“Davidson” submits:

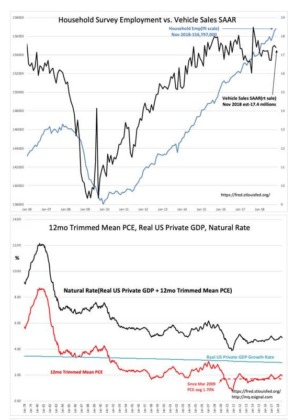

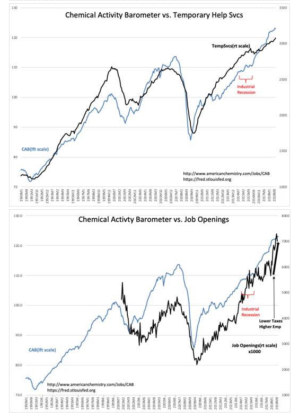

Employment growth continues to trend higher and vehicle sales continue to be maintained at levels reflecting replacement and new additions characteristic of a strong and steady economic expansion. I use the Household Survey because it is the only estimate including the self-employed, higher by 233,000 in this report. Inflation as measured by the 12mo Trimmed Mean PCE has actually fallen a little from slightly over 2% to 1.9%. Another positive! Employment demand as evidenced by Job Openings, Temp Help and the Chemical Activity Barometer(CAB) indicate further expansion ahead.

A new policy shift to support uptrend for several years

Markets are understandable but only partially predictable. Innovation and policy shifts have major impacts often unseen. These influences are mostly out of sight because investor’s short-term focus always misses the more subtle long-term benefits which evolve over years and not quantified quarter-to-quarter. The introduction of Apple’s iPhone(the first smartphone), a solution to HIV and a cure to Hep C have had major economic benefits and outcomes. Smartphones are responsible for ‘The Arab Spring’ uprisings because subjugated individuals suddenly had access to information about the rights people enjoyed elsewhere. Mass migration towards better living conditions elsewhere has been a result of smartphones. Medical innovations in HIV and Hep C have dramatically lowered society’s costs for these devastating issues. We often take innovations like these in stride with little appreciation for the societal benefits they bring. Innovations make economics and investment markets unpredictable. We never see them coming and never fully appreciate their impact.

Policy shifts likewise impact economic activity but take time to quantify. Lowering taxes, reducing regulations have had dramatic positive impact the past 2yrs. If the current efforts to reduce global tariffs are successful, the impact will prove very positive economically. Recently, steps have been taken to resolve onerous regulations on the US banking sector. Not having perfect vision, Dodd Frank regs applied the same set of restrictive rules to large banks as to very small banks. The outcome has been a housing market atypically unresponsive to an economic recovery.

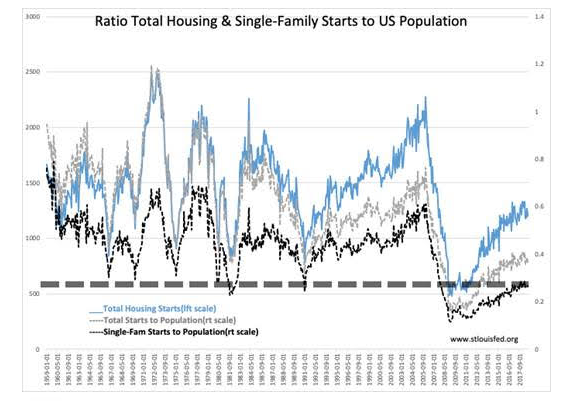

The proper perspective on housing comes from comparing Single-Family Starts(Housing) to US Population. The chart shows Total Housing Starts on the left scale with Total Starts/Population and Single-Family Starts/Population ratios on the right sale from Jan 1959. The DARK DASHED LINE is the current Single-Family/Population ratio. Single Family Starts remain atypically low at this point in the economic cycle. Current lending levels remain atypically low relative to our housing needs.

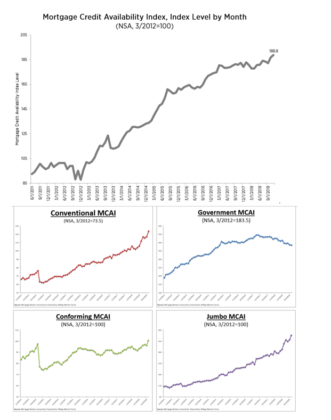

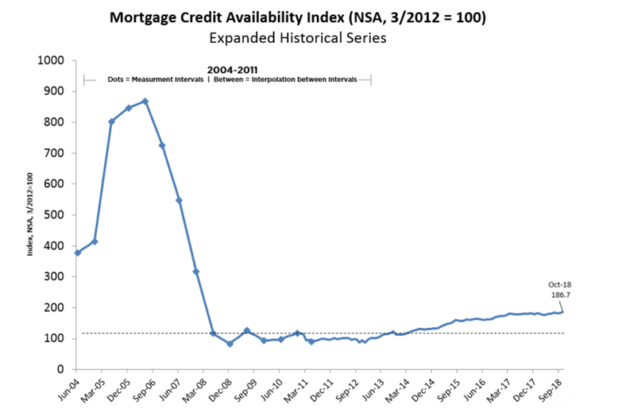

Small and Regional Banks are responsible for much of the mortgage lending which drives housing starts. Dodd Frank legislated ‘one-size fits all’ banking regs requires adjustment. The current FDIC Chairperson Jelena McWilliams has very recently taken steps to adjust this inequity. The Mortgage Credit Availability Index(MCAI) reflects a recent upturn in Single-Family mortgage lending. One can see that increases come from Conventional and Jumbo mortgages the bailiwick of Small and Regional Banking.

.

That this is a significant change in the impact of Dodd Frank on the MCAI is shown in the chart from 2004. Dodd Frank was signed into law July 21 2010. The inception of the MCAI captures the period just prior to the explosion of Sub-Prime lending responsible for the Sub-Prime Crisis which can be taken as typical of lending a couple years out of the 2002 recession. If we use 400 as a reasonable level, the current 188.8 is still less than half the mortgage lending pace representing levels typical regarding US housing needs. Household Debt to GDP and Single-Family Mortgage Delinquencies(not shown here) continue to reflect declining levels of issues with indebtedness. These are signs of strong current financial conditions. Millennials have mostly been unable to qualify for mortgages as they still carry college loans even if they have developed strong employment histories. That they have been kept out of housing market as first time homeowners has been an impact of Dodd Frank that is only now being corrected.

Keep in mind, fostering Sub-Prime lending was a government policy to ‘cure poverty’. Dodd Frank was an over-correction to the damage caused the previous government policy. Both, policies came from government. Neither policy produced the intended outcomes and both produced unintended consequences!

The Investment Thesis:

The media has been abuzz concerning the “SP500 Death Cross”. This is a Momentum Investor term for when the 50 Day Mov Avg falls below the 200 Day Mov Avg as shown in the SP500 chart. This is believed to “guarantee a significant market decline” in the months ahead. That the economic evidence strongly contradicts this thinking and supports higher equity prices for the next few years should be no surprise.

Rising mortgage lending coming at this point in the economic cycle is likely to support economic activity for several years. The MCAI can double to 400 in my estimation without negative financial consequences. This lending impact is likely to have considerable positive impact on the US economy. I expect equities to continue to rise considerably from current levels.

The current recommendation is to buy equities, especially those with the better long-term management histories which have experience the largest recent price declines coupled with significant insider buying activity.