“Davidson” submits:

Job Openings, a leading economic indicator, posts another record high. The economic context is sound. Why have markets not responded?

Any single investment recommendation has 2 important components, 1) price vs. future financial surprises and 2) the broad economic context. Being positive at this time requires cheap individual security prices relative to financial performance and indications that the broad economic context is far more positive than the consensus of investors perceive. This is how one anticipates future positive results which surprise to the upside vs. market expectations.

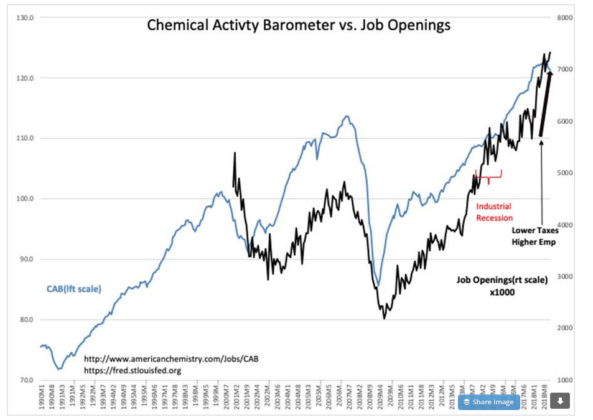

It is through anticipating better reports than the bulk of investors expect that fundamental investors gain as market psychology swings from pessimism to optimism. Two of fundamental indicators which help one judge the economic context are the Chemical Activity Barometer(CAB) and Bureau of Labor Job Openings(JO) indices. The CAB measures chemical industry economic activity and anticipates positive employment and retail sales reports. JO anticipates rises in employment and personal income including rising wages. The higher demand reflected in JO is also pressure to raise hourly wages for existing employees. The CAB and JO are part of several doz one can use to assess economic context.

Getting the economic context correct and coupling it to the pricing of individual securities makes investing look fairly simple. The unspoken factor is market psychology. It is the change in market psychology which causes prices to rise and fall. One can be right on judging fundamentals and under-/over-pricing but be forced to wait several years for market psychology to develop as anticipated.

History records that markets have always responded after-the-fact. Investors have never missed an opportunity to profit once the opportunity is recognized. They have also routinely chased investments they believed might have but did not eventually have fundamental returns. The pessimism since Oct 2018 that a recession is looming provides the best opportunity in ~6yrs years for investors. There are many individual opportunities which appear attractive.