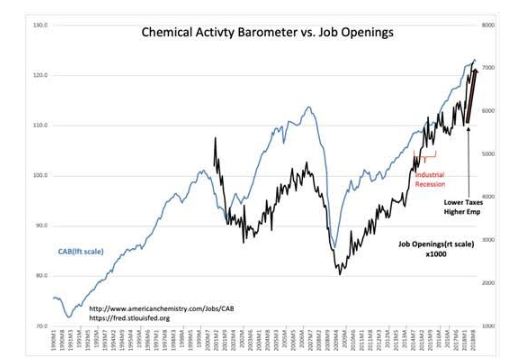

The Chemical Activity Barometer(CAB), with a history from 1919 or ~100yrs, was revised higher this morning as was the recent Job Openings series, referred to most often as the JOLTS. One never uses a single economic measure when investing, even though they provide similar insight. Data comes from different sources provides fundamental redundancy. The sharp rise in Job Openings, see the BLACK ARROW, is coupled to the recent tax cut. No one expected this policy change, just as few expected the reduction in regulations, the reduction of terrorism globally and other policy changes. If global tariffs are reduced by recent initiatives and if the FDIC reduces the small/regional bank regulations which have stymied the US housing cycle at half the long-term pace(it is well known we have a single-family housing shortage due to historically stringent lending standards), then we should see an extension of the current expansion perhaps beyond 5yrs.

The Investment Thesis October 25, 2018:

Momentum Investors have panicked a bit due to turmoil from Chinese markets and impact of recent tariff policies. Fundamentals, meanwhile, remain biased to the upside with potential boosts from polity initiatives. One could never have predicted this environment 24mos ago. History provides us with ample insight to how economic strength carries markets across periods of troubled waters. This is one of those periodic periods of pessimism with out any justification.

My recommendation continues to be in Domestic equities, avoid Fixed Income as rates rise and if possible add to portfolios.