“Davidson” submits:

Economic indicators = continued expansion or Sentiment indicators =”Run for the Hills”?

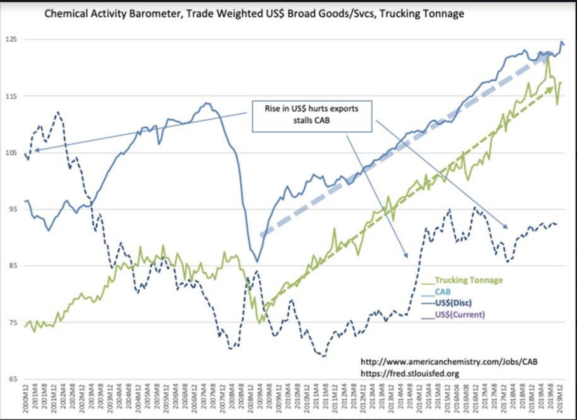

The Chemical Activity Index(CAB) was reported today following the Trucking Tonnage Index(TTI) reported last week. Each is a hard measure of broad-based activity as opposed to sentiment measures which many conflate as economic indicators but are not in fact so. The CAB reflecting chemical manufacturing activity shows a slight down-tick for Feb 2020, but Jan 2020 was revised to a new record 124.64. The TTI reflecting the activity of good’s transport remains on trend from 2009. US economic activity remains in expansion.

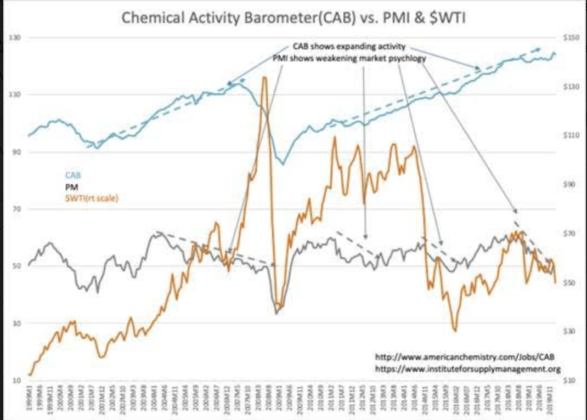

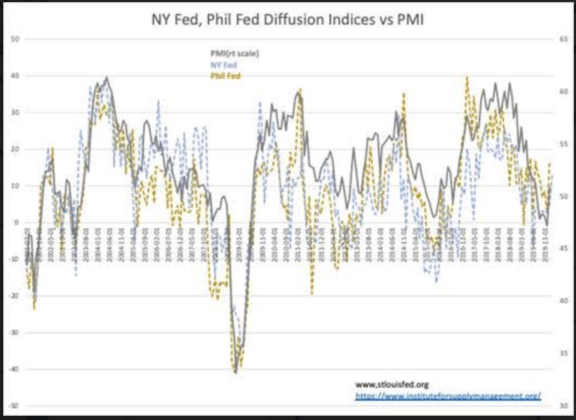

Confusing investors are many conflated measures of market sentiment reported with heightened importance while the CAB and TTI rarely receive recognition. The various regional Federal Reserve activity indices(diffusion indices) fall into the same market sentiment category with the Purchasing Managers Index(PMI). These are well correlated with another over-worn concept of economic activity in the perception of $WTI(Price/BBL West Texas Intermediate Oil). As in the prior use of copper prices as a primary economic indicator, “Dr. Copper”, oil price trends have captured investor thinking as an early indicator of changes in economic trends. Analysis makes it clear that oil prices are swamped by market sentiment and show little correlation with actual supply/demand. The Fed diffusion indices correlate strongly with the PMI and $WTI but not at all with CAB or TTI indicating a wide divergence between market psychology vs economic activity.

The media reporting of Fed diffusion and other market sentiment correlated indicators has been underpinned by declines in oil prices. The reporting is that these signal a looming economic/market decline. Many panicked in yesterday’s 1,000+pt decline in the Dow Jones Ind Index. Economic measures tend to be ignored. As investors, two choices are present. Does one add to portfolios taking advantage of discounted prices to economic activity or does “Run for the Hills”?

Economic indicators = continued expansion or Sentiment indicators =”Run for the Hills”?

This is a time to add to portfolios. Economic indicators have always proven the better guideposts.