“Davidson” submits:

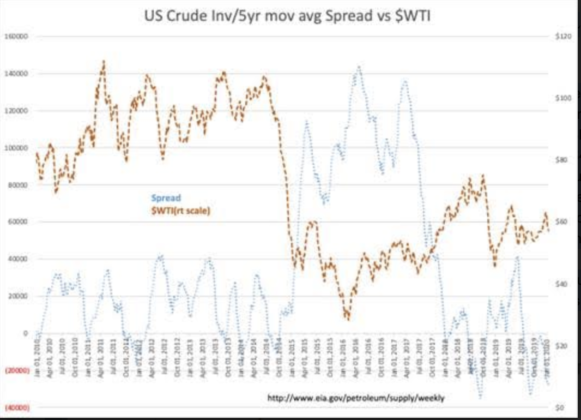

- US Crude Inv fall 0.4mil BBL-~28mil BBL below 5yr mov avg

- US Crude Production 13mil BBL/Day

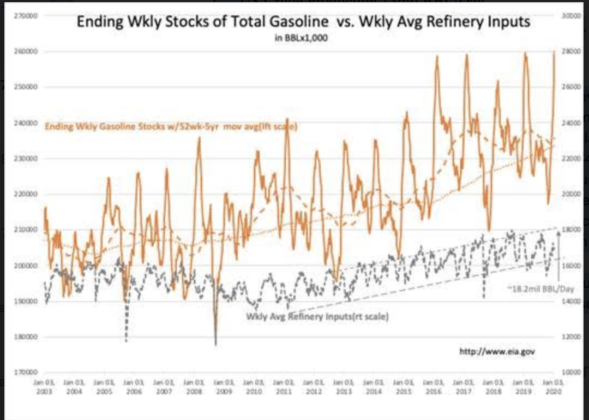

- US Gasoline Inv rise to seasonal levels, ~260mil BBL

- US Refining Input drops 0.125mill BBL/Day

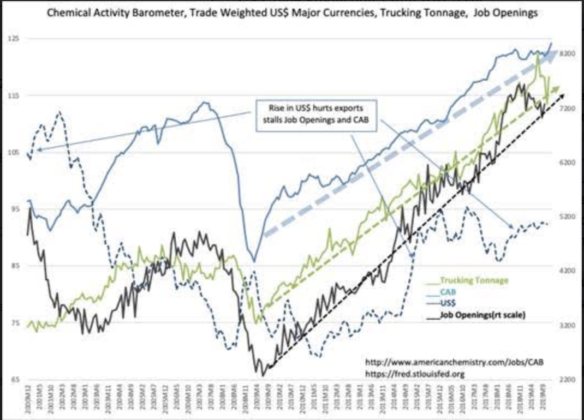

Little change from last week in the US Oil Situation. US Crude Inv levels drifted towards a deficit of 28mil BBL vs the 5yr mov avg. In 2018 with a more bullish market psychology on economic growth, a deficit over 30mil BBL helped boost $WTI to $75/BBL before expectations suddenly shifted to a ‘Black Swan’ leading to a condition similar to ‘1929 Crash’. The panic which ensued drove prices in 3mos to less than $45/BBL by year end. Prices have grudgingly recovered to the $57-$63/BBL range. While critical economic measures, the Chemical Activity Barometer(CAB), the Trucking Tonnage Index(TTI), Job Openings and etc, remain in uptrends since 2009, market psychology as measured by the level of assets in Retail Money Funds has been increasingly pessimistic. There is a sharp contrast between strong economic performance and an investor public which simply does not believe it.

History shows that this has always been resolved by investors capitulating to economic trends. Once this is resolved, equity prices should price significantly higher with energy related issues leading the pack, in my opinion.