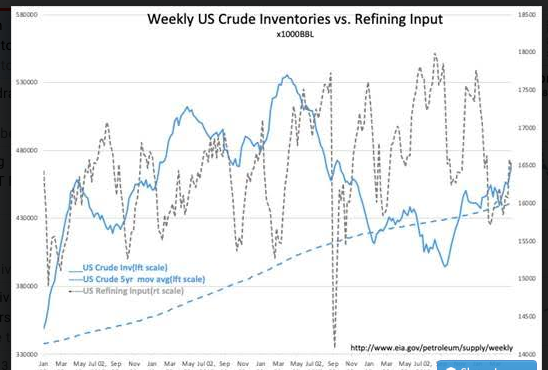

This is the reason for the “oil inventory build” we are seeing. Less of it is getting refined into other products right now due to refinery downtime.

“Davidson” submits:

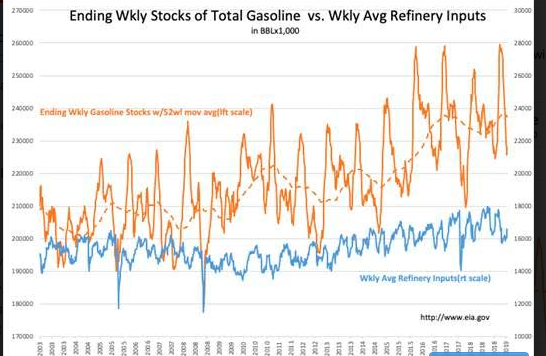

Current gasoline inventories are 1mil BBL above the Nov 2018 lows, refining inputs remain well below historical levels at this time of year.

Exxon has reportedly restarted its refineries after being shutdown for capacity upgrades, but other refiners have shutdown for similar capacity upgrades. The Net-Net is that refining activity is unusually low for this time of year and we see a sharp drawdown in gasoline inventories which are usually building for summer demand. The deepest draw in gasoline inventories in recent times occurred in 2017 with the three big hurricanes of 2017, Harvey, Irma and Maria, which are now listed as three of the five costliest hurricanes in U.S. history. It is too early to tell if Exxon will make up for needed gasoline supplies with numerous upgrading programs in progress.

US Crude Inventories rose by nearly 10mil BBL leaving current crude inventories 30mil BBL above its 5yr moving avg of 440,959,000 BBL. Should refining inputs ramp back to typical historically seasonal levels, the perceived excess could be worked down in less than 10days and market psychology shift towards closer to an ‘oil shortage’ mentality and drive prices higher.

Hard to predict week-to-week when refining inputs will rise back to seasonal trends.