“Davidson” submits:

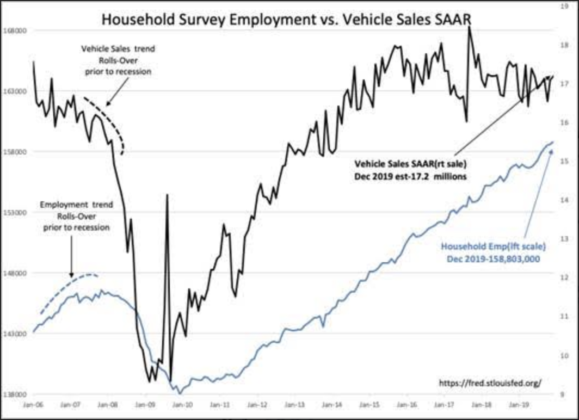

US Household Survey Employment reported at a new high of 158,803,000, a gain from Nov 2019 of 210,000. Light Weight Vehicle SAAT(Seasonally Ad Annual Rate) is estimated at 17.2mil. TEMPHELP data after pausing 12mos on multiple recession scares is turning higher. This data indicates that economic trends continue since this cycle began in 2009. This the longest economic cycle in history and current indications are that it can continue for another 3yrs-5yrs.

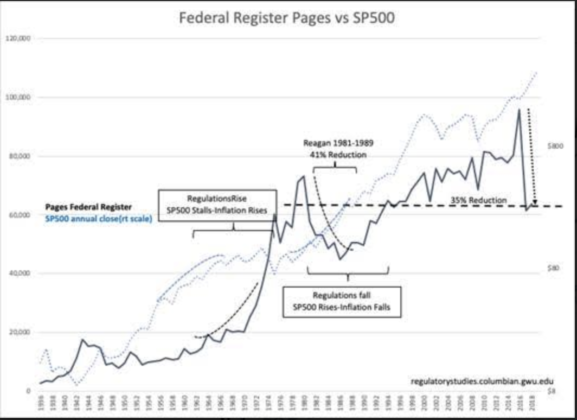

Many continue to forecast recession saying economic cycles cannot last this long. These forecasts are in error. They do not take into consideration that this cycle has seen a series of new policies that are likely to last several years, driving economic activity. Policy is not an economic event one can plug into a formula. Policy represents a set of rules designed with anticipated outcomes. Every policy is intangible, meant to change human behavior within the broad dynamic of existing policies. A new policy is always new regulation. Every area a policy impacts will shift behavior to minimize policy negatives and maximize positives to themselves policy makers did not anticipate. This always makes specific outcomes unpredictable. Complying with additional policies always has cost. Removing policies reduces cost and provides added flexibility to society to improve outcomes. Much of what is occurring today is regulation reduction.

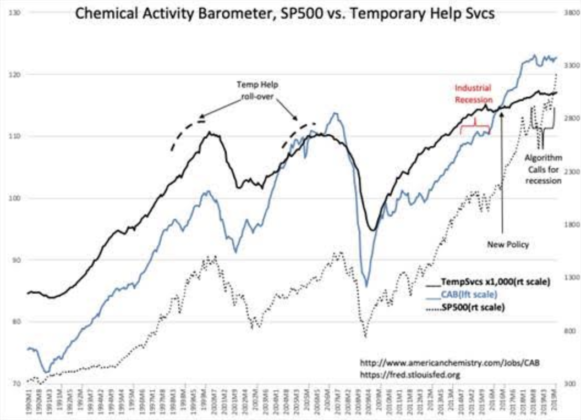

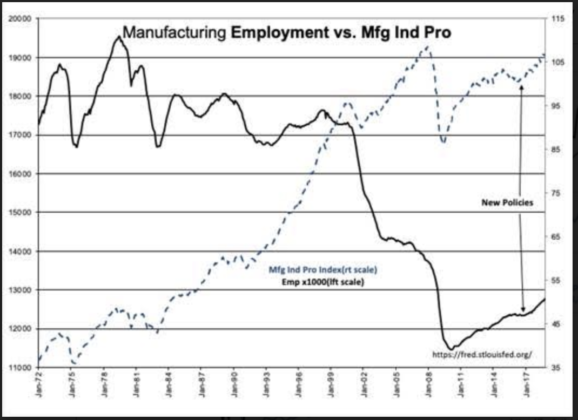

The least discussed and least understood new policy of the past 2 ½yrs has been the reduction in regulation as reflected in the number of pages reported in Federal Register(FR). The current administration has lowered regulations published in the FR by 31% through 2018. The impact of less regulatory burden on society which primarily impacts business activity is impossible to predict with certainty. The best one can do is review trends with hindsight to pull out identifiable shifts to which one can ascribe specific quid pro quo. In the TEMPHELPS data it can be seen that a turn positive occurred with the down shift in FR. The detail of Manufacturing Employment and Industrial Production turn higher coincides with deregulation, Quid Pro Quo. This is quite dramatic. What is more dramatic is how little the media focus captures the impact of deregulation. The last period of deregulation of this magnitude was under Pres. Reagan who produced the “Miracle Economy” of the 1980s the basis of which remains mostly misunderstood. The ‘Miracle Economy’ was Reagan’s Quid Pro Quo.

Deregulation remains in early stages. Dodd-Frank legislation has virtually stalled single-family mortgage lending at less than half what the MCAI(Mortgage Credit Availability Index) suggests should be normal during economic recovery. This has left single-family starts stalled equal to the lowest levels experienced in housing recessions since 1959. The roll-back of Dodd-Frank rules treating community banks, the source of most mtg lending, with the same set of regulations as the Money Center banks has only just begun. Should this prove successful, upwards of $600Bill annually of new mortgage lending could enter new single-family building to offset the severe housing shortage we currently have in single-family homes. More Quid Pro Quo. It will take several years to satisfy single-family housing demand and this is one reason to expect 3yrs-5yrs of additional economic expansion this cycle. But, there is more policy to this story.

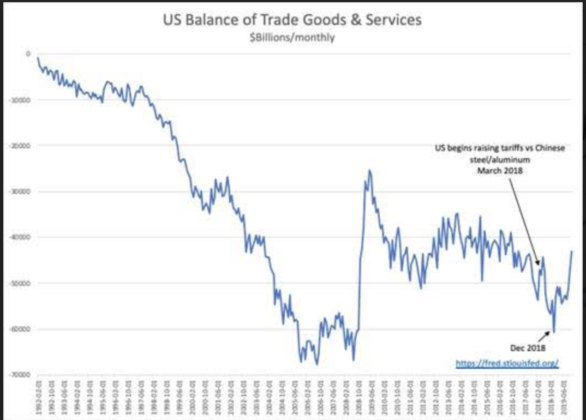

In addtion to a significant tax cut, the current administration has taken steps to rebalance the lopsided trade agreements the US has withstood the past 40yrs which in effect gifted US innovation and capital to trading partners. Technological innovation theft by China is only recently entered the media discussion. Of equal value and most misunderstood is the cost of healthcare and pharmaceuticals which gives the US the leading healthcare system globally. Little analysis has been applied to reveal that the US pays for a tremendous flow of medical innovation. This is innovation the R&D of which is recouped through initially higher prices for pharmaceuticals and devices. After a period during which efficacy and safety have been established in the US, US medical innovation is typically sold globally at prices much less than prices in the US. The reasoning the US accepts this is that R&D innovation carries a high risk of failure and future innovation will diminish. Just as the US has basically gifted other technology and capital to trading partners with high tariffs, the same has occurred with medical innovation. The current adminsitration has taken steps to equalize trading barriors and signed 4 new trade deals, Mexico, Canada, South Korea, Japan, and is on the verge of a phase-one trade agreement with China to rebalance trade relationships long detrimental to US innovation and manufacturing. These are significant policy shifts and take time to implement and have an effect. The first signs of the US tariff initiatives March 2018 are beginning to be seen in the US Balance of Trade in Goods & Services. The decline in the US Trade Balance this cycle occurred Dec 2018. There has been a notable improvement since Aug 2019 as manufacturing contracts have been shifted to trade partners with desirable tariff regimes. More Quid Pro Quo. Recently proposed regulations to permit healthcare providers to import at lower prices pharmecuticals and medical devices sold outside the US would have the effect of having all global users bear the burden of R&D costs rather than the US carrying this cost alone.

The sanctions against disruptive geopolitical actors is also a new and novel policy factor. Economic barriors preventing access to vital trade avenues is proving far more effective than oft tried and failed outcomes of past military actions. Wars have always proven inflationary and hurt one’s own economic wealth. While the eventual outcomes will take longer than 2yrs to fully define, the current trends of the US economy support this approach more than repeating past known failures.

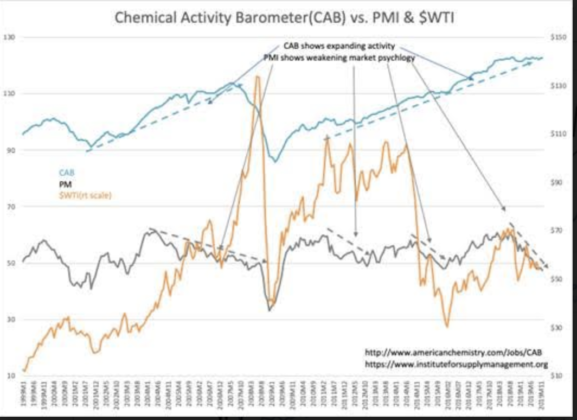

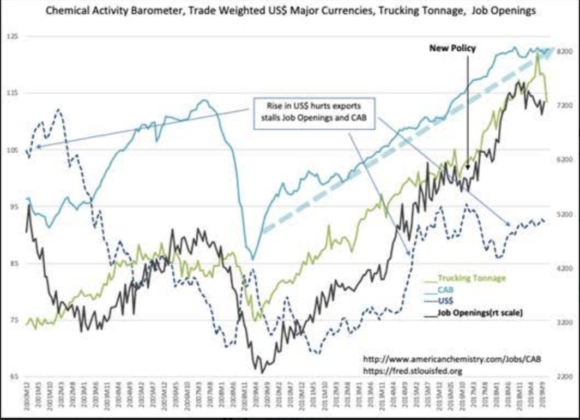

The impacts of current policy shifts have confused some resulting in global capital shifts towards the US as the safest of ‘Safe Havens’ globally. The Chinese Yuan has been especially weaker vs. US$. Not seeing the entire picture results in many using imperfect proxies to anticipate outcomes. The shift of capital to the US makes the US$(US Dollar) stronger, pushed rates lower and pushed real estate prices higher. Oil prices, the new ‘Dr. Copper’, have fallen as the 10yr Treasury fell and pushed the yield curve into inversion. Investor fears rose. The PMI(Purchasing Managers Index), a market sentiment indicator pressumed to measure manufacturing activity, has fallen to recessionary levels. The CAB(Chemical Activity Barometer), a truer measure of manufacturing activity continues to rise. The strong US$ did slow US manufacturing and Job Opening trends, but new policies have been quite positive. More Quid Pro Quo.

The investment environment has turned decidedly more positive since Aug 2019. Beginning Oct 2018 we have experienced an extreme in pessimism with the media harping of another “Great Depression”. Throughout this period economic trends contiued higher as market sentiment deteriorated. Some closely watched market sentiment indicators such as the PMI has yet to turn positive having just registered another low. Sentiment for manufacturing should turn higher as recent positive reports by individual companies are in sharp contrast to expectations.

The US economy continues firmly in an uptrend with the policy shifts the past 2 ½ years. As investors become convinced their fears are misplaced, equity prices should move higher.