“Davidson” submits:

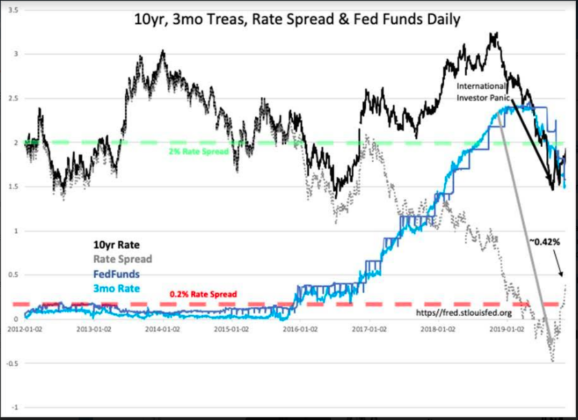

Watch the T-Bill/10yr Treas Spread. I do this daily and monthly(from 1953). Rates are set by market psychology not by the Fed which lags T-Bill rates by several weeks.

Negative rates globally and the recent plummet of 10yr Treas rates is due to capital escaping China and coming into Western Sovereign Debt. The US tariff initiative has accelerated this as has the unrest in Hong Kong.

The US yield curve inverted July and hit -0.51% 1st week Sept 2019 and has now turned a positive 0.42%. Many algorithms key into the inverted yield curve which is why we have seen markets swoon since Sept 2018 when 10yr yields began their recent plunge. Meanwhile, employment, Personal Income, Retail Sales and the Trucking Tonnage Index have remained in decent uptrends signaling that economic expansion continues.

A wider yield curve spread makes lending more profitable and the current rise indicates lending expansion all things being equal. Many say rising rates are good for stocks and economic activity, but the truth is closer to the widening spread between T-Bill/10yr Treas on which lending spreads rely.