“Davidson” submits:

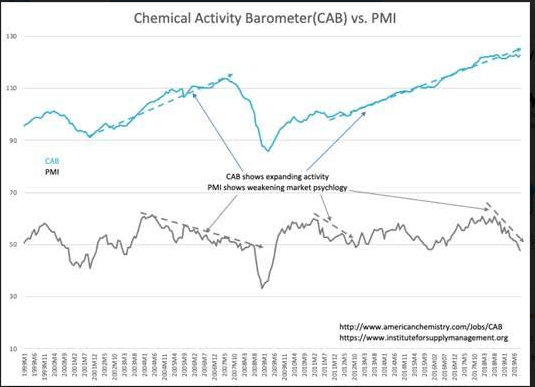

Daily details matter, especially during periods of shifting market psychology. Inversion in the T-Bill/10yr Treasury rates occurred May 2019 after a tumultuous period of rapidly falling 10yr Treasury rates beginning Nov 2018 with the onset of the Chinese attempt to take over Hong Kong and the ensuing protests. This drew recession signals from algorithms when US economic indicators continued to signal expansion. Coupled to algorithms was a stronger US$ and the PMI(Purchasing Managers Index) contributing additional misleading signals. The PMI is an opinion survey, i.e. market psychology, of Purchasing Manager expectations which has reflected negative outlooks in the past when economic indicators such as the Chemical Activity Barometer(CAB) remained positive. At some unpredictable point, economic trends become recognized and market psychology realigns. It appears we are witnessing this process at work the past few days.

This morning the T-Bill/10yr Treasury rate spread, a market psychology driven trend, turned positive by 0.07% after being negative by 0.51% the 1st week Sept 2019. Changes such as these form major market turns. While it is too early to state something definitively, hindsight of previous turns strongly suggest we are seeing a turn positive today.

The T-Bill/10yr Treasury rate is a key market psychology indicator. A widening positive-spread is very positive for equities as it reflects capital into equities.

Economic indicators provided signals the past 2yrs that expansion continued uninterrupted. Negative market psychology fed on itself causing one non-economic signal after another to reinforce algorithmic models during this period in the face of economic strength. Economic trends always win!

In my opinion, this is what we are seeing today.