“Davidson” submits:

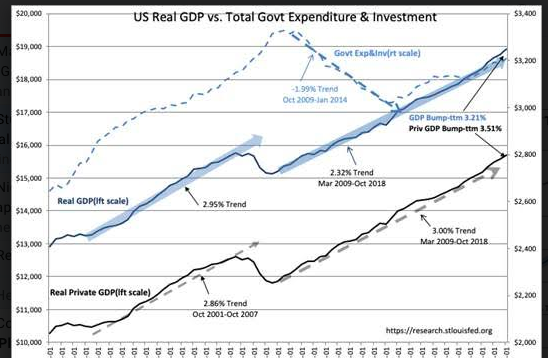

Real Trailing Twelve Mos GDP reported as now 3.2% and the Real Trailing Twelve Mos Private GDP 3.51%

I held off concluding the rise in Real GDP, which includes the recent expansion in Total Govt Expenditure&Inv to rebuild the military, was a true rise in the underlying Real Private GDP. But, the data reveals that an expansion in the Private economic activity the past 18mos has definitely accelerated. The Real Trailing Twelve Mos Private GDP is definitely significantly higher than the trend of 3.00% since early 2009. Today’s report of 3.51% confirms all other economic trends I monitor and is something expected in GDP data.

The development of Real Private GDP is to remove the skewed perception many derive from the widely reported and in my view misinformed GDP data. GDP includes discretionary govt spending which comes from taxation and govt borrowings based on the Private economy. It is a form of double counting the underlying strength or weakness when govt spending tends to rise and fall somewhat along economic trends. Total Govt Expenditure&Inv does not include the mandatory payments from Social Security or Medicare and etc.

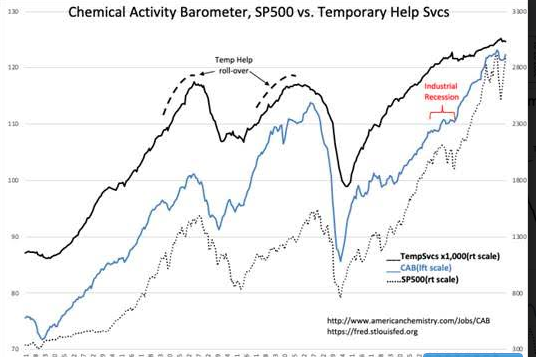

The Real Private GDP trend is a measure of the past and being at least 1Q behind in its report is not overly useful as a forward economic indicator. What it does is confirm that our use of other indicators as representative of likely future trends has been on the mark. With this in mind, the Chemical Activity Barometer(CAB) was reported higher this week including higher revisions to past 2mos. The minor dip in the CAB in response to the Dec 2019 swoon comes from the inclusion of chemical company shares as part of this useful index which is mostly based on fundamental economic data. I expect the CAB to reach new highs shortly tracking the economic expansion visible elsewhere.

Things are all quite positive.

To access paid content at original 2009 prices, please follow this link