“Davidson” submits:

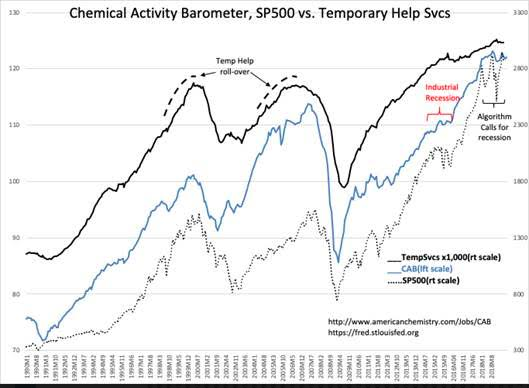

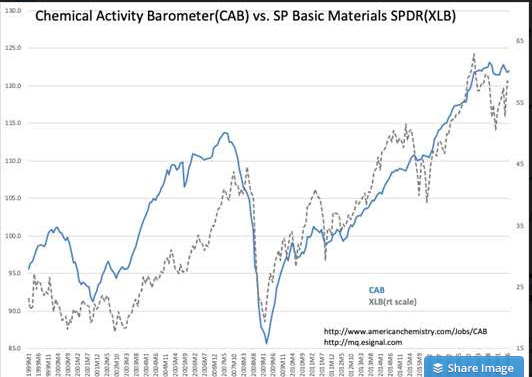

The latest Chemical Activity Barometer(CAB) reading is up slightly to 122.1 but flat the past 12mos. While US production rose 3.1% in 2Q19 and 2% YoY, equity prices have been weak since Jan 2018. The impact of equity prices as one of four inputs to the CAB has kept this index flat while production activity has continued higher. The SP Basic Materials SPDR(XLB) provides a comparison of equity prices vs the composite CAB. If chemical company equity prices had tracked production, the CAB would be at record highs.

The CAB is artificially flat due o equity prices while economic activity continues expand.

Excerpt: “The CAB has four main components, each consisting of a variety of indicators: 1) production; 2) equity prices; 3) product prices; and 4) inventories and other indicators. Production-related indicators in June were slightly positive. Trends in construction-related resins, pigments and related performance chemistry were mixed and suggest few gains in housing activity. Plastic resins used in packaging and for consumer and institutional applications were positive. Performance chemistry was positive and U.S. exports were mixed. Equity prices slipped this month, while product and input prices rose. Inventory and other indicators were positive.”