BP just told us that oil demand rose in 2018 at the fastest rate since 2009;

U.S. oil demand jumped 500K bbl/day to 20.46M bbl/day in 2018, the biggest increase in more than a decade and accelerating a trend of rising oil demand since a trough in 2009, BP said in its latest annual Statistical Review.

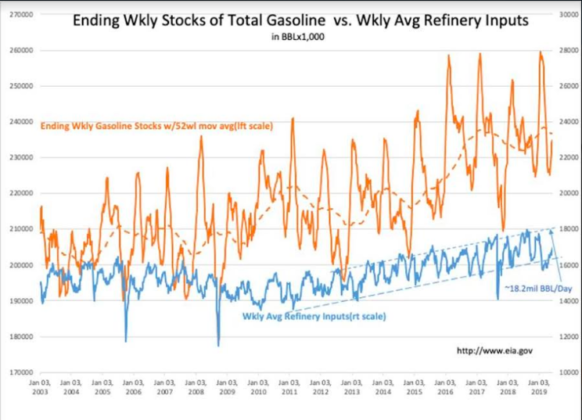

Rapidly rising demand lead to matching increases in production. We also know refinery throughputs rose at levels lower than 2017:

Refinery throughput rose by 960,000 b/d, down from 1.5 million b/d in 2017. Nevertheless, average refinery utilisation climbed to its highest level since 2007.

This was due to extended downtime at many refineries and has lead to the perceived “glut” in the oil supply. It isn’t necessarily due to falling demand but a clogged system as refineries are not able to refine it at historical levels right now. As these refineries come back online the excess inventory will fall off and oil should rise back into the mid $60’s to lower $70’s.

I also continue to think that while Iran has been quite lately that situation could explode at any time so the most likely scenario for any major move in price either way in my opinon is to the upside.

“Davidson” submits:

Refining input of 17mil BBL/Day while a little higher than last week, is still ~1.2mil BBL/Day below what is est to be necessary to meet summer demand. US gasoline inventories began the driving season near 2018’s lows. US Crude built by 2.2mil BBL, much less than last week’s 6.78mil BBL, but still enough to revive calls of an ‘oil glut’ with traders pressuring lower prices.

ExxonMobil’s Baytown unit with capacity nearly 600,000 BBL/Day remains off-line. Reports are this capacity is to start up before the end of this month.

To access member-only content free for 5 days at 2009 prices, please follow this link.